C-MACC Sunday Executive Summary

No Free Pour: Liquidity Sets Chemical Markets

