Base Chemical Global Analysis

Global Weekly Catalyst No. 316

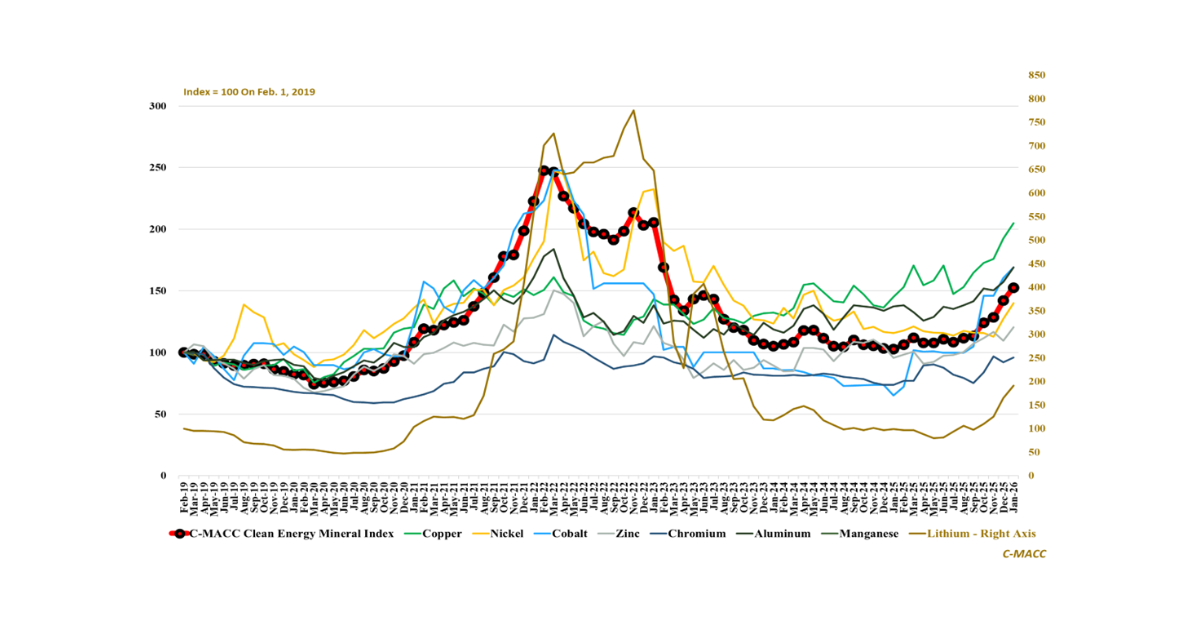

- General Thoughts: Energy retracement and post-storm natural gas normalization begin to restore relative cost balance, enabling advantaged producers to outperform, while persistent oversupply constrains pricing power.

