Base Chemical Global Analysis

Global Weekly Catalyst No. 299

- General Thoughts: Into 4Q25 and 2026, compressed spreads, uneven demand, and policy recalibrations converge, rewarding nimble low-cost producers while penalizing rigid models tied to fragile regional arbitrage.

- Feedstocks & Energy: Crude’s range-bound US$65-70/bbl corridor, gas spread compression, and NGL strain converge, foreshadowing 2026 turbulence as LNG expansion collides with shale costs, compressing margins.

- Olefins: Global ethylene and propylene prices diverged last week, as ethylene weakened broadly, propylene mixed, underscoring oversupply, derivative policy friction, and feedstock agility as key drivers of regional prices.

- Other Base Chemicals: Market turbulence intensifies as benzene drifts, methanol fragments, and chlor-alkali imbalances persist, sharpening the advantage of nimble low-cost producers heading into year-end volatility.

- Agriculture: Ammonia spot prices hold firm, yet most reflect levels far above their 2Q25 averages, amplifying returns as divergent gas cost dynamics secure an advantage for North American and Middle Eastern producers

- Refining & Biofuels: US spot ethanol profit rises to a 2025 high on resilient demand and capped corn costs, while domestic crude oil refining profits benefit from conditions likely to support higher 4Q25 margins relative to 4Q24.

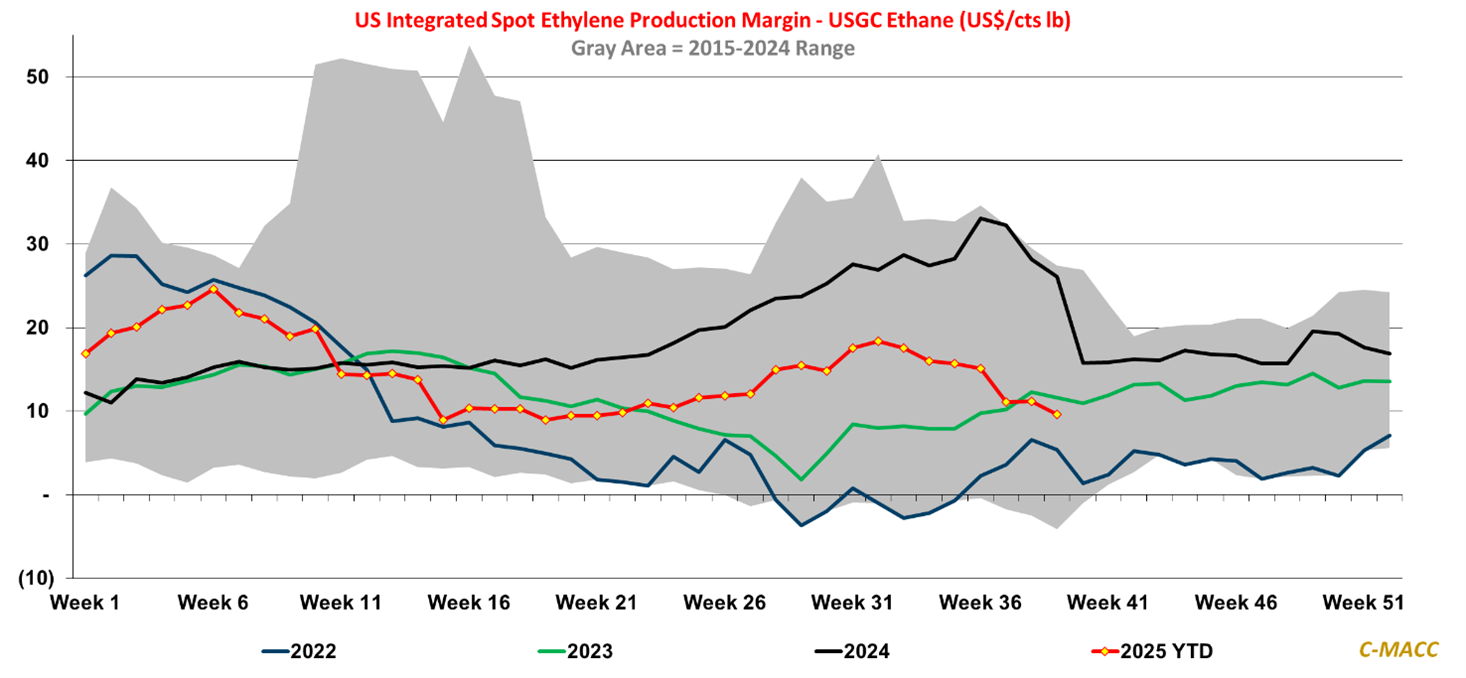

Exhibit 1 – Chart of the Day: US spot ethylene margins fall to 2025 low, driven by higher costs, arbitrage compression.

Source: Bloomberg, C-MACC Estimates, September 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!