Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

Key Findings

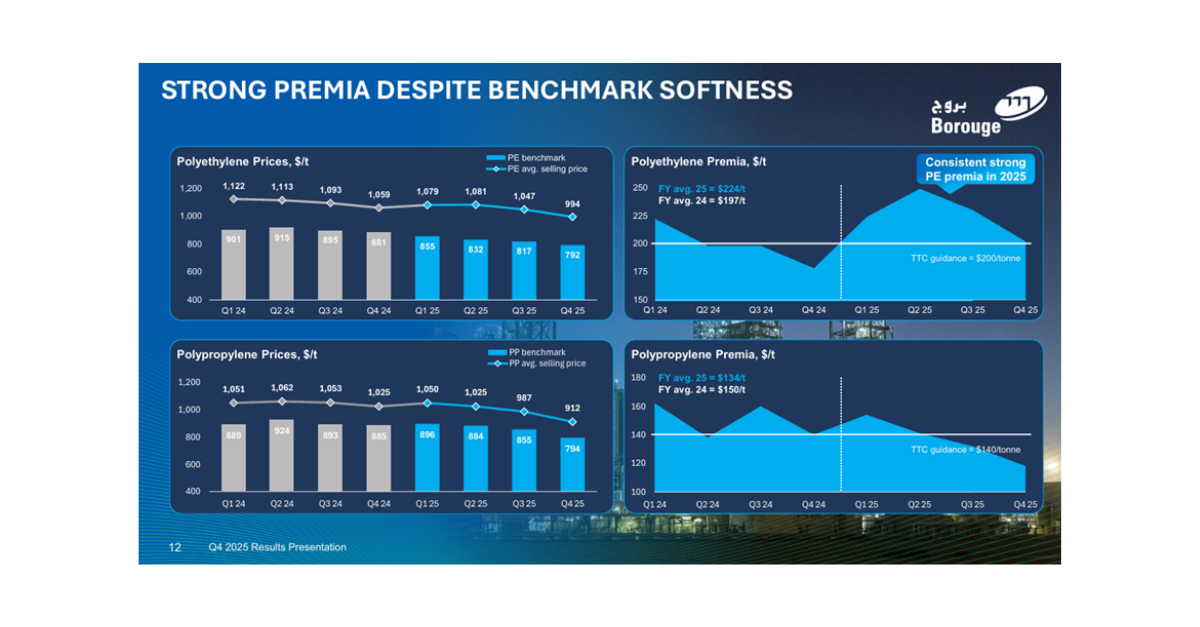

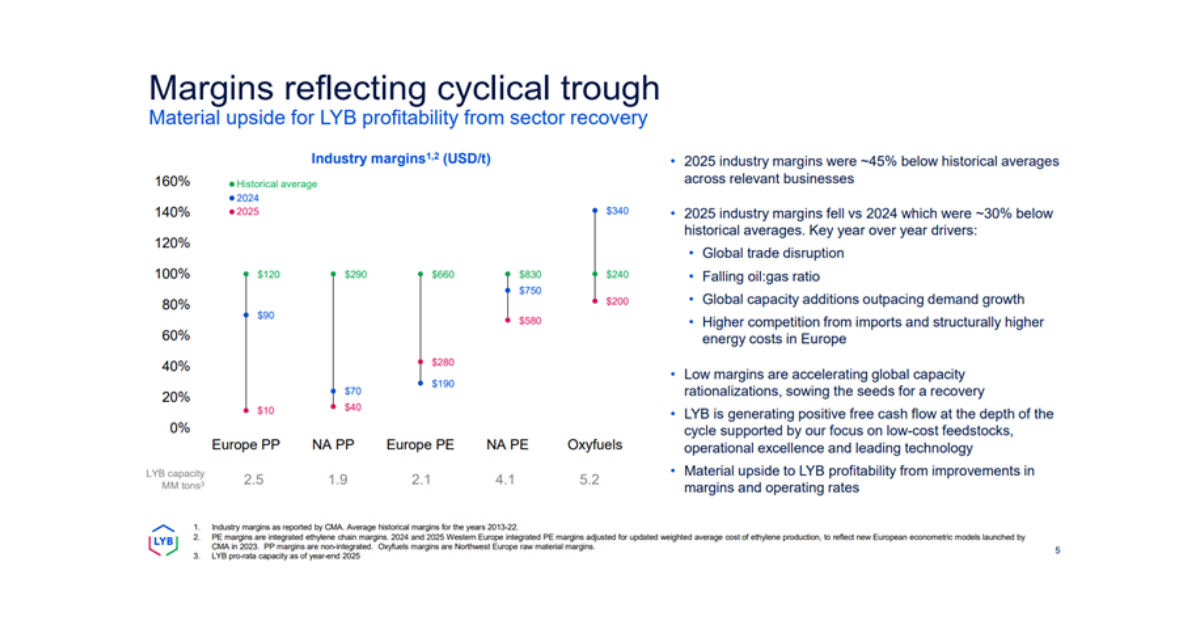

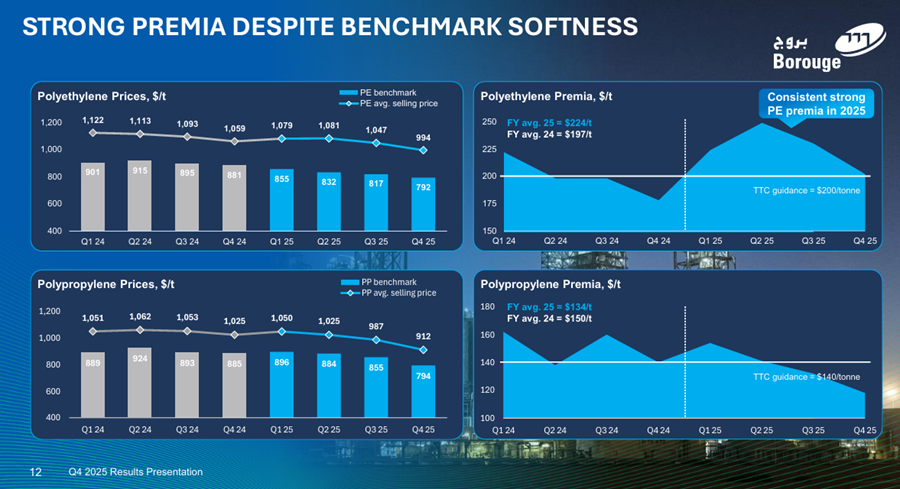

- General Thoughts: Value premia earned through differentiation at cycle troughs can signal future share gains, enabling advantaged producers to run hard, more consistently price on outcomes, and better forecast risk-adjusted returns.

