Global Market Analysis

Surplus In The Air Tonight: Low-Cost Integration In Plastics Rewarding, China Is Still A Risk!

Key Findings

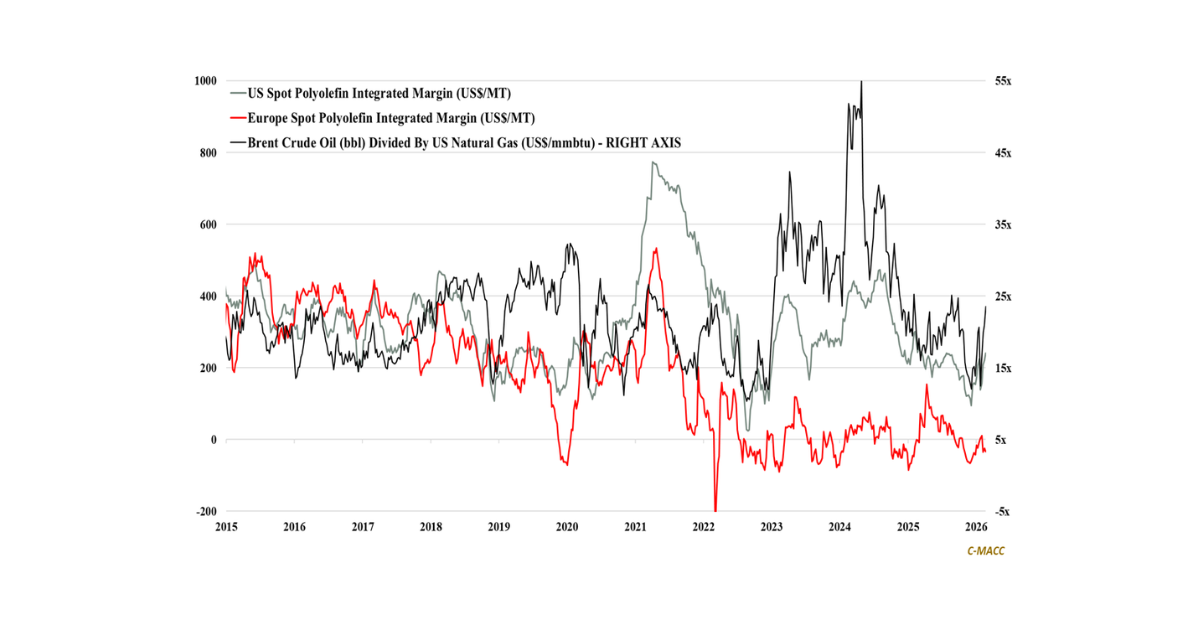

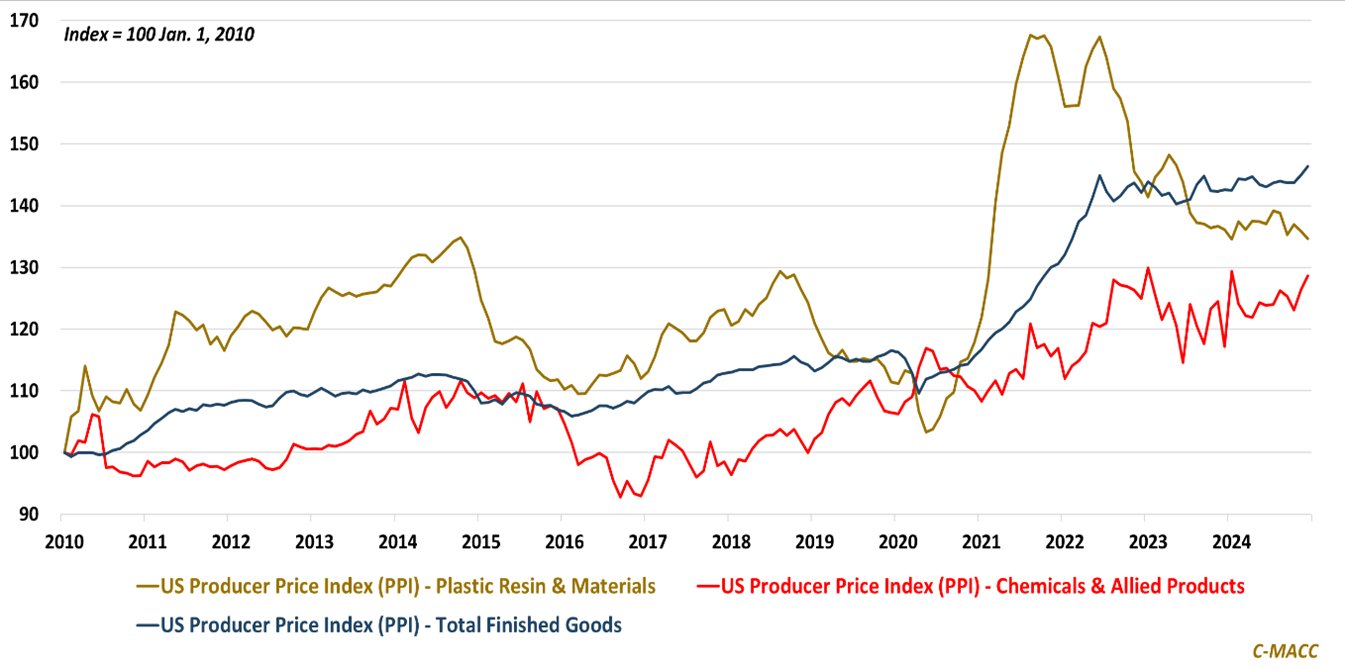

- General Thoughts: We discuss the downward trend in the US plastics PPI relative to the chemicals PPI, supporting the case for upstream integration, and the record China trade surplus in 2024 that could increase further in 2025.

- Supply Chain/Commodities: We focus on weak lithium market prices at the start of 2025, and our view that this market is unlikely to abruptly tighten amid high global inventories, weak margins, and China overcapacity.

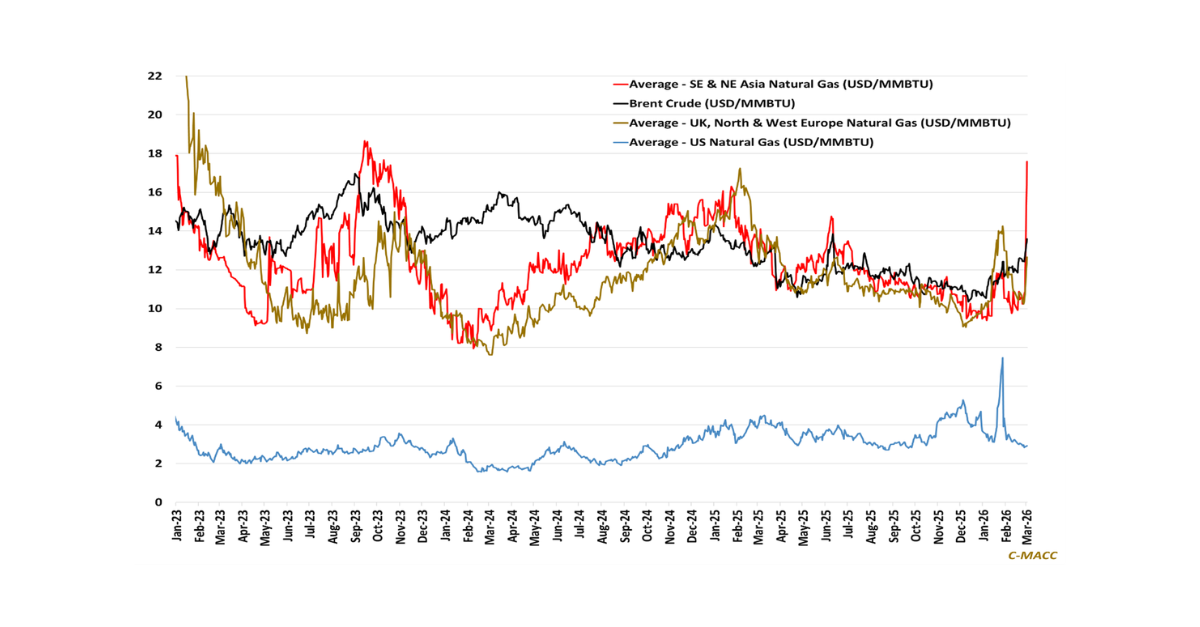

- Energy/Upstream: There were more natural gas power plants scheduled for closure than for development not long ago, but this trend has firmly reversed. We separately flag a last-minute Biden push to spur US power growth.

- Sustainability/Energy Transition: European carbon prices have surged higher into 2025, with levels approaching those last seen in late 2023. We discuss the EU carbon credit market benefiting EV producers, such as Tesla.

- Downstream/Other Chemicals: We discuss the US Dollar had strengthened to roughly a 25-year high relative to the Chinese Yuan, a few recent updates related to potential trade disputes, and relevant global industry news.

Exhibit 1: US PPI for total finished goods rises in 4Q but less than most estimates – Plastic PPI falls, Chemical PPI rises.

Source: Bloomberg, C-MACC Analysis, January 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!