C-MACC Sunday Executive Summary

I Walk the Line: Logistics Beat Capacity, Discipline Defines Returns

- The fundamental health of the global ammonia market increasingly hinges on logistics, reliability, and timing constraints, making basis risk and seasonal timing more decisive than headline prices or announced capacity.

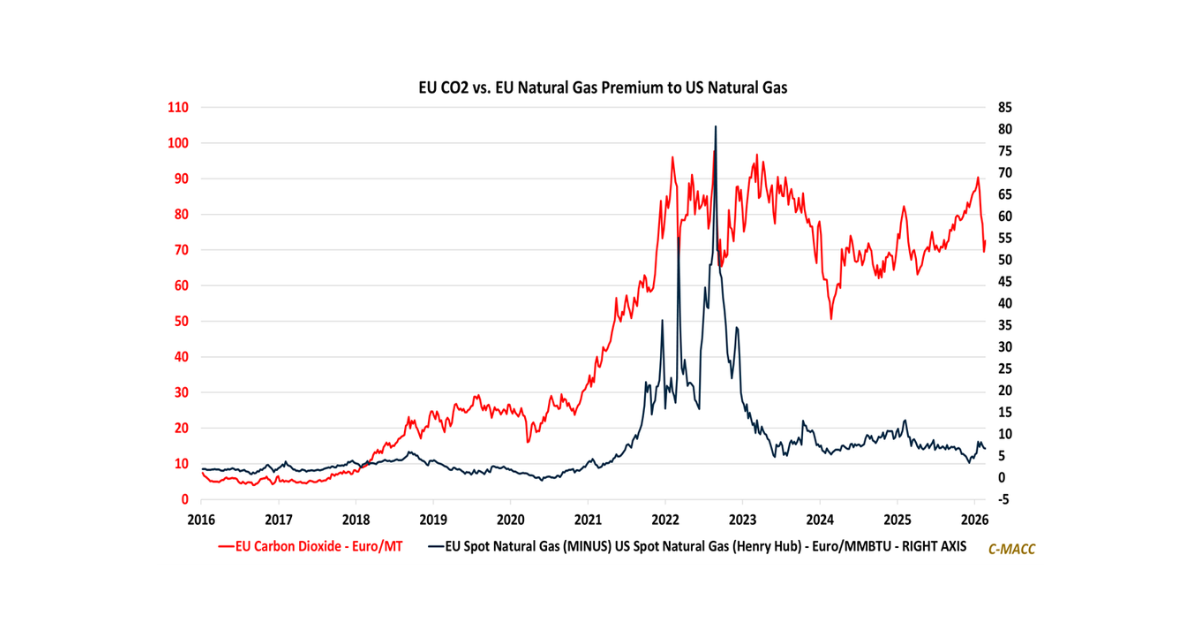

- Hydrogen cost dispersion, more than policy design, shapes ammonia trade patterns, structurally favoring gas-advantaged regions despite persistent momentum around alternative clean transition paths and subsidies.

- Capital discipline has become a differentiator, as higher real rates reward incumbents that invest in reliability, debottlenecking, and balance-sheet durability rather than irreversible expansion in volatile macro conditions.

- Investor confidence into 2026 depends on management teams framing durability under volatility, avoiding aggressive volume promises that risk credibility amid volatile agriculture, energy, and policy signals.

- Otherwise, petrochemical sector developments show that oversupply caps integration upside, accelerating restructuring and shifting value creation toward selectively advantaged downstream and energy exposures.

- Companies Mentioned: CF Industries, Nutrien, LSB Industries, Fertiglobe, Yara International, Woodside Energy, The Andersons, Green Plains, ADM, Shell, SABIC, LyondellBasell, Phillips 66, Albemarle, Rio Tinto, Glencore

- Products Mentioned: Ammonia, Nitrogen, Urea, UAN, Corn, Soybeans, Natural Gas, Hydrogen, Ethylene, Ethane, Polyethylene, Polypropylene, Polyvinyl Chloride, Naphtha, Crude Oil, LNG, Biodiesel, Biofuels, Copper, Lithium, Aluminum, Carbon, Phosphate

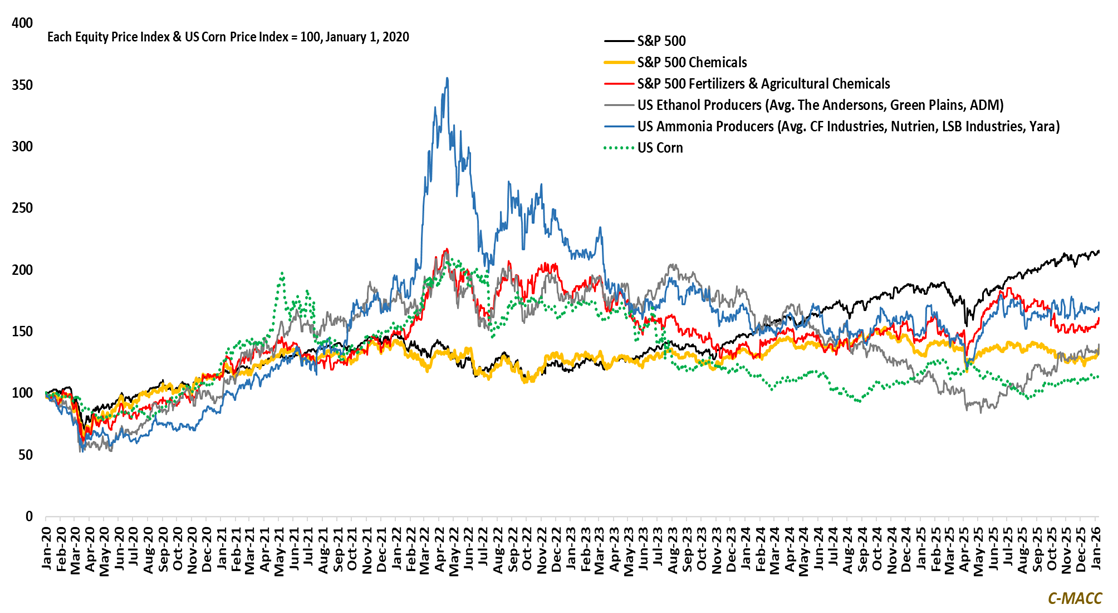

Exhibit 1: Ammonia equities stay resilient as supply discipline and logistics scarcity dominate the cycle.

Source: Bloomberg, C-MACC Analysis, January 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!