C-MACC Sunday Executive Summary

Global Cost Curve Compression: The Quiet Repricing of Chemical Competitiveness

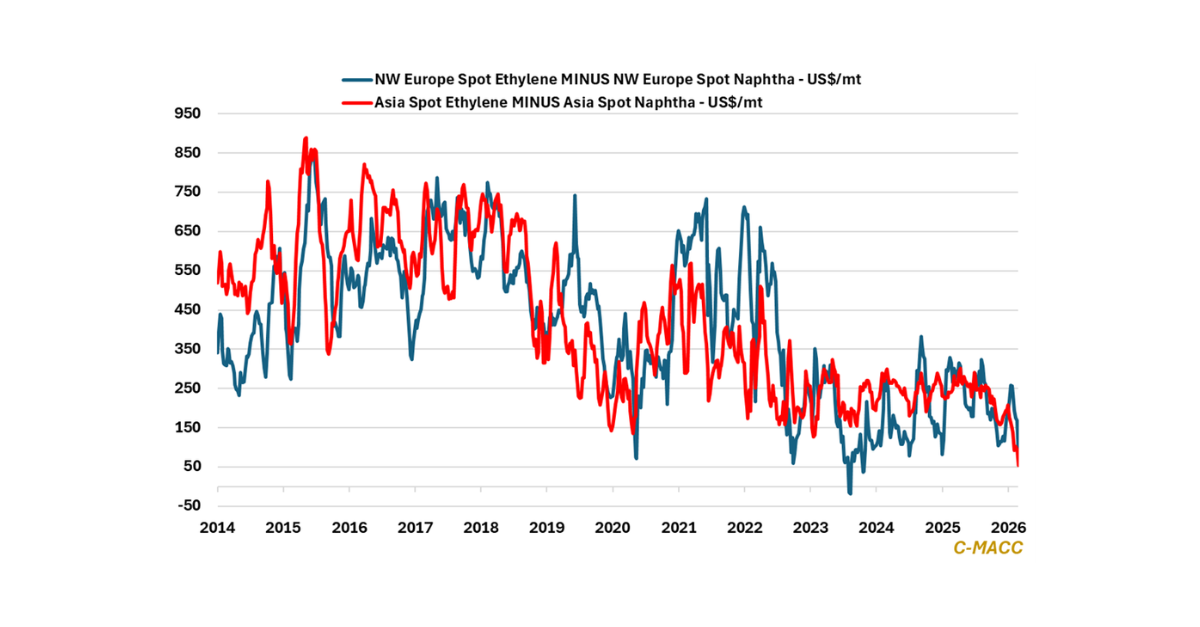

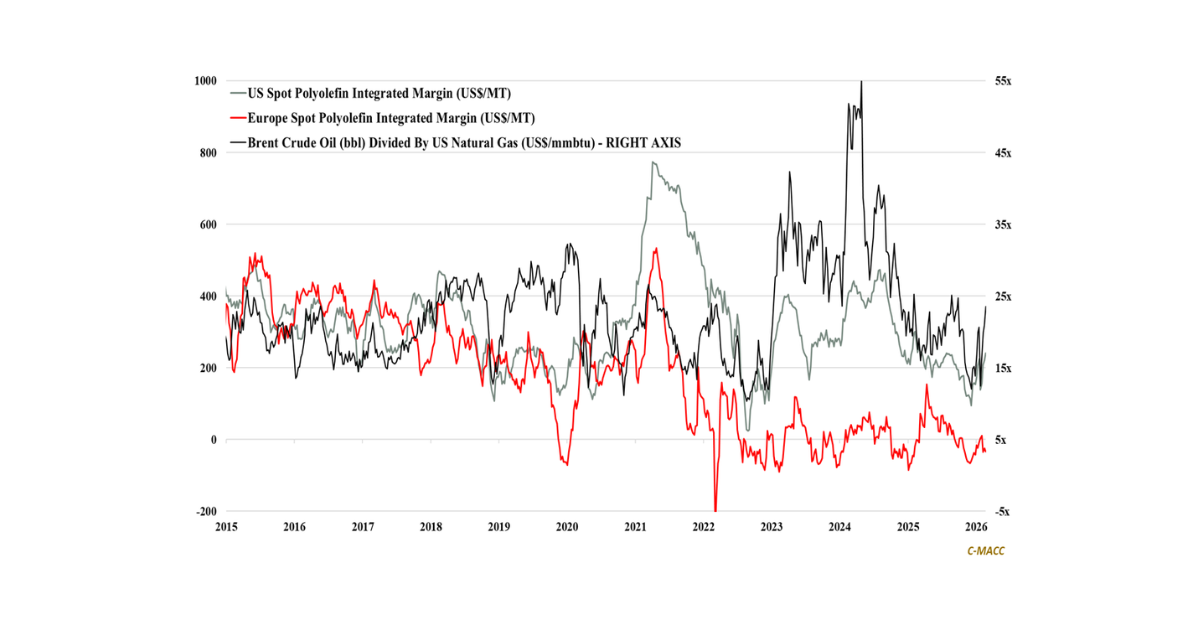

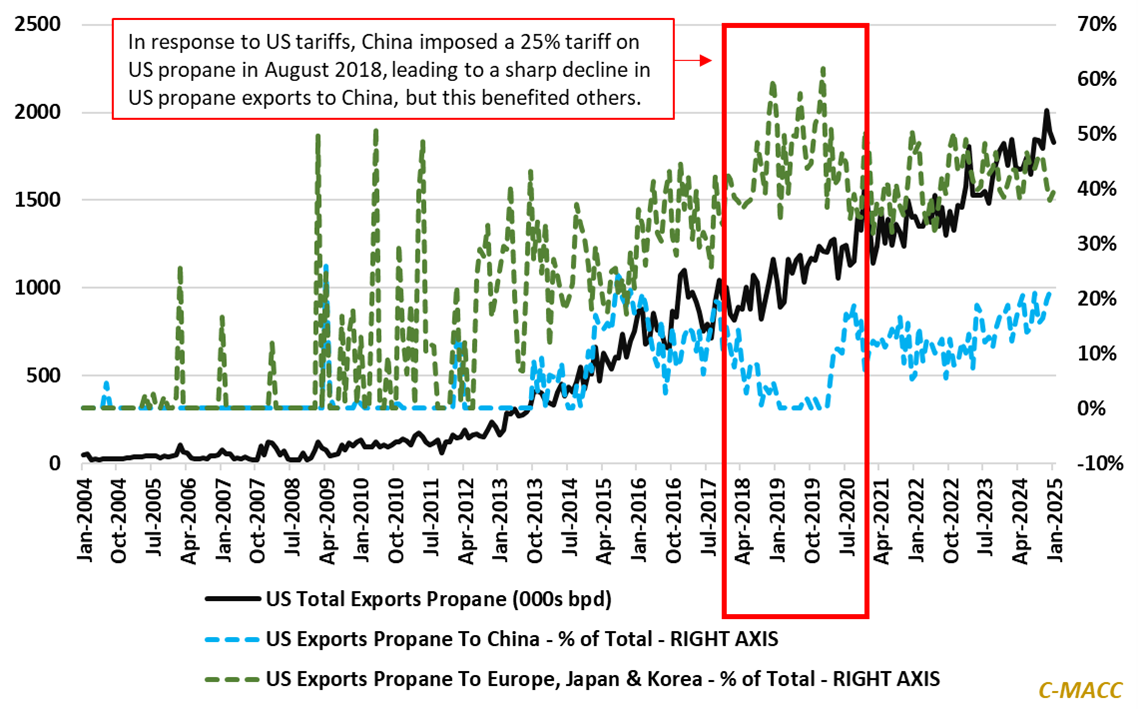

- China’s latest retaliatory tariff threats increase the risk of a supply chain reset, holding the potential to realign global petrochemical flows structurally, erode US margins, and shift net benefits to Europe and Asia Ex-China.

