Global Market Analysis

Riders on the Storm – Flattening Global Chemical Cost Curve Adds to Oversupply Risk as Competitive Dynamics Shift

Key Findings

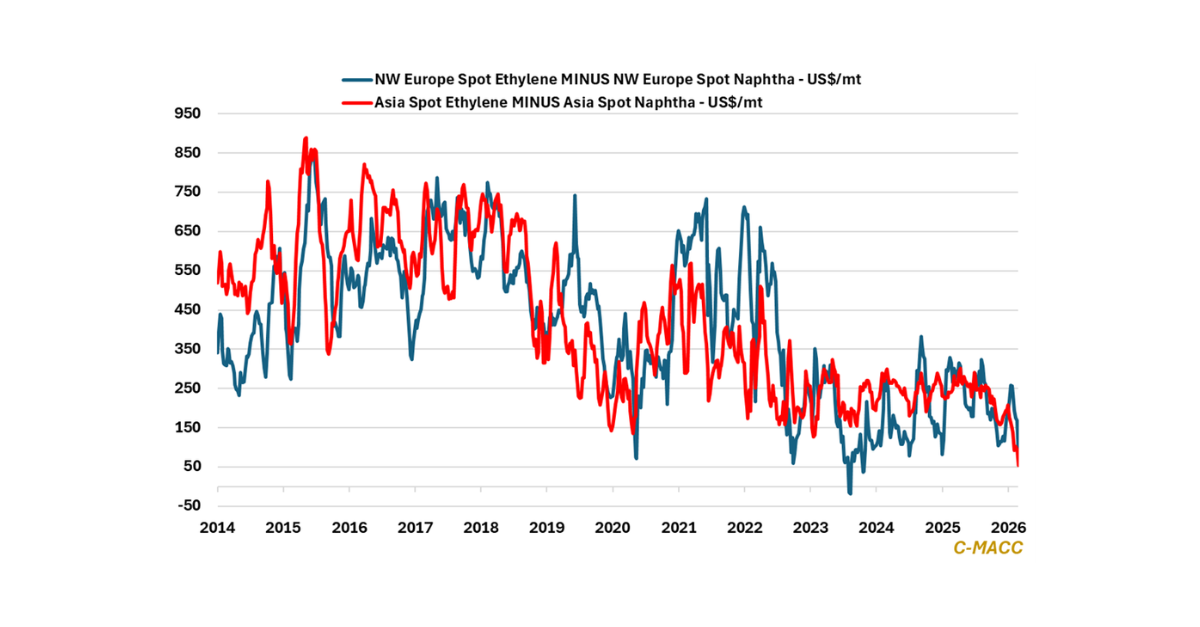

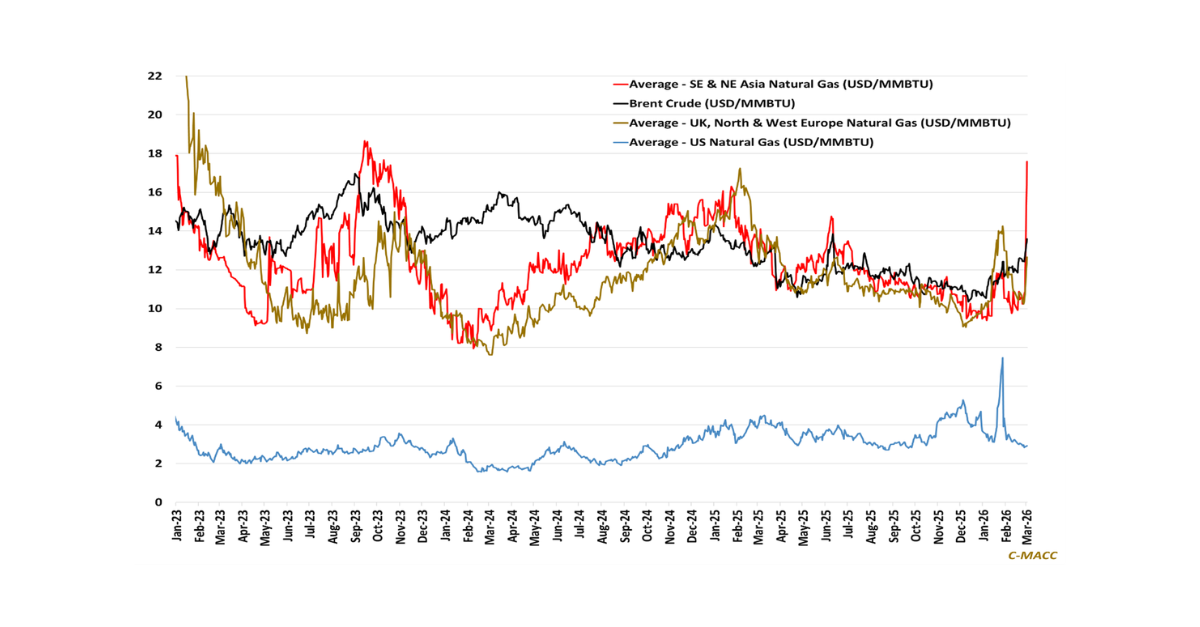

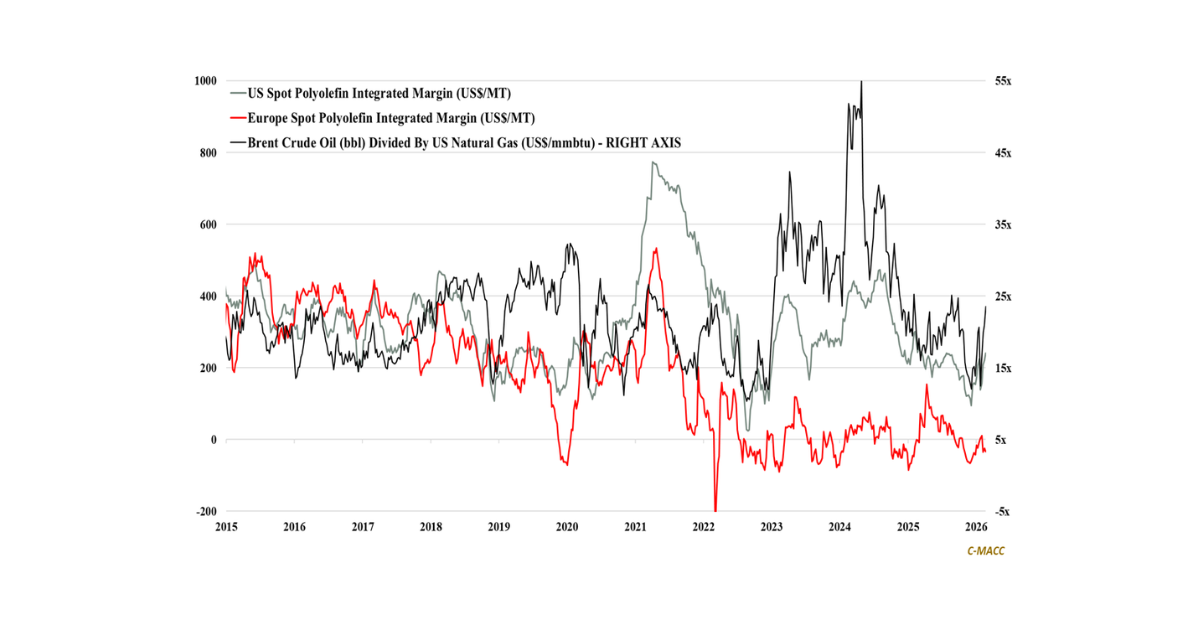

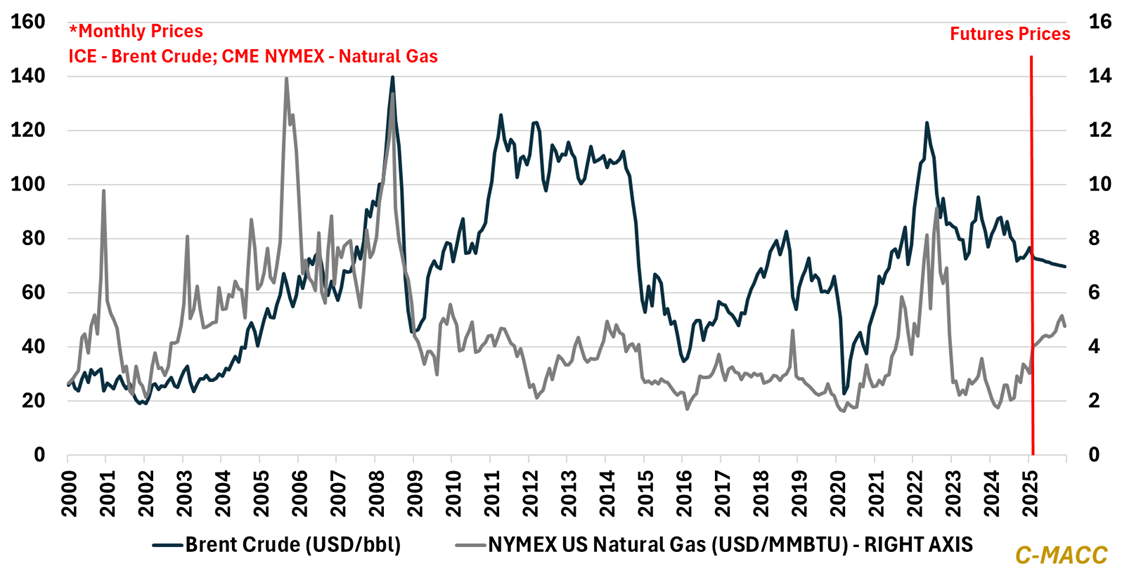

- General Thoughts: The global chemical production cost curve reflects a flattening pattern YTD, with futures implying flatter conditions ahead. We discuss the general setting and other factors shifting the global cost curve.

- Supply Chain/Commodities: With integrated EDC profits being negative if using purchased USGC ethylene, we make a positive case for PVC prices in late 1Q25. We also flag the risk of cheap Asia PP targeting Western markets.

- Energy/Upstream: We discuss the Braskem initiative to invest in a fleet of naphtha and ethane carriers to lessen its current cost position, and we also discuss ONGC efforts to secure partners to help it import ethane in India.

- Sustainability/Energy Transition: We discuss efforts from the German Steel Federation to push the newly elected German coalition toward an incentive policy to cut regional electricity prices and further discuss 45Q in the US.

- Downstream/Other Chemicals: Building product markets and housing conditions are weak, which is well known, but we think better conditions are ahead, and we highlight a few PVC and PU producers likely to benefit in 2025.

Exhibit 1: Brent crude oil has fallen relative to US natural gas YTD; futures markets suggest further spread contraction.

Source: Bloomberg, C-MACC Analysis, February 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!