Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

- General Thoughts: Global polymers navigate a fragile yet tightening landscape as disciplined Western rate cuts and China’s rising export muscle reshape value chains, setting the stage for a gradual utilisation recovery through 2026/27.

- Polyethylene (PE): PE markets firm as regional floors take shape, with tighter US inventories, stabilising European prices, and heavy Asian inflows pointing toward a late-2025 bottom and a more synchronised, cost-supportive setting in 2026.

- Polypropylene (PP): PP margins remain under acute pressure as China’s rising export push and constrained US cost leverage suppress spreads, signalling that tight PP-to-PGP economics will likely persist globally in late 2025 and 2026.

- Polyvinyl Chloride (PVC): PVC edges toward a cyclical inflection as US inventory draws deepen, global operating rates tighten, and housing indicators stabilise, setting the stage for price support and a gradual utilisation recovery in 1H26.

- Other Sector Developments: Feedstock prices have fallen relative to their 3Q25 averages, positioning low-cost, globally integrated producers to benefit as high-cost producers battle oversupply, low prices, and more limited recovery hopes.

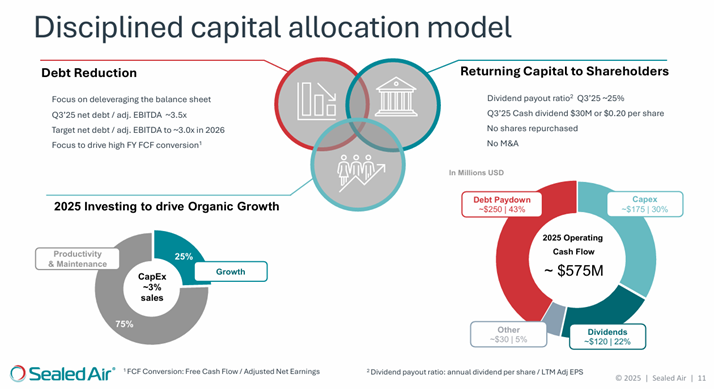

Exhibit 1 – Chart of the Day: Capital discipline positions Sealed Air for CD&R’s value-driven acquisition thesis.

Source: Sealed Air – 3Q25 Earnings Call Presentation, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!