Base Chemical Global Analysis

Global Weekly Catalyst No. 312

- General Thoughts: Early-year chemical spot prices and relative feedstock cost movements suggest that the pace of restructuring and regional return-enhancement efforts will be more decisive than demand recovery in 1H26.

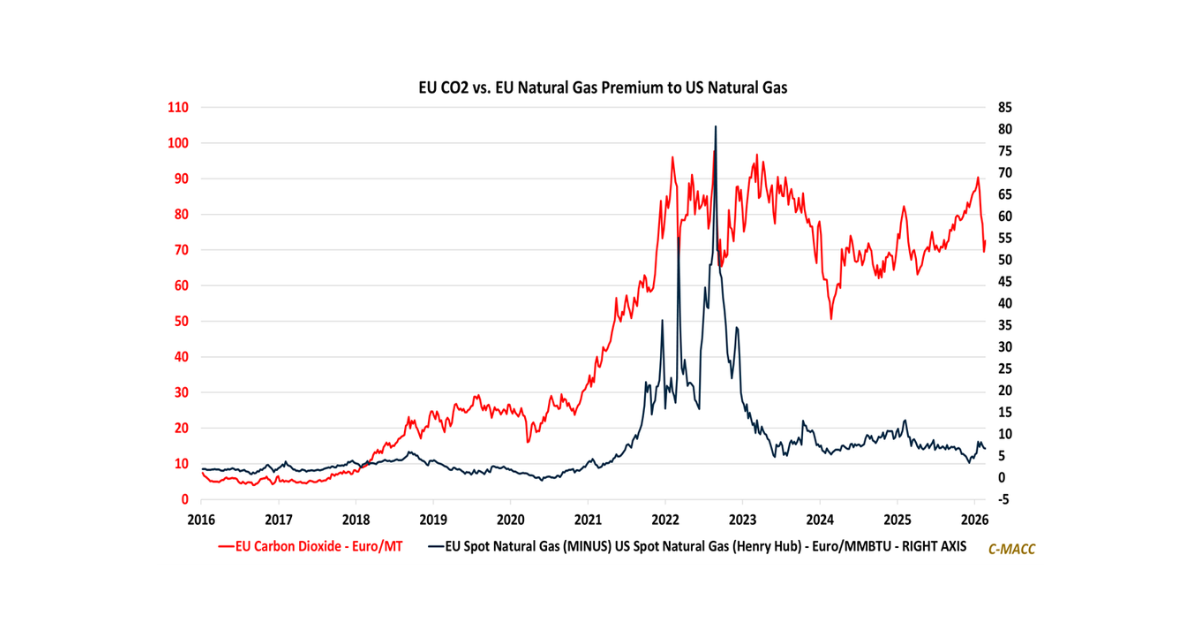

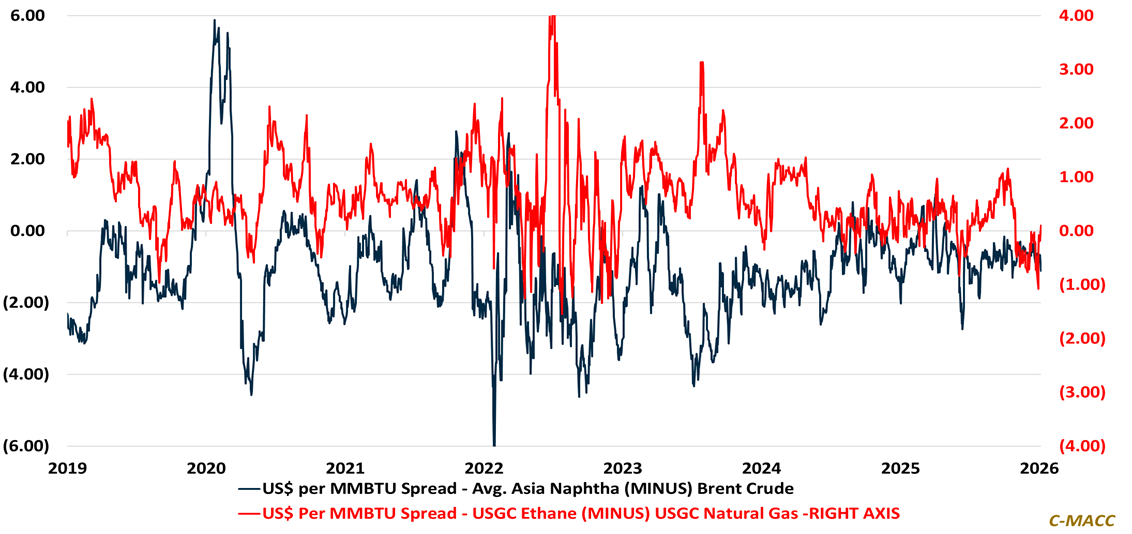

- Feedstocks & Energy: Feedstock cost relief caps prices but quietly sets asymmetric upside, because depressed expectations, fragile oil discipline, and resilient US feedstock advantages leave markets poorly hedged.

- Olefins: Global olefin markets clear through regional discipline, not demand, as outages mask structural oversupply, polymers lag pricing signals, and normalization risks quickly erode any pockets of abnormal strength.

- Other Base Chemicals: Non-olefin base chemicals continue to fragment along cost and logistics lines, with methanol and benzene exposed to supply normalization while global chlor-alkali awaits restructuring to reprice materially.

- Agriculture: Ammonia spot prices show pockets of weakness in early 2026, as the market grapples with the prospect of improved supply, likely capping upside risk to spot prices and keeping margins in check in 1H26.

- Refining & Biofuels: Global refining margins remain positive but weaken into early 2026 as downstream prices weaken relative to crude oil. US ethanol margins show relative support, but at depressed levels to start the year.

Exhibit 1 – Chart of the Day: Asian naphtha weakens versus oil, while US ethane strengthens relative to gas into 2026.

Source: Bloomberg, C-MACC Estimates, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!