1st Topic of the Week: Electrification is tightening aluminum's structural...

Read MoreOur Base Chemical & Polymer Analysis reports offer a comprehensive, data-rich snapshot of global market dynamics every week. Each edition delivers actionable insights backed by curated charts and margin models to help you stay ahead of market movements, arbitrage trends, and structural shifts.

Weekly reports on base chemicals and polymers provide data-driven insights and charts to help understand market changes and trends.

Offers an update on global supply chains, chemicals, energy, sustainability, and industry changes, tracking key developments.

Provides weekly updates on global plastic resin markets, focusing on polyethylene, polypropylene, and polyvinyl chloride.

The report examines global energy transition trends, focusing on sustainability, hydrogen, clean tech, and circular economy themes.

A concise weekly briefing that ties it all together—highlighting the most important themes, shifts, and strategic insights across our research coverage.

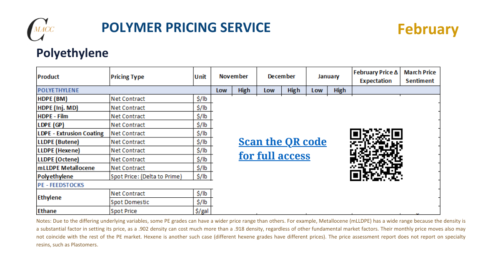

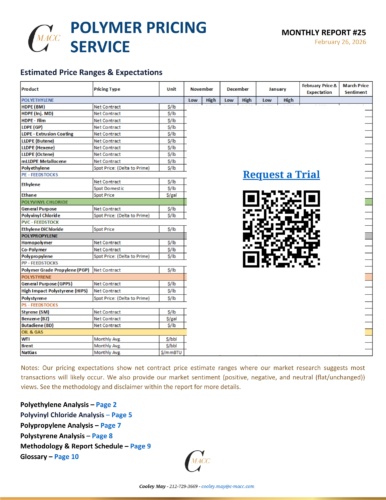

Independent monthly guidance from C-MACC on expected U.S. contract prices for PE, PP, PS, and PVC—grounded in fundamentals, not post-settlement reporting.

1st Topic of the Week: Electrification is tightening aluminum's structural...

Read MorePolyvinyl Chloride – February - 2026 Monthly Price Expectation Report

Read MorePolystyrene – February - 2026 Monthly Price Expectation Report

Read MorePolypropylene – February - 2026 Monthly Price Expectation Report

Read More

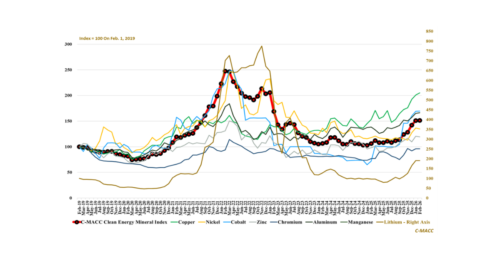

1st Topic of the Week: Electrification is tightening aluminum’s structural balance; are supply chains prepared for constrained capacity, elevated premiums, and consumer price inflation later

Polyvinyl Chloride – February – 2026 Monthly Price Expectation Report

Polystyrene – February – 2026 Monthly Price Expectation Report

Polypropylene – February – 2026 Monthly Price Expectation Report

Polyethylene – February – 2026 Monthly Price Expectation Report

General Thoughts: Simultaneous natural gas and carbon price compression eases Europe’s cost burden, yet demand fragility, structural import dependence, and risk of renewed global tightening

Polymer Price Expectations – February’26 – Monthly Report # 25

Polymer Global Analysis Resin To Riches: Weekly Plastic Market Insights Exhibit 1 – Chart of the Day: US integrated PVC and PE margins rebound in

Sign up below to get updates on our events, publications, and insights—straight to your inbox.