C-MACC Sunday Executive Summary

Champagne Off, Reality On: Chemical Markets To Reward Preparedness, Not Patience In 2026

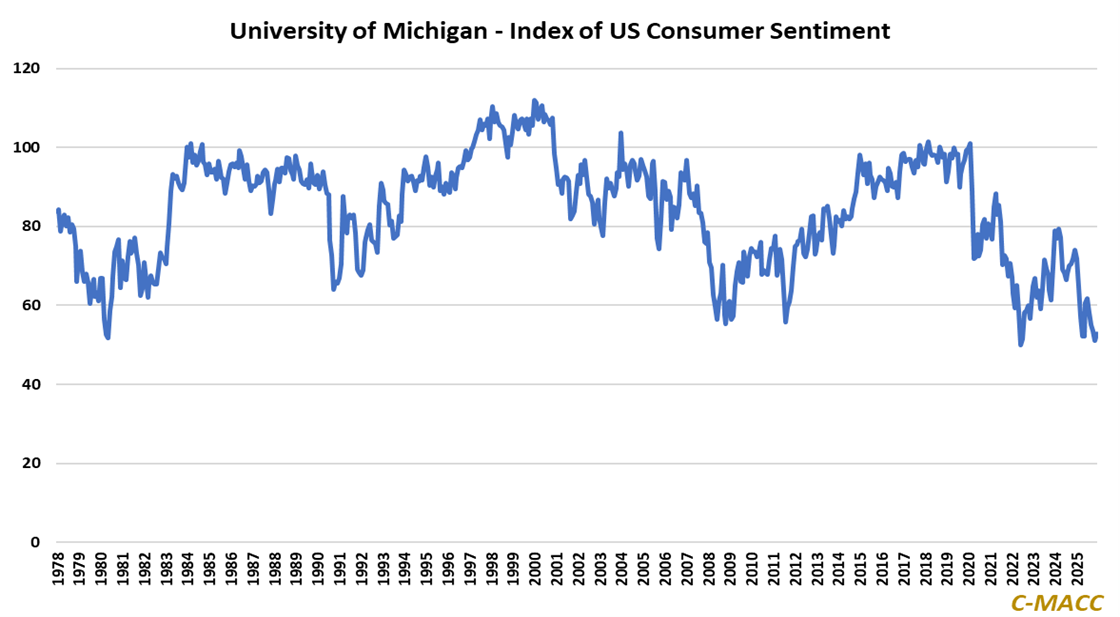

- Depressed consumer sentiment and weak business expectations imply demand will not offset oversupply, with 2026 outcomes more likely to be determined by restructuring discipline rather than cyclical recovery hopes.

