Global Market Analysis

If Policy Writes The Rules, Do Costs Still Matter?

Key Findings

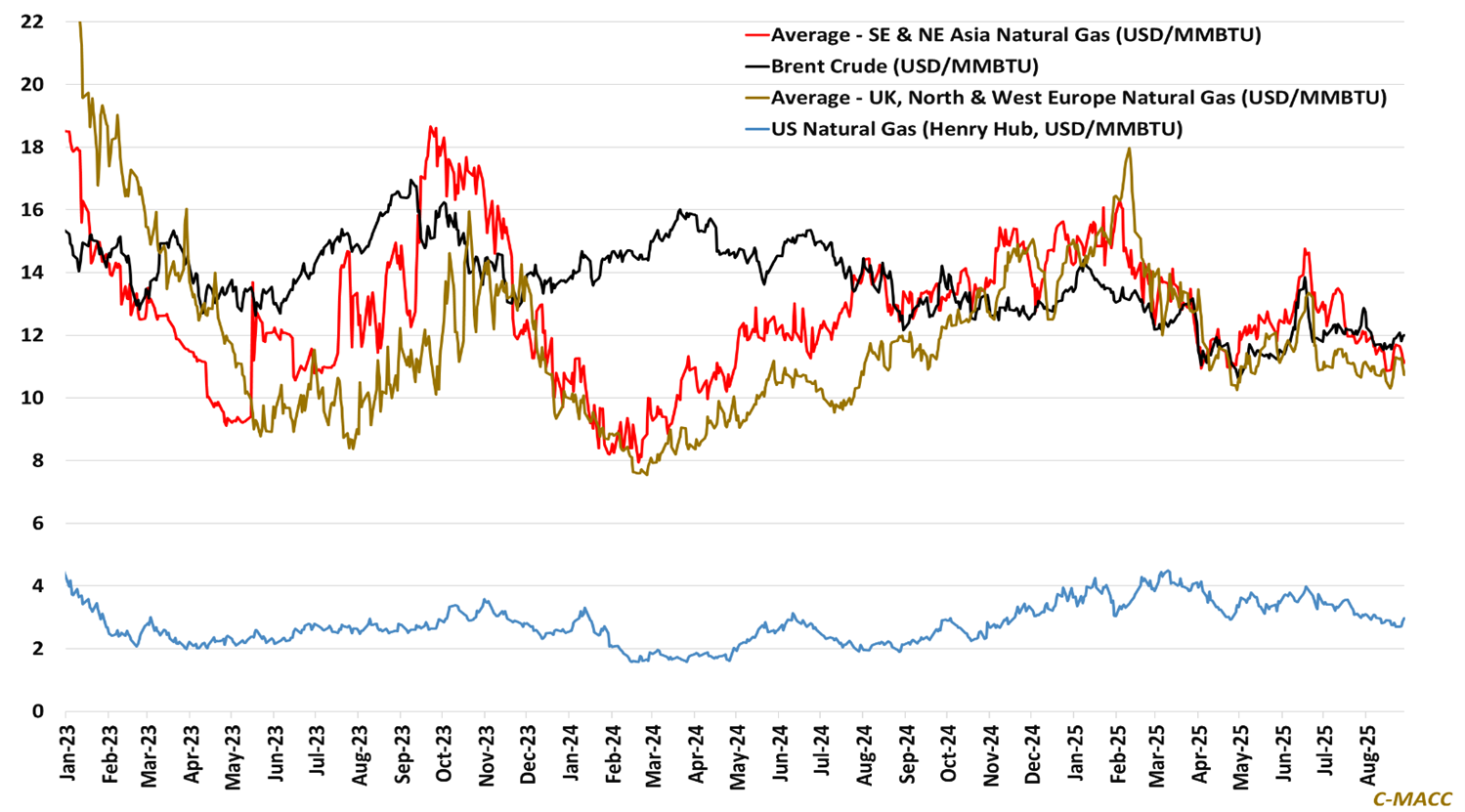

- General Thoughts: Global oil flows remain unified, but fragmented gas markets now expose how policy, contracts, and cost divergence combine to redefine competitiveness across energy, agriculture, and critical minerals.

- Supply Chain/Commodities: Methanol benchmarks endure above volatile spot levels, validating North American advantages, while Western premiums over Asia show contracts, logistics, and policy shaping competitiveness.

- Energy/Upstream: Europe builds a diversified LNG grid to replace Russian flows, improve energy security, and stabilize industry, while US crude oil refiners face closures, tighter markets, and strategic pivots eastward.

- Sustainability/Energy Transition: Ethanol’s winners combine financial strength with CCS execution and export growth, treating carbon as a co-product while leveraging policy incentives to secure durable competitiveness.

- Downstream/Other Chemicals: Global agriculture and trade reveal imbalances where South American supply and transatlantic policy disputes, not yields or tariffs, increasingly redefine competitiveness and stability.

Exhibit 1: Global oil, regional gas: market structure and policy drive competitiveness, for most.

Source: Bloomberg, C-MACC Analysis, August 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!