C-MACC Weekly Sustainability and Energy Transition Report

Electric Avenue: Policy Power Surges, Metals at a Crossroads

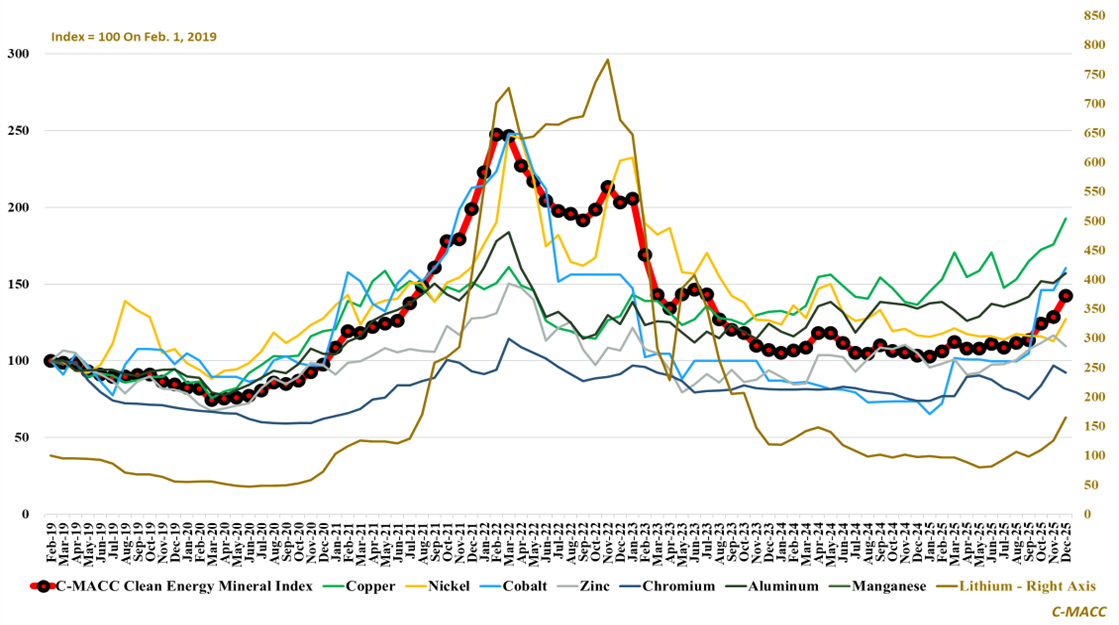

- 1st Topic of the Week: Are copper and lithium entering a policy-anchored price regime where security-driven supply caps upside while speculative flows amplify volatility across producers, OEMs, and investors?

- 2nd Topic of the Week: Which hydrogen strategies survive shifting policy, volatile premiums, and uneven demand without corridor flexibility, global sourcing, and capital discipline as ammonia trade economics reset in 2026?

- Otherwise, market mispricing of power volatility, mineral security, carbon costs, biofuel margins, and transition assets will likely persist in 2026 as policy constraints overwhelm traditional global supply-demand fundamentals.

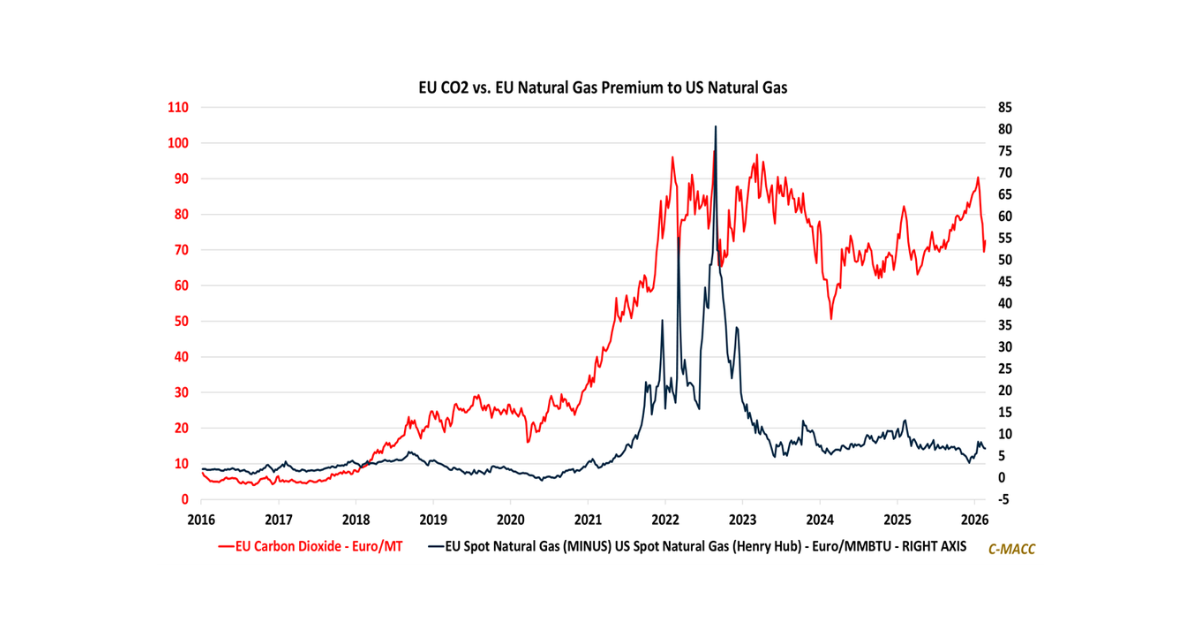

Exhibit 1: C-MACC clean energy minerals index rises for the fourth consecutive month amid improved fundamentals.

Source: Bloomberg, C-MACC Analysis, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!