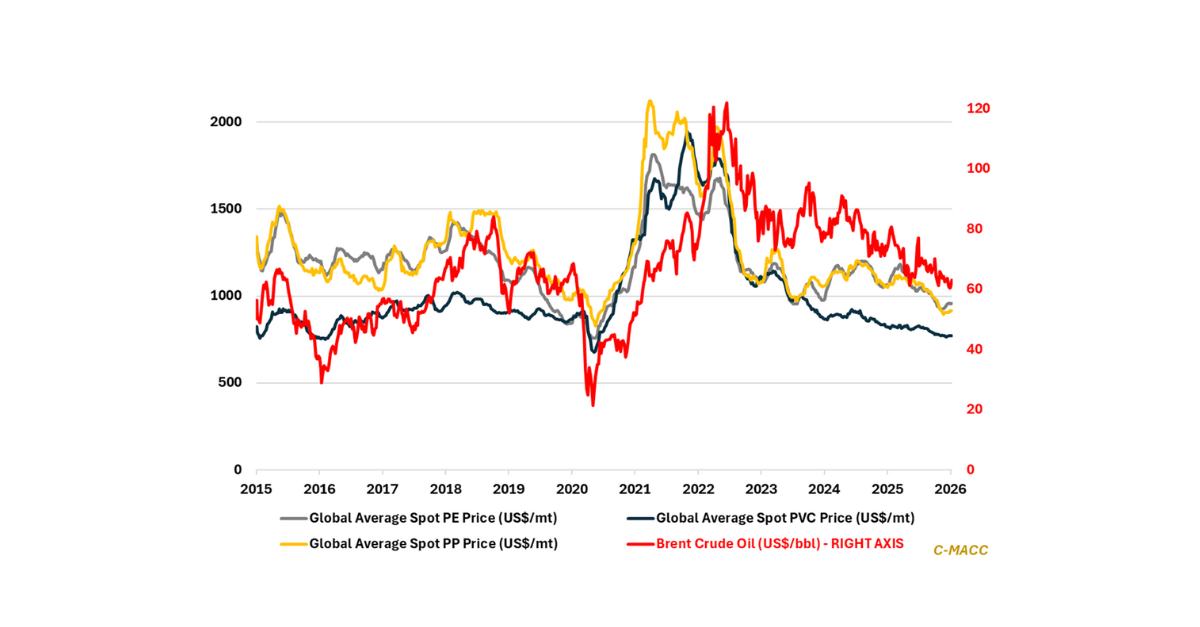

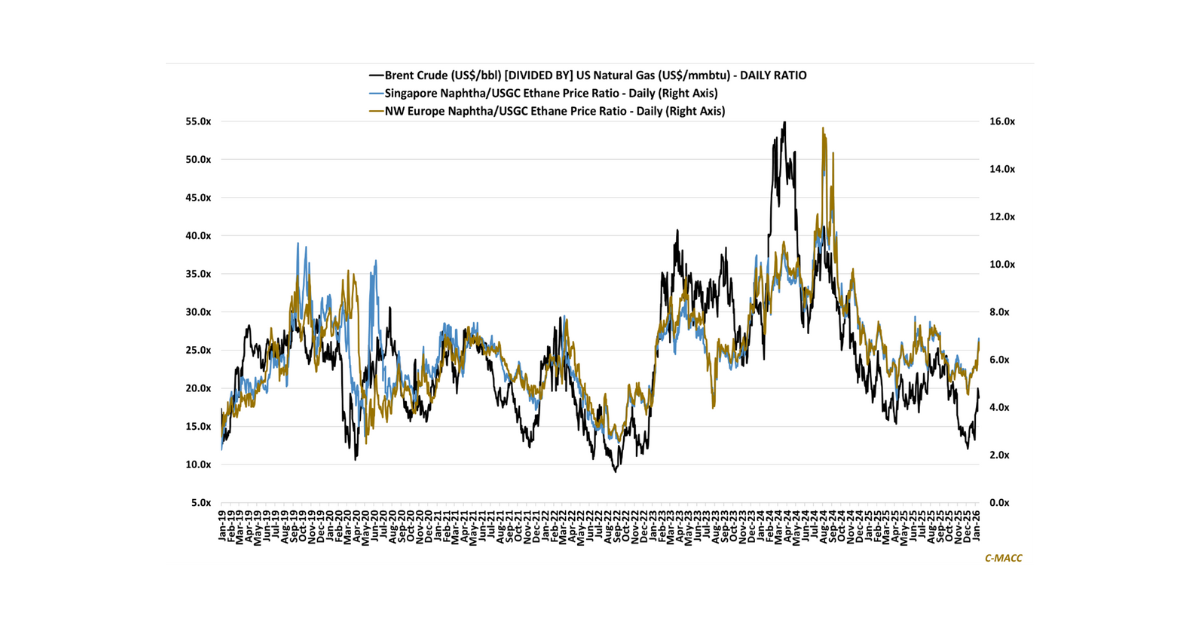

- Flatter oil-to-gas ratios and low expectations for improvement stabilize chemical costs but delay natural exits, compress margins globally, and force management to execute, integrate, and rationalize capacity to lift returns.

- Global chemical sector equity dispersion already rewards integrated producers acting decisively, as high-cost non-integrated players face escalating pressure to close assets, consolidate, or accept prolonged value erosion.

- The most underappreciated opportunities in 2026 will likely arise where low expectations intersect with balance sheet strength, credible restructuring, and a willingness to exit uneconomic capacity across markets.

- Otherwise, depressed global energy prices and freight rates mask binding carbon costs, currency swings, and oversupply, forcing restructuring, cautious trade, and margin defense across chemicals and adjacent markets.

- Companies Mentioned: ExxonMobil, Dow, Westlake, Braskem, HD Hyundai, Lotte Chemical, LyondellBasell, BASF, SABIC, Sinopec

- Products Mentioned: Ethylene, Polyethylene (PE), HDPE, Crude Oil, Natural Gas, Naphtha, Ethane, LNG

Exhibit 1: US consumer sentiment ended 2025 near multi-decade lows; corporate outlooks should not rely on recovery.

Source: University of Michigan, C-MACC Analysis, January 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!