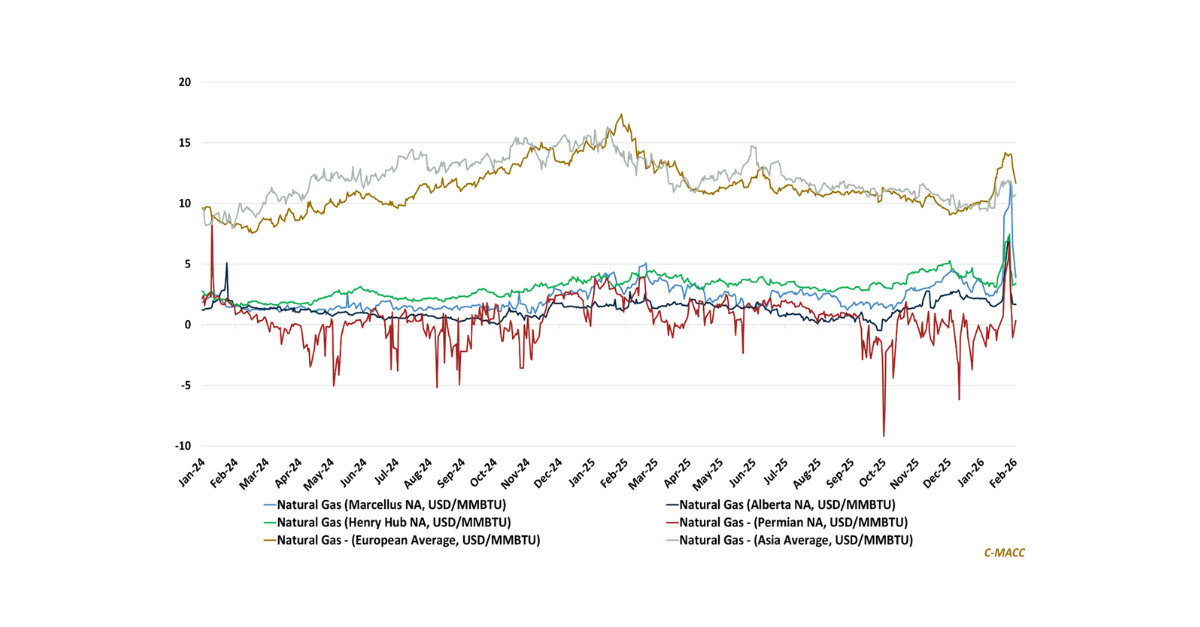

- Feedstocks & Energy: Brent crude oil retreated but remains range-bound, likely reducing further naphtha cost creep, and US natural gas retraces more quickly than overseas benchmarks, but US NGL costs lag in response.

