Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

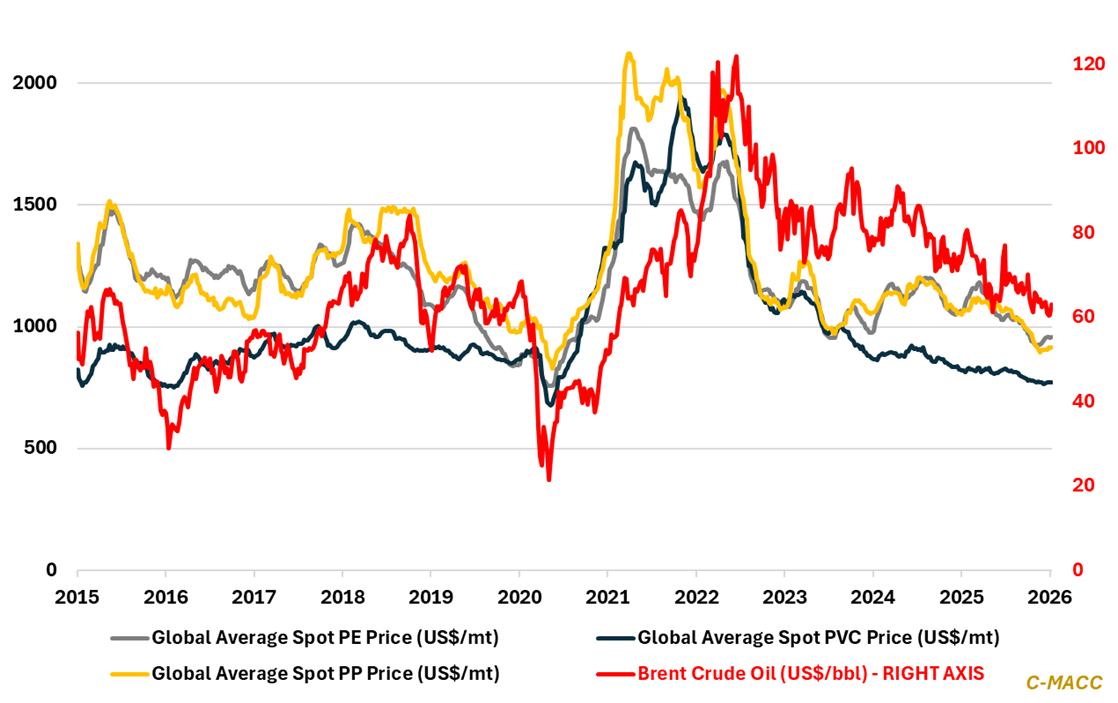

- General Thoughts: Spot polymer prices reflect stabilization in early 2026 as crude strength, feedstock dispersion, and production curbs lift price floors, with 1H26 favoring margin defense and selective upside over demand-led recovery.

- Polyethylene (PE): Early-2026 PE prices firm on rising ex-US naphtha costs and operating discipline, with cautious global buying and restocking patterns giving way to a 2026 likely defined more by margin defense than a demand-led recovery.

- Polypropylene (PP): Early-2026 PP prices stabilize globally amid higher crude and propylene prices, with production curbs offsetting weak demand but leaving margins strained as cost pressure, not consumption, shapes 2026 outcomes.

- Polyvinyl Chloride (PVC): Early-2026 PVC prices appear set to find a firmer floor as China’s announced VAT removal lifts global costs, housing stabilizes, and mid-2026 supply tightening offsets tepid global demand and inventory overhangs.

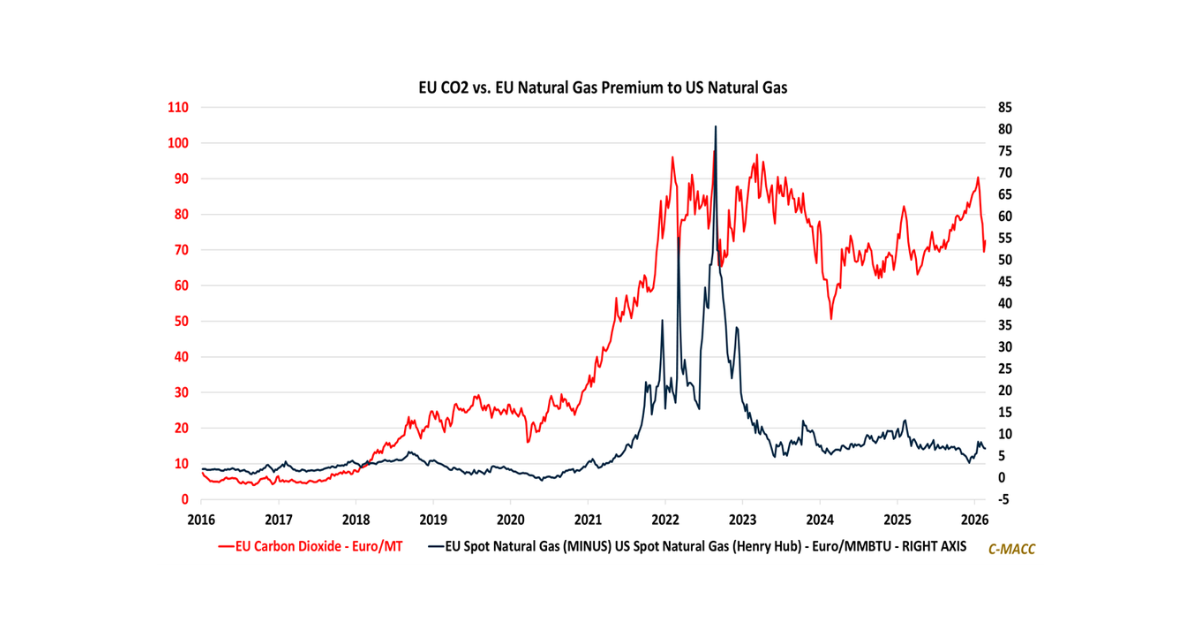

- Other Sector Developments: Rising oil/firmer naphtha, tighter olefin markets, resilient freight rates, and regional gas divergence steepen polymer cost curves, reinforcing price floors despite weak demand and volatile currency dynamics.

Exhibit 1 – Chart of the Day: Global polymer spot prices stabilize in early 2026, as oil support steepens cost curves.

Source: Bloomberg, C-MACC Analysis, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!