Daily Chemical Reaction

Winter Is Coming! Many Global Industries Face A Rocky Year End, Some Better Poised For 2025 Improvement Than Others

Key Findings

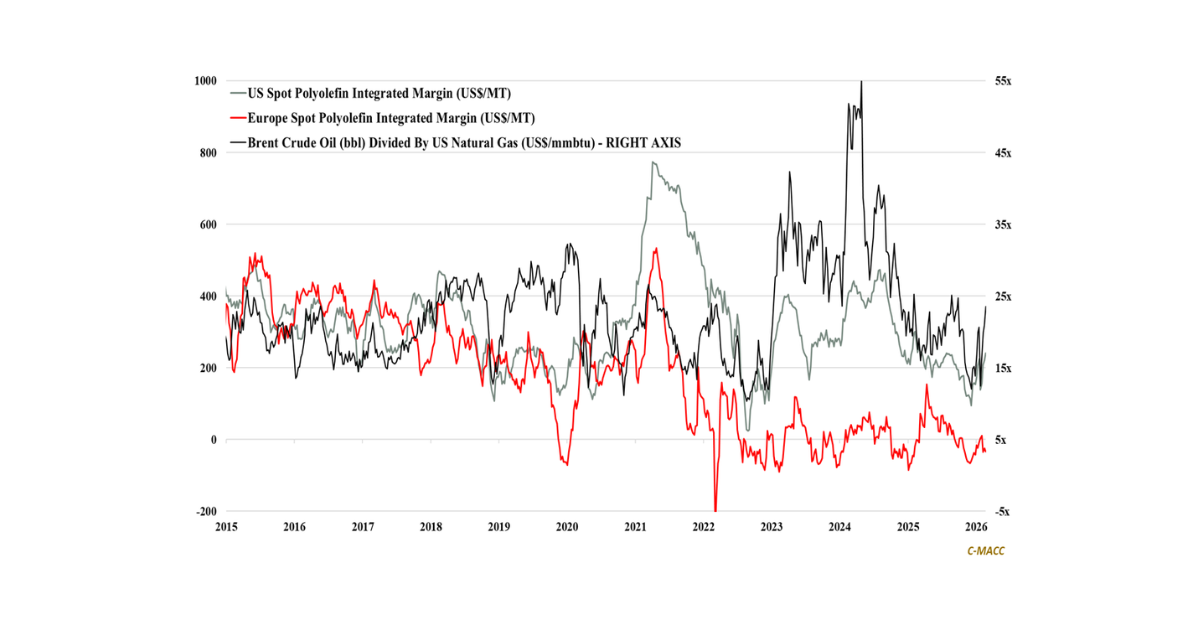

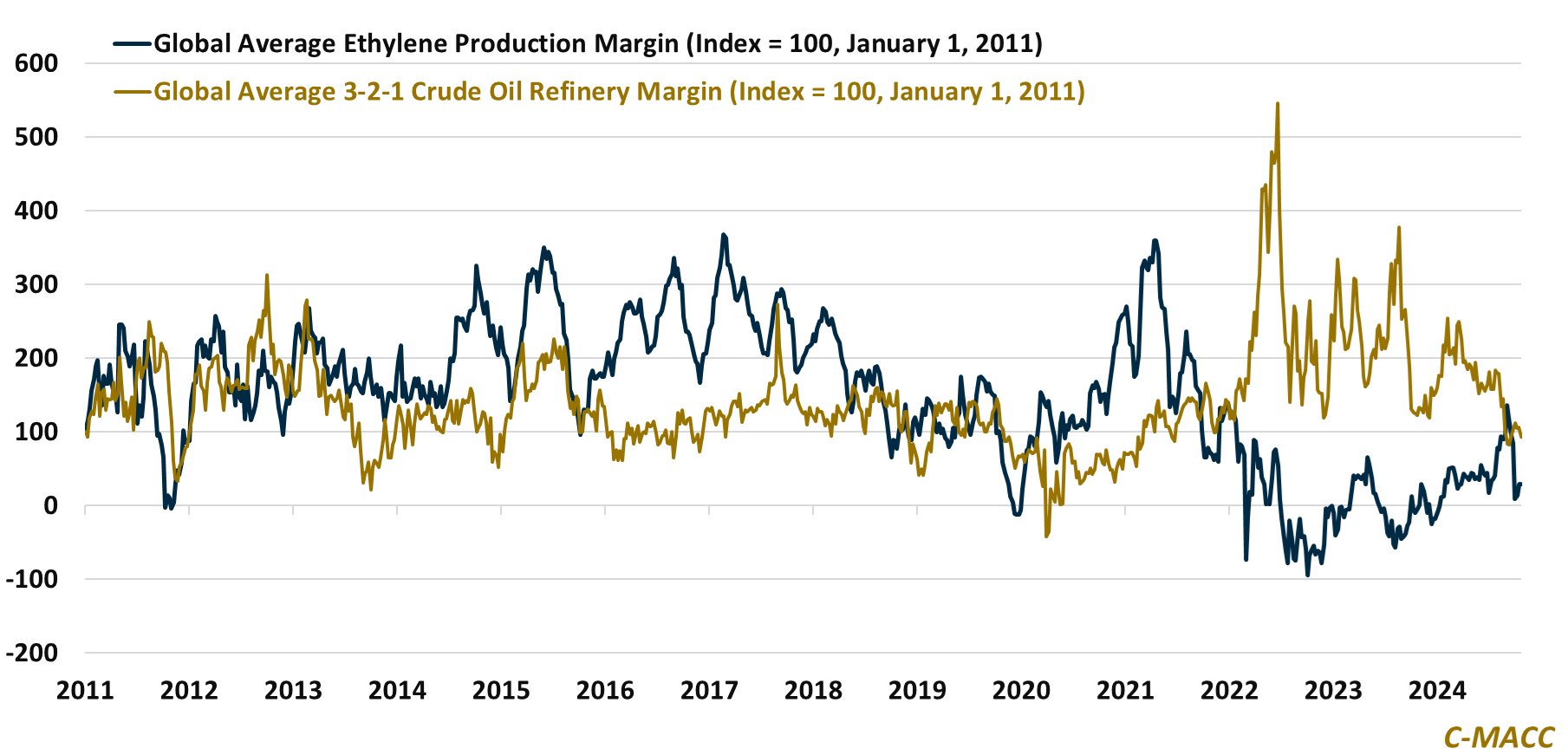

- General Thoughts: Global refinery and ethylene production margins have fallen considerably from the YTD highs. Refinery margin outlooks are mostly linked to demand, while overexpansion is more of a concern in ethylene.

- Supply Chain/Commodities: We discuss takeaways from Element Solutions and Enterprise Products 3Q24 results and our negative view of US spot polymer-grade propylene prices in the near term amid improved supply.

- Energy/Upstream: We highlight bp 3Q24 results showing its push away from some clean energy projects and weak refining results. We also discuss the rising value of US existing power/pipeline right-of-ways, such as at EPD.

- Sustainability/Energy Transition: We discuss the sizable drop in clean-technology investment YTD in 2024 relative to 2023, which is also being met by a recent surge in cancellations among existing projects proving uneconomical.

- Downstream/Other Chemicals: We highlight the drop in German manufactured goods export expectations, which many link to weak demand that misses that many of its manufactured goods cost positions are uncompetitive.

Exhibit 1: Global crude oil refinery and ethylene production margins, on average, reflect weakness in 2H24, though crude oil refinery margins have trended lower from levels seen at the start of 2024 while ethylene margins are higher.

Source: Bloomberg, C-MACC Analysis, October 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!