The Hydrogen Economy #78

A Large European Subsidy, or Not So Much Because of Slower Progress?

Key Points

- Huge European subsidies for green hydrogen might look cripplingly unattractive to taxpayers. However, it is still possible that the pace of activity slows, such that absolute government spending is not that high.

- On a per KG basis, some subsidies or “contracts for difference” look high. Cash outlays will not be as extreme if activity slows, but slower activity will not drive the learning and scale economies intended by the subsidies.

- We are a week away from a new Administration in the US, and what could be “all change” for several energy transition initiatives. Some will be direct, and some indirect, such as reprioritizing spending in Europe.

- A couple of European electrolyzer producers indicate financial trouble this week; as we have noted before, this is likely to be the theme for 2025. There is insufficient near-term demand relative to expensive capacity

- Otherwise, we look at a couple of green projects outside of Europe – good if they are selling locally – less so if they are exporting to Europe. We also introduce more commentary on fuels, this week SAF.

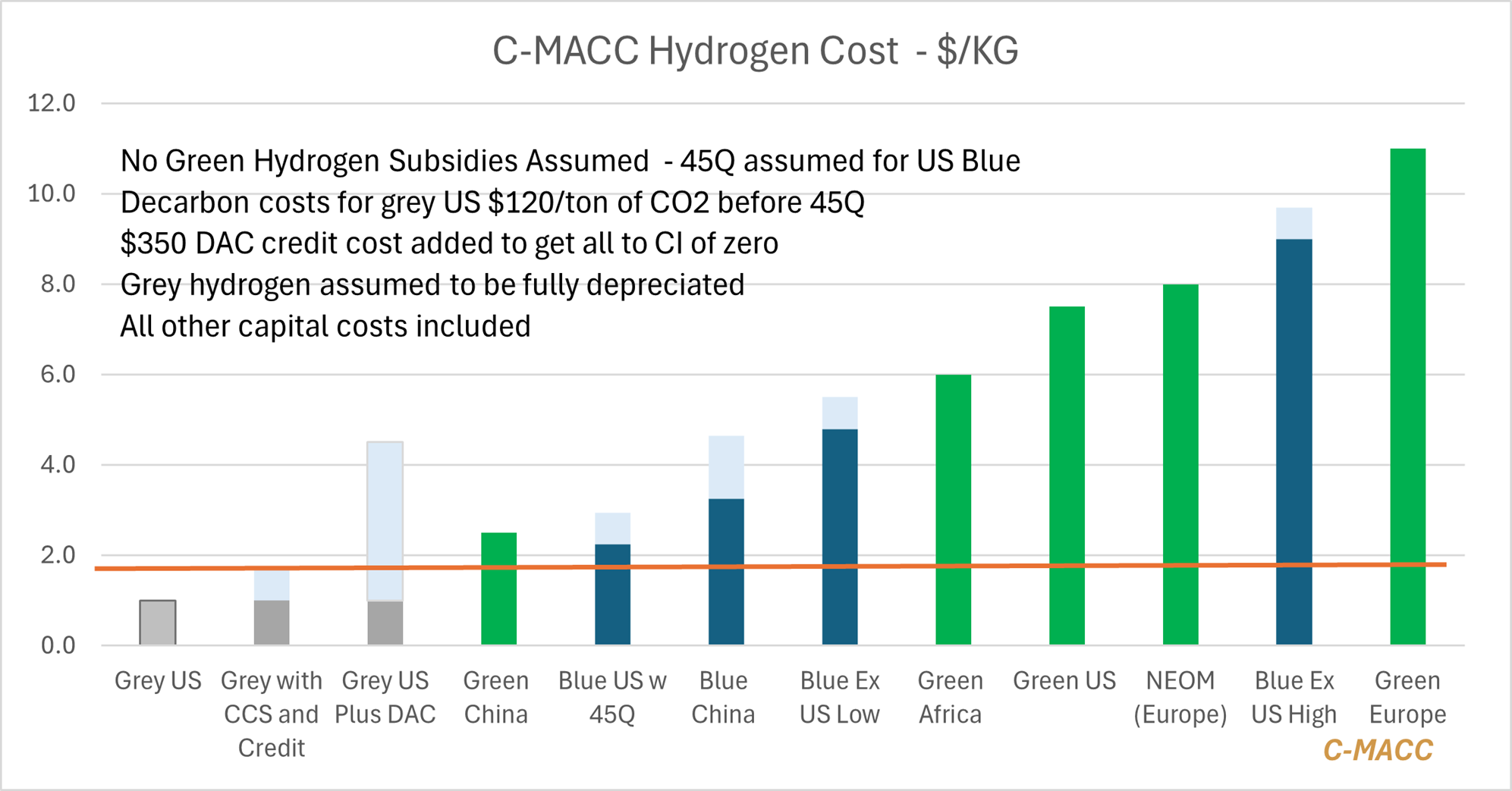

Exhibit 1: Note that these are cash cost estimates and averages without any subsidy for hydrogen – there are ranges in each region, especially for green, as electricity prices can be very different based on scale, location, and intermittency.

Source: Corporate Reports, client discussions and C-MACC Analysis

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!