- The potential shift of US feedstock exports and chemicals away from China risks creating a flatter global cost curve, flooding alternative markets, and favoring regional players with logistical and greater policy flexibility.

- Canada’s push to boost propane exports to Asia—enabled by its strategic West Coast port access—shows how secondary suppliers can swiftly capitalize on geographic advantage and geopolitical shifts amid trade tensions.

- For US producers of methanol and polymers—especially those who banked on China-bound growth—this is a wake-up call: demand doesn’t reroute as easily as molecules and new capacity may face unforeseen challenges.

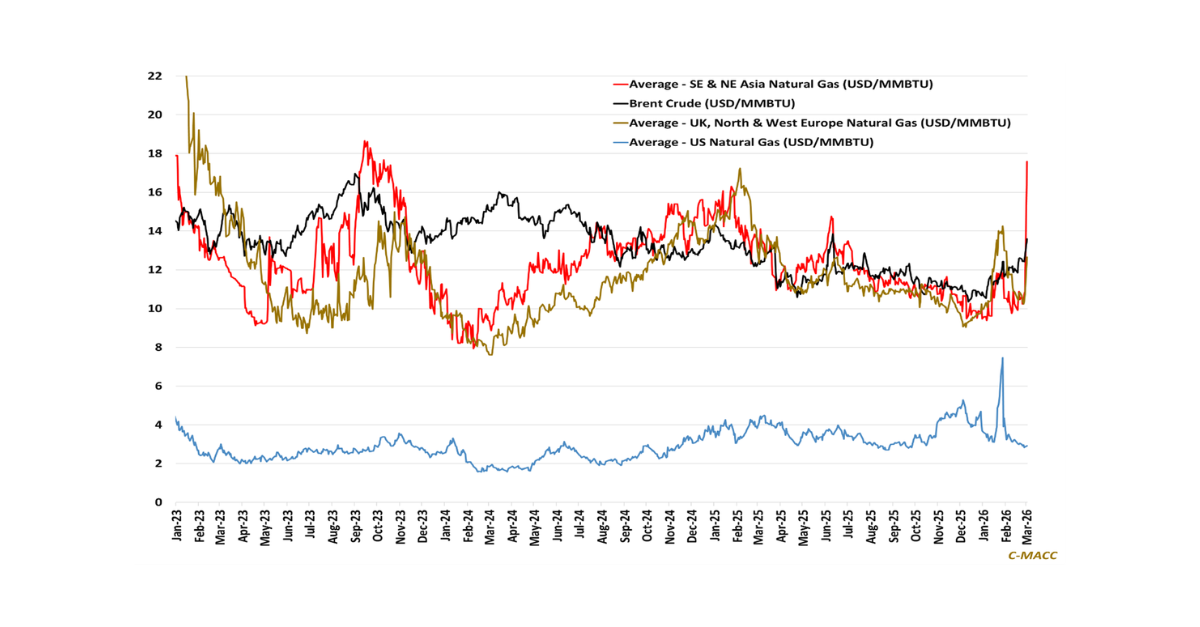

- Otherwise, the report highlights compressed polymer margins, cost curve convergence, volatile biofuel dynamics, and water risks in critical minerals—reminding us that resilience depends on adaptability and scale.

- Companies Mentioned: China National Petroleum Corporation (CNPC), Inter Pipeline, Methanex, Celanese, OCI, ExxonMobil, LyondellBasell, Braskem, Pinnacle Polymers, Alpek, Dow, SABIC, Enterprise Products, TPC Group, CF Industries, Nutrien, Rio Tinto, Arcadium, Albemarle, Li-Cycle, Lithium Americas, Mangrove Lithium

- Products Mentioned: Propane, Methanol, Ethylene, Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Ammonia, Corn, Ethanol, Crude Oil, Natural Gas, LPG, Butadiene, Benzene, Copper, Lithium, Nickel, Manganese, Graphite, Cobalt, Steel, Aluminum, Spodumene, Water

Exhibit 1: If China advances with a blanket tariff on US imports; net benefits may flow to Europe & Asia Ex-China.

Source: Bloomberg, C-MACC, April 2025

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!