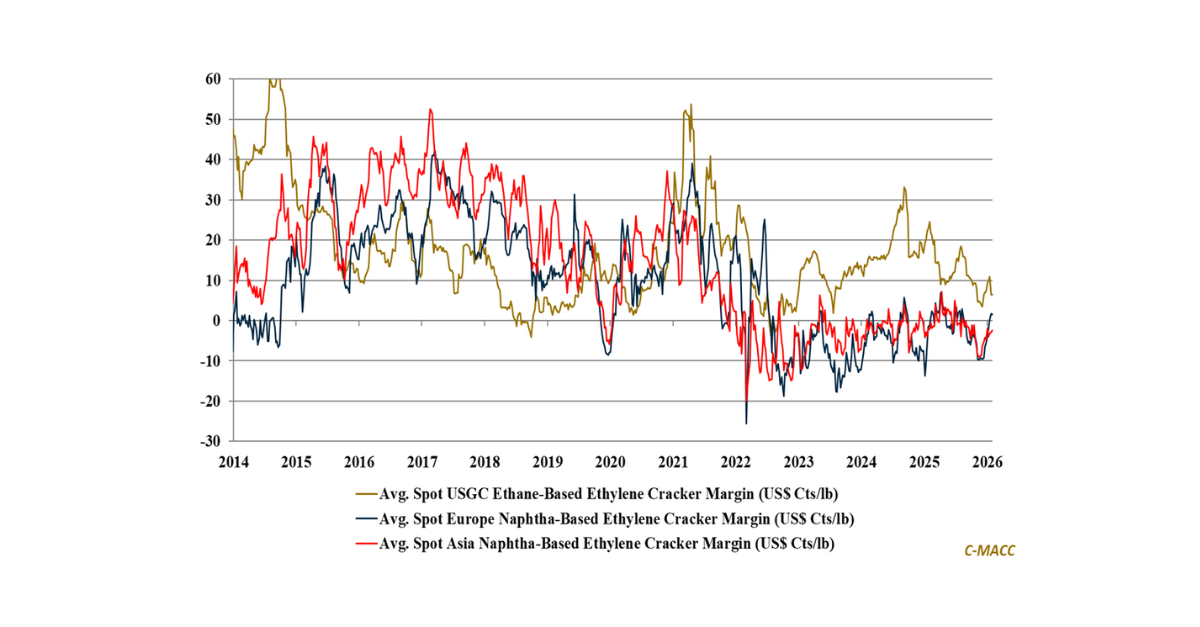

- Polyethylene (PE): Global PE spot price strength reflects cost pressure, operational friction, and producer restraint, but more permanent capacity exits are needed; 2026 risks renewed imbalance as logistics normalize and inventories rebuild.

- Polypropylene (PP): Global PP spot prices are firm amid propylene volatility and regional outages, while excess polymer capacity and cautious demand limit margin expansion, pointing to uneven, event-driven pricing through most of 2026.

- Polyvinyl Chloride (PVC): Global PVC markets are supported by policy shifts, logistics constraints, and limited capacity growth, positioning 2026 for modest improvement even absent cost curve shifts or a broad global construction recovery.

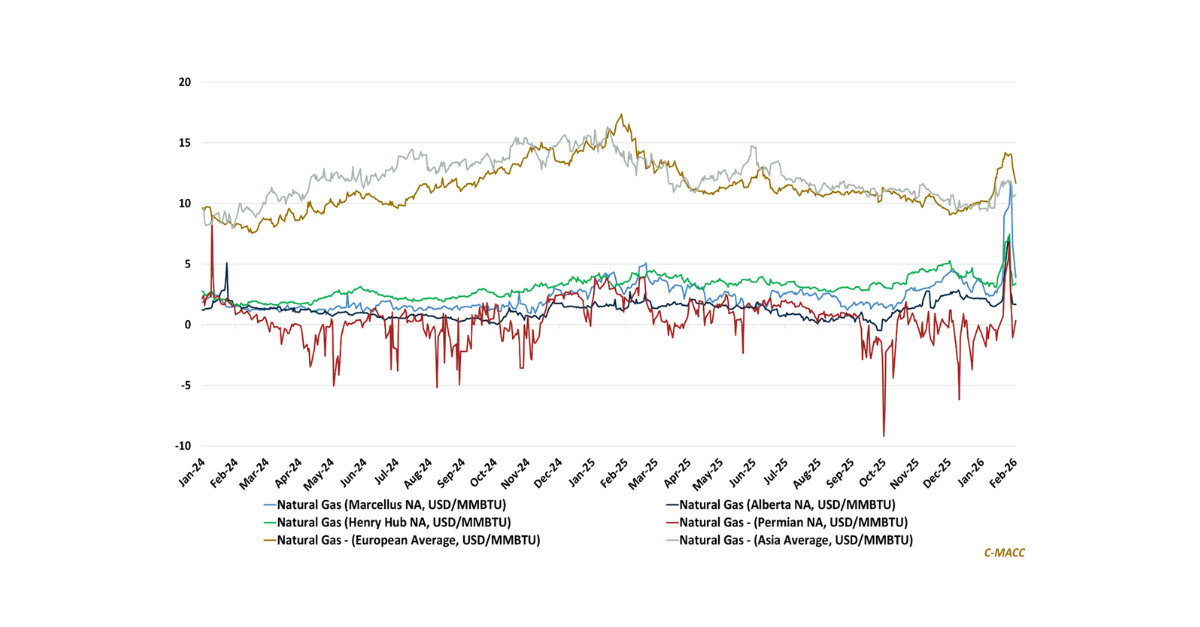

- Other Sector Developments: Freight normalization, widening olefin feedstock divergence, weather disruptions, and policy-driven trade shifts are amplifying short-term price signals without resolving most longer-term oversupply issues.

Exhibit 1 – Chart of the Day: Differentiation sustains polyolefin premia through downcycles, enabling higher returns.

Source: Borouge – 4Q25 Earnings Presentation, February 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!