Global Market Analysis

There Will Be Blood, Closures: Global Return Hurdles Further Harden Into 2026

Key Findings

- General Thoughts: Higher capital costs and flatter global chemical cost curves harden return hurdles, accelerating rationalizations while benefiting advantaged integrated projects, setting the global stage for tighter balances.

- Supply Chain/Commodities: Westlake’s vinyl closures signal disciplined footprint optimization; alongside sector rationalizations in Europe and Asia, industry tolerance for marginal assets is falling, supporting firmer 2026 prices.

- Energy/Upstream: Brent crude oil and Ex-US natural gas prices moderate in 2H25, as US natural gas and NGL volatility keep marginal supply investment disciplined. US LNG and NGL exports heighten global convergence risk.

- Sustainability/Energy Transition: Cheap virgin resin and weak PCR premiums further push brands from pledges to redesign and contracts; solution-led producers position to take share as laggards risk stranding capital.

- Downstream/Other Chemicals: Mortgage lock-ins keep turnover muted, yet repair- and contractor-driven work gains share; Home Depot’s speed and credit ecosystem efforts shift share toward building product markets.

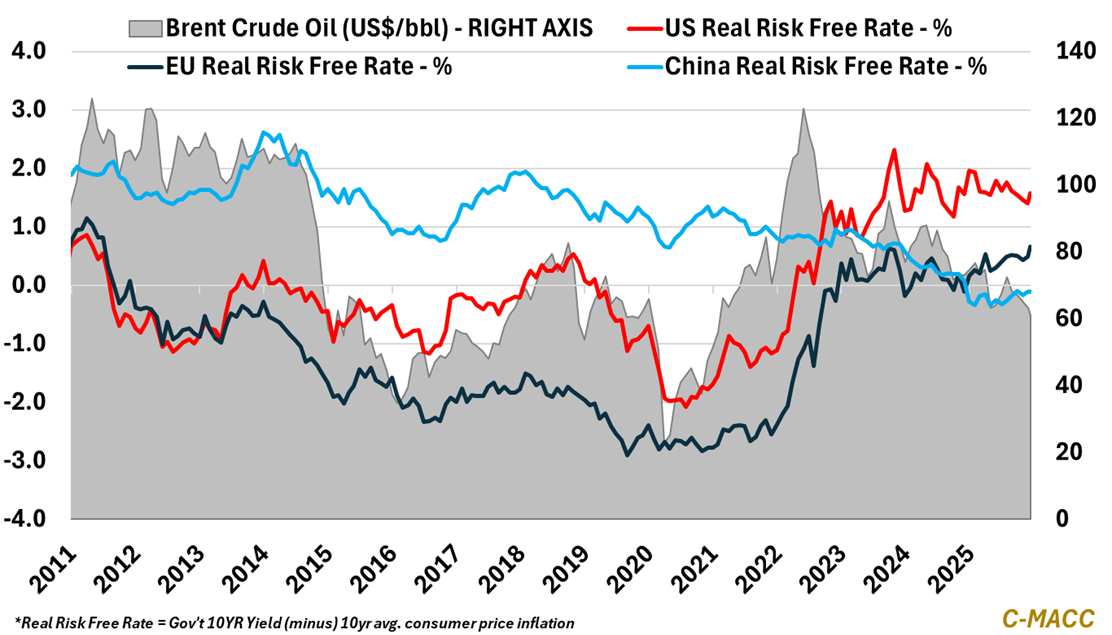

Exhibit 1: Real rates strengthen globally in late 2025 as Brent crude oil softens, tightening capital markets and returns.

Source: Bloomberg, C-MACC Analysis, December 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!