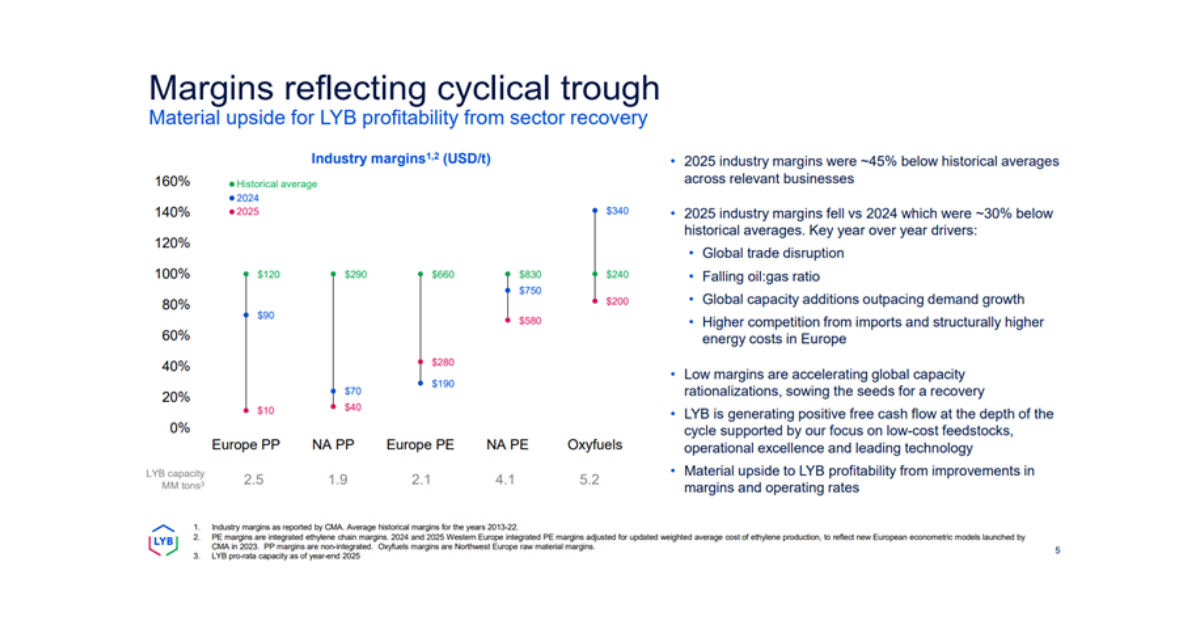

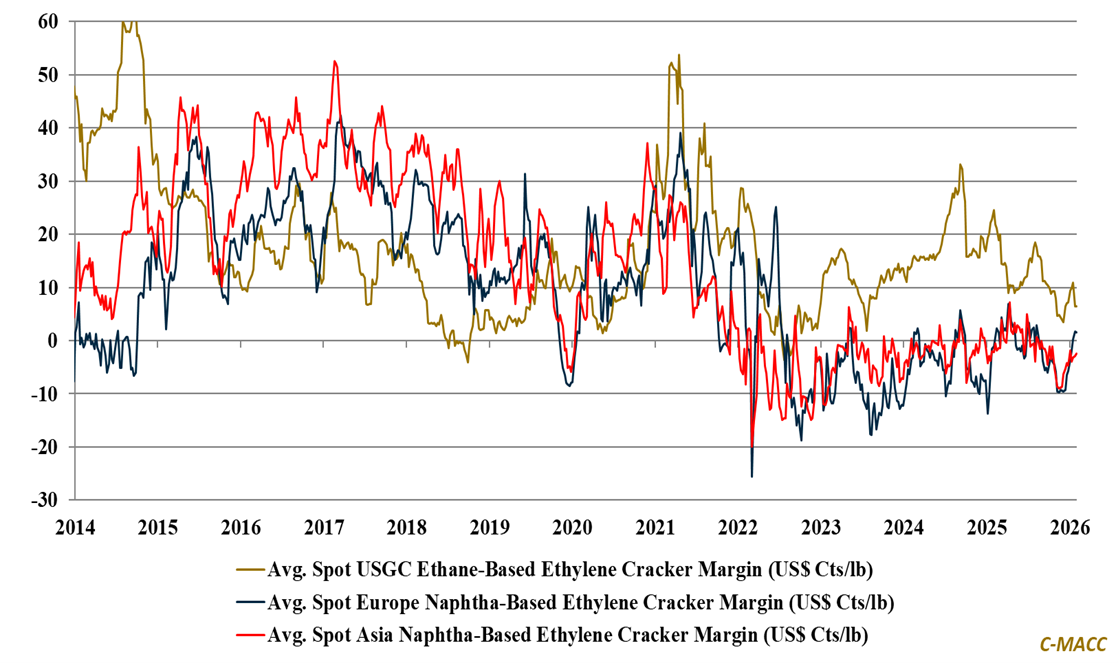

- Olefins: 4Q25 results and 2026 outlook commentary from producers emphasize discipline, restructuring, and reliability, as ethylene length caps upside, and execution determines global margin defense outcomes.

- Other Base Chemicals: Global chemical feedstock market shifts support intermediates. Western methanol spot stays firm amid logistics constraints, benefiting US producers amid lingering supply concerns and lower gas costs.

- Agriculture: Ammonia markets remain basis-driven, with inland strength persisting, affordability limits, and logistics shaping trade into February, while elevated natural gas costs pressure marginal global producers.

- Refining & Biofuels: US refining margins moderated last week as winter uplift and outage concerns faded, while ethanol margins stay positive but below early 2026 highs, leaving exports, policy, and reliability key drivers.

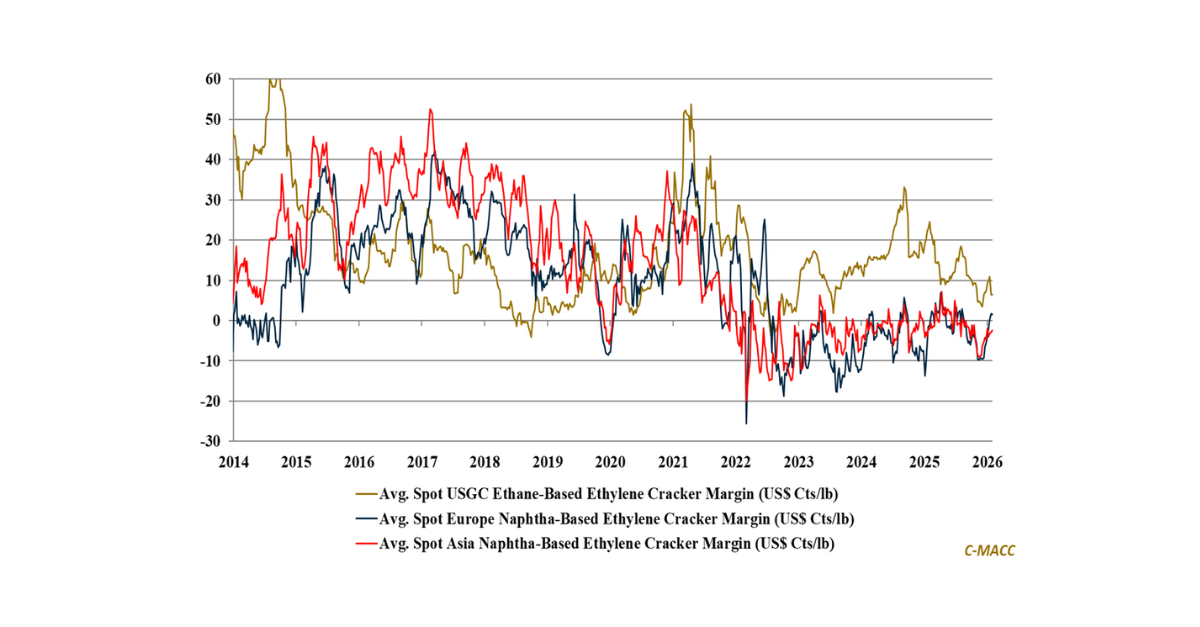

Exhibit 1 – Chart of the Day: European and Asian ethylene margins to stay squeezed, accelerating restructuring needs.

Source: Bloomberg, C-MACC Estimates, February 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!