Base Chemical Global Analysis

Global Weekly Catalyst No. 313

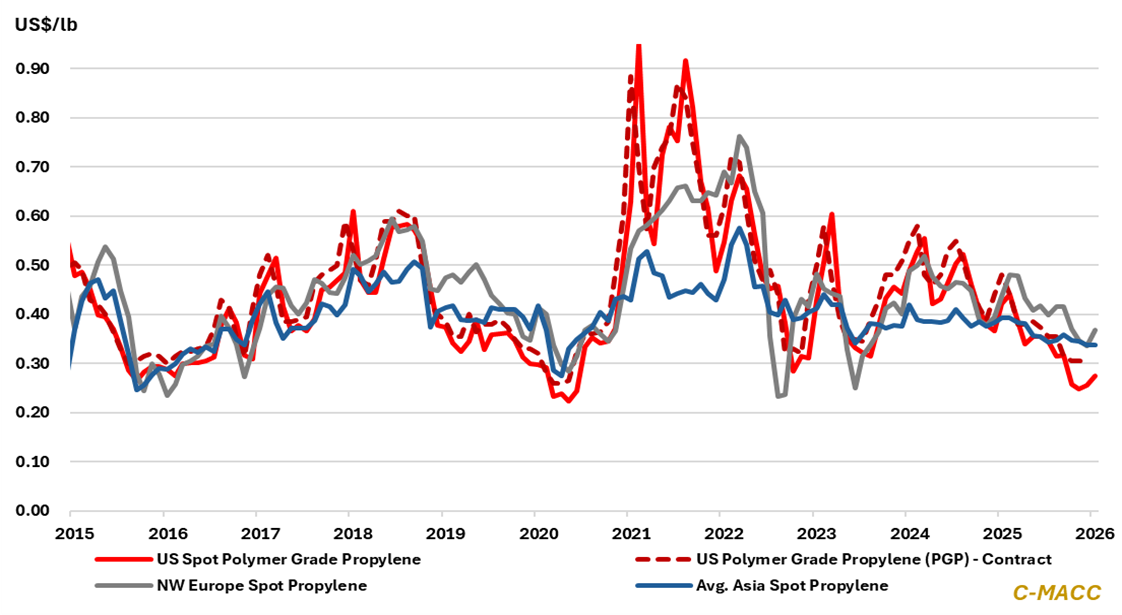

- General Thoughts: Across markets, tighter conditions are mainly driven by higher costs and lingering curtailments, not by demand, as US propylene firms WoW, while early-year consumption growth remains generally tepid globally.

- Feedstocks & Energy: Expectations for global feedstock-level petrochemical cost curves to remain relatively flat and oversupplied markets to persist should spur the accelerated restructuring needed to restore balance.

- Olefins: Global olefin prices increasingly reflect operating discipline rather than demand recovery, leaving 2026 margins subject to coordinated capacity restraint, sustained supply cuts, and managed arbitrage across regions.

- Other Base Chemicals: Base chemicals face episodic tightness without structural demand recovery, shifting earnings volatility toward logistics flexibility, outage management, and regional cost advantages through 2026.

- Agriculture: Ammonia markets will likely transition from scarcity toward balance in 2026, with profitability increasingly determined by cost position, logistics execution, and supply timing rather than headline prices.

- Refining & Biofuels: Global refining and biofuels margins recover unevenly in early 1Q26, favoring integrated operators that convert volatility, turnarounds, and regulatory complexity into durable structural advantage.

Exhibit 1 – Chart of the Day: US and European spot propylene rises WoW; prices still below 1Q25 amid tepid demand.

Source: Bloomberg, C-MACC Estimates, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!