Global Market Analysis

Sprockets! Power Demand Surges as Gas Spreads Compress and European Chemicals Stop Dancing

Key Findings

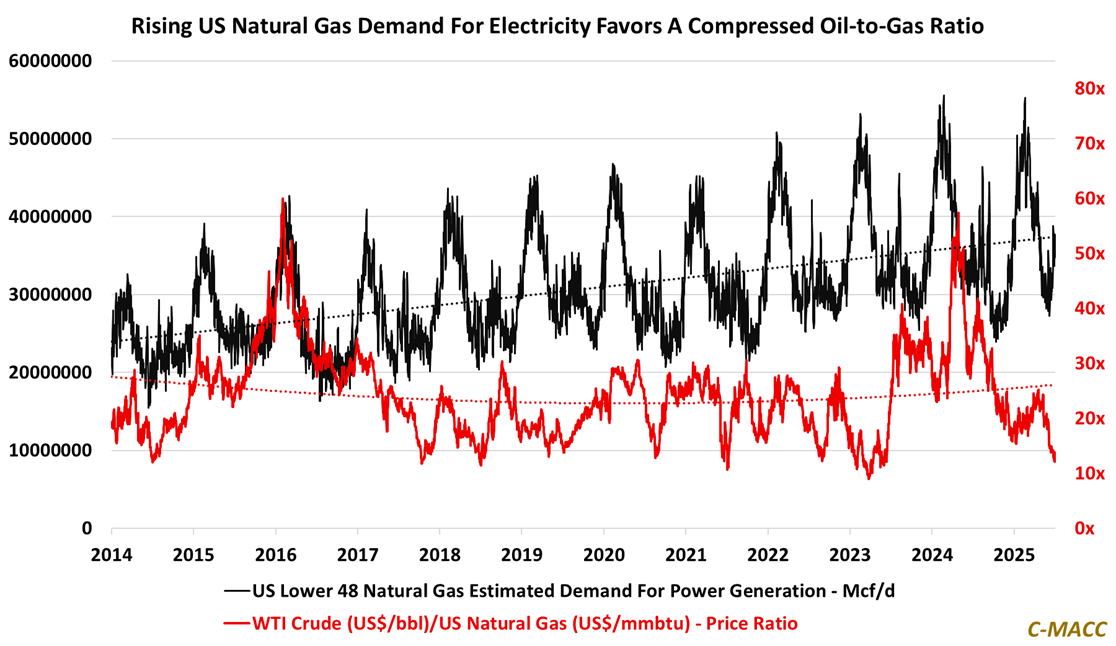

- General Thoughts: Growing structural natural gas demand, persistent global chemical overcapacity, and tighter grid constraints will jointly determine competitiveness and boost cross-sector consolidation well into 2026.

- Supply Chain/Commodities: Structural cost disadvantages, weak demand, and global overcapacity deepened Europe’s 2H25 chemical sector downturn, reinforcing its need for coordinated rationalization and credible policy.

- Energy/Upstream: Rising natural gas dependence, grid congestion, and accelerating electrification demand create structural scarcity, positioning integrated power-system players to capture value as load growth intensifies.

- Sustainability/Energy Transition: Integrated grain-to-ethanol systems, accelerating low-CI credit economics, and co-product merchandising scale benefit integrated players disproportionately amid feedstock and policy swings.

- Downstream/Other Chemicals: Normalized freight and a weaker dollar reset cost curves, shifting advantage toward integrated low-carbon exporters while compressing margins for fragmented global downstream markets.

Exhibit 1: Rising US gas demand for power accelerates structural compression of oil to gas price ratios

Source: Bloomberg, C-MACC Analysis, December 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!