Global Market Analysis

Many Expect 2025 to Mirror 2024 – A Reassuring Outlook or a Warning to Brace for Impact?

Key Findings

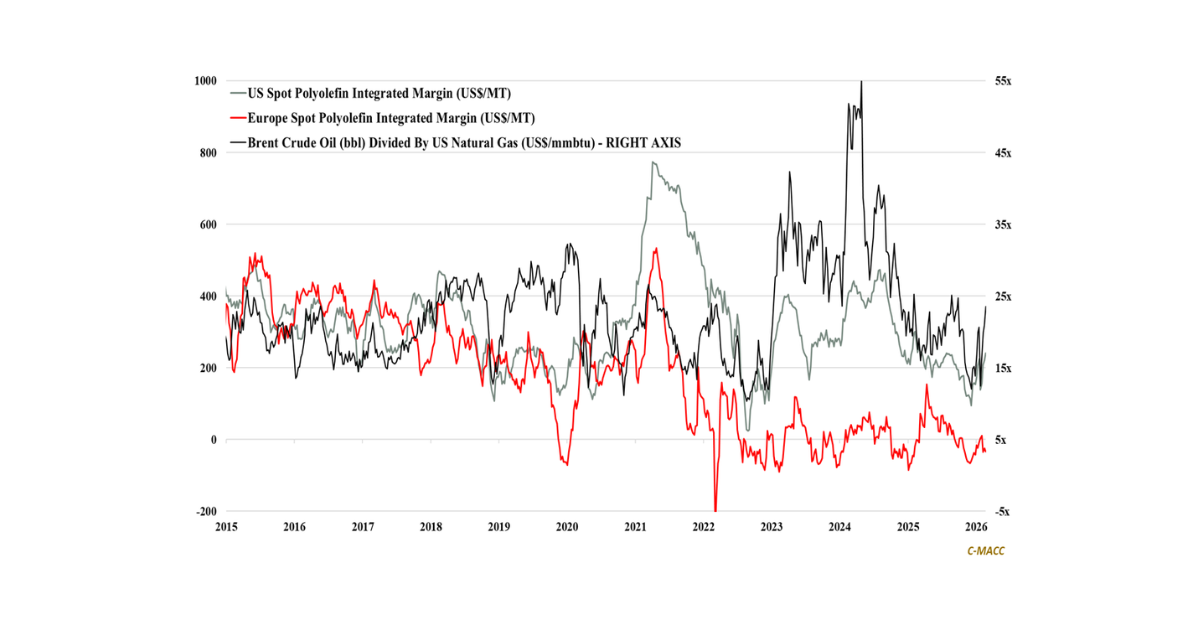

- General Thoughts: Many global petrochemical companies expect a similar market setting in 2025 relative to 2024, despite a flatter global production cost curve, more China capacity, and trade/geopolitical issues posing risk.

- Supply Chain/Commodities: We discuss 4Q24 earnings reports and 2025 outlooks from LG Chem, Borouge, and OMV to create a global view of takeaways following mostly North American chemical producer reports last week.

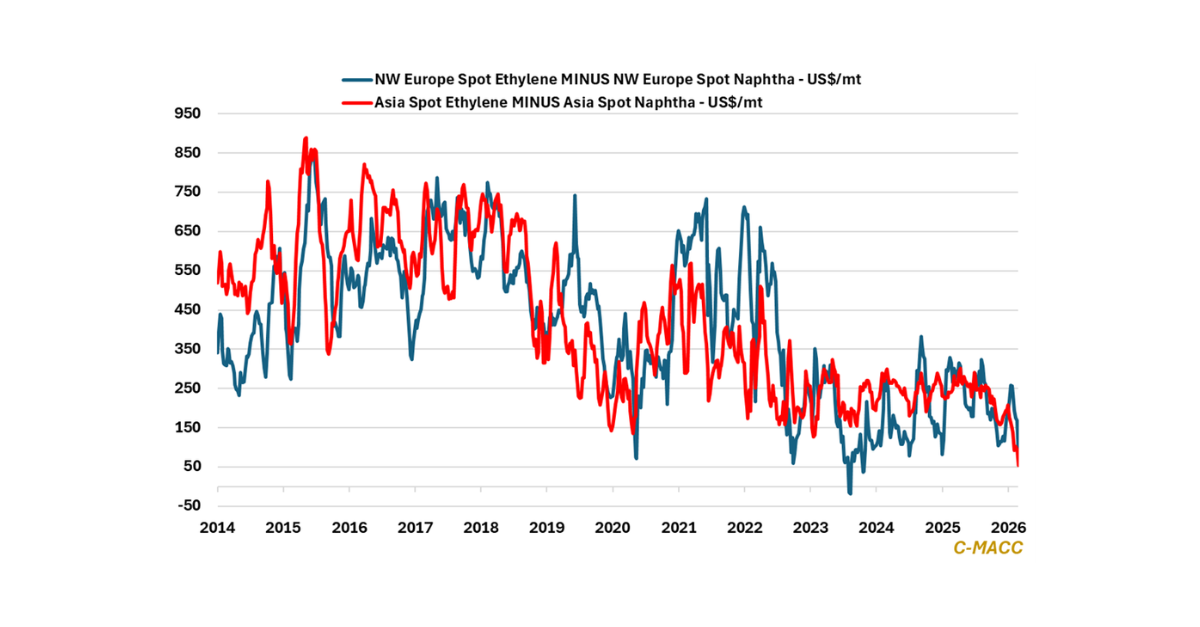

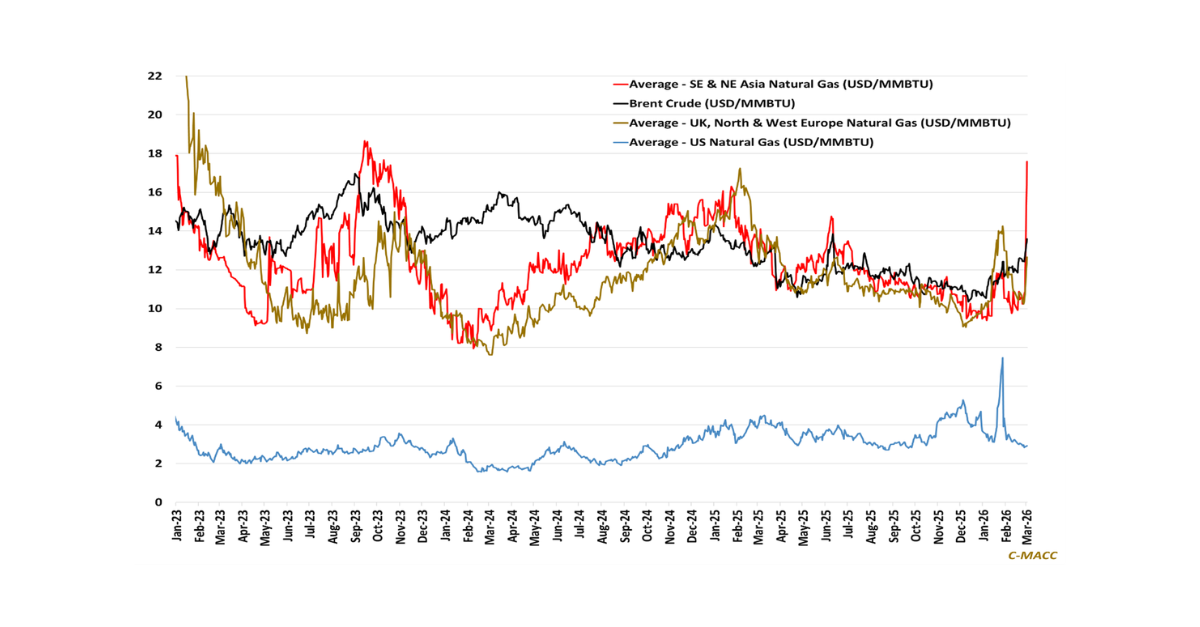

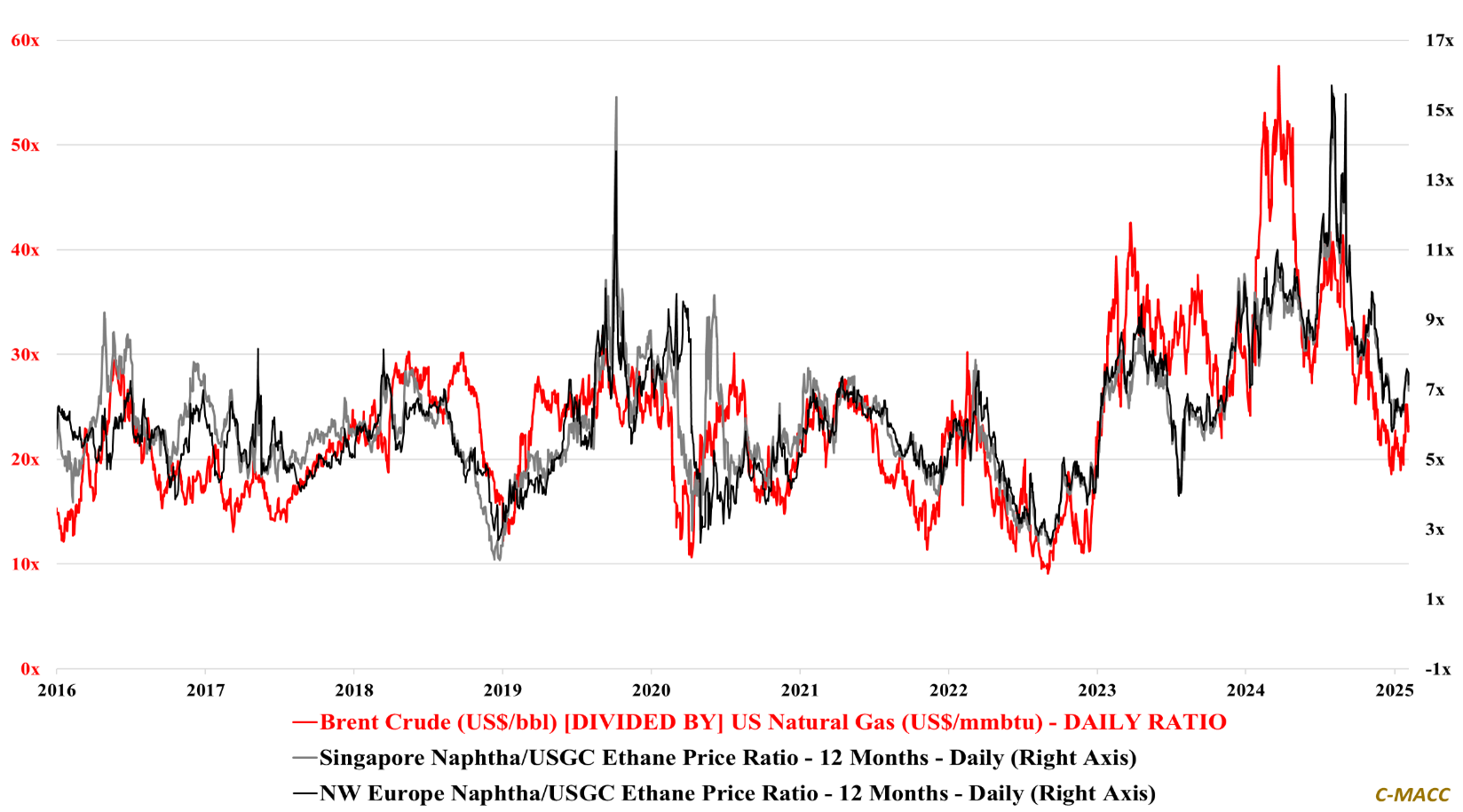

- Energy/Upstream: We discuss the push to export more US LPG, flag the retaliatory measures from China toward US energy exports, and highlight movements in crude oil and ex-US naphtha relative to US natural gas and ethane.

- Sustainability/Energy Transition: We highlight that European carbon prices have risen with its natural gas prices YTD and discuss the push among EU automakers to shift EU carbon policy from putting them at a disadvantage.

- Downstream/Other Chemicals: We discuss the depreciation of the Chinese yuan relative to the US Dollar, and the potential for Chinese currency depreciation to offset US tariffs and jolt our chemical oversupply concerns.

Exhibit 1: Petrochemical feedstock ratios are likely to reflect a flatter production cost curve in 2025 relative to 2024.

Source: Bloomberg, C-MACC Analysis, February 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!