Global Market Analysis

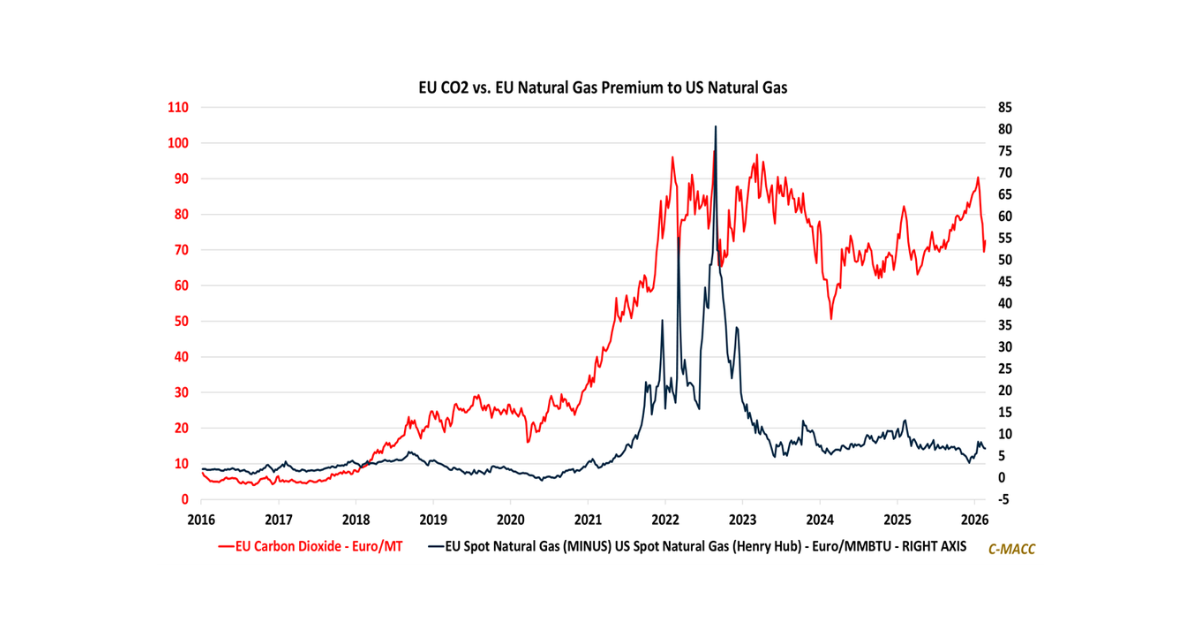

It’s Not All Relative: Higher Absolute Natural Gas Costs Lift Chemical Floors and Squeeze Margins

Key Findings

- General Thoughts: Weather-driven global natural gas inflation supports higher chemical prices despite relative cost positions holding, with chemical margins compressing absent structural supply cuts.

- Supply Chain/Commodities: Butadiene prices increase on tighter C4 supply and resilient tire demand, with Asia setting margins and 2026 outcomes for the global market hinging on cracker discipline versus capacity.

- Energy/Upstream: Global natural gas prices surge on weather and LNG pull, rising relative to range-bound crude oil prices, as 2026 base chemical feedstock trends support price floors but pressure producer margins.

- Sustainability/Energy Transition: EU carbon prices remain tight amid policy volatility, with 2026 outcomes favoring disciplined compliance spending, selective capex, and margin pressure amid CBAM uncertainty.

- Downstream/Other Chemicals: Near-term acreage incentives favor corn due to policy-insulated demand and reduced trade exposure, but rising on-farm input costs are enhancing soybeans’ relative attractiveness.

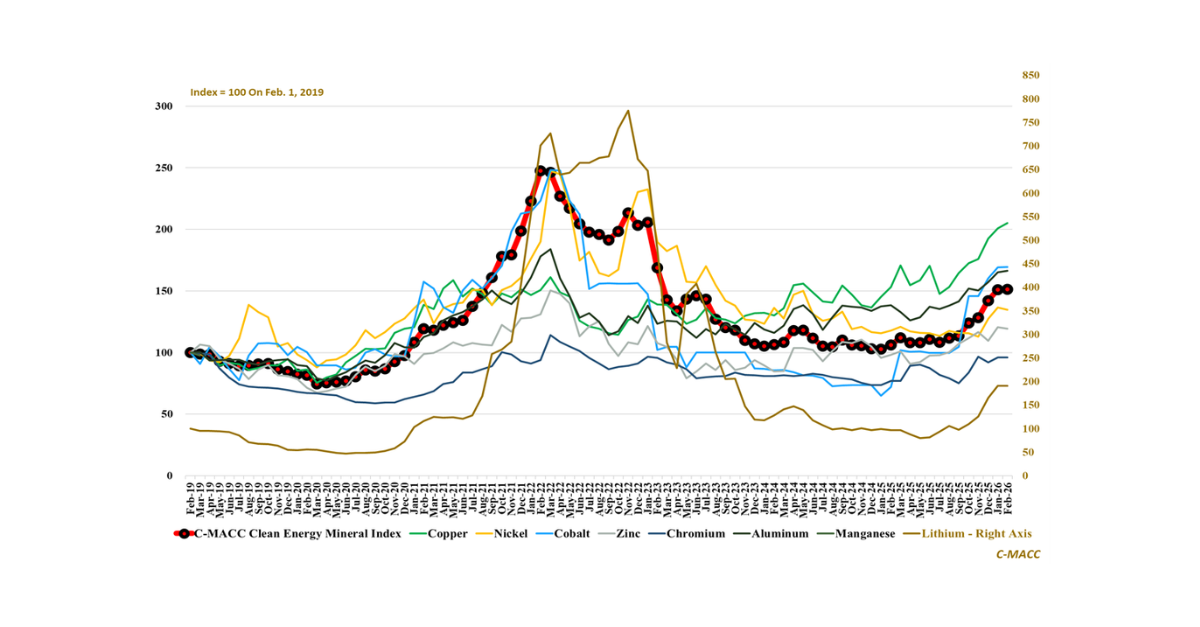

Exhibit 1: Rising global natural gas lifts methanol and ammonia floors and pressures the US ethylene advantage.

Source: C-MACC Analysis, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!