Global Market Analysis

Under Pressure: Natural Gas Spreads Compress, and Policy Expectations Turn Markets Inside Out

Key Findings

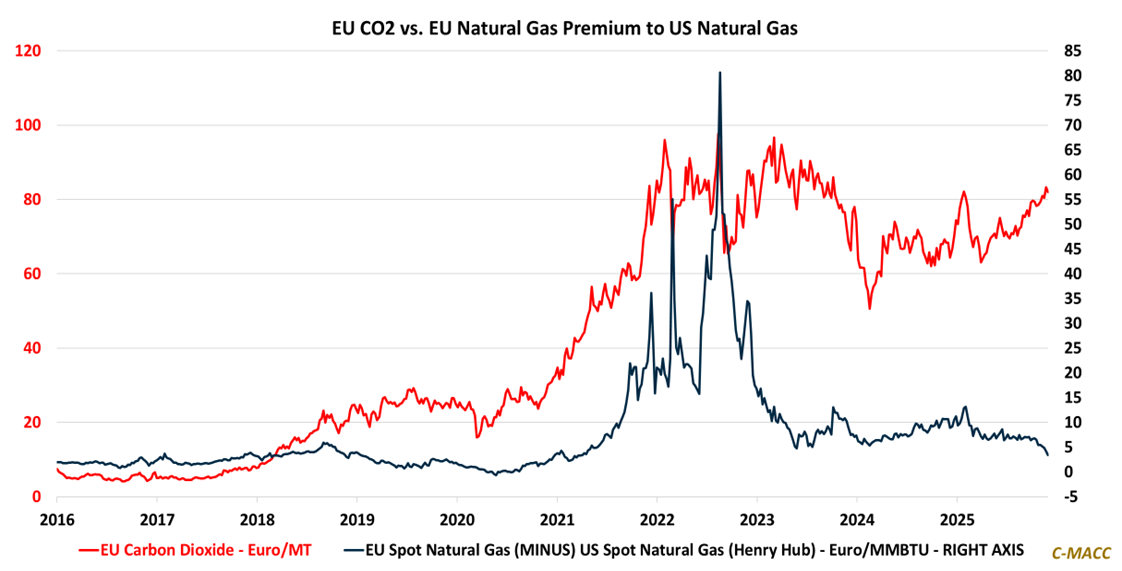

- General Thoughts: Flattening global natural gas spreads and rising carbon costs are reshaping industrial cost curves and embedding markets that increasingly reward certified reliability over pure feedstock advantage.

- Supply Chain/Commodities: Narrowing gas spreads compress ammonia margins, yet unreliable supply, firmer on-farm demand, and accelerating carbon differentiation increasingly underpin global price resilience into 2026.

- Energy/Upstream: Crude and petrochemical markets increasingly pivot on global gas-price divergence, feedstock substitution, and integrated returns, shifting competitive advantages far more than headline oil balances imply.

- Sustainability/Energy Transition: Air Products–Yara negotiations highlight a low-carbon ammonia playbook in which hydrogen-led economics, carbon-policy advantage, and global logistics scale shape industry outcomes.

- Downstream/Other Chemicals: US farm policy, fragile China demand, and tight farmer liquidity are beginning to tilt acreage toward nitrogen-hungry corn, favoring 2026 fertilizer demand support despite subdued crop prices.

Exhibit 1: EU carbon prices outpace fading gas premium, fundamentally recasting industrial cost hierarchies.

Source: Bloomberg, C-MACC Analysis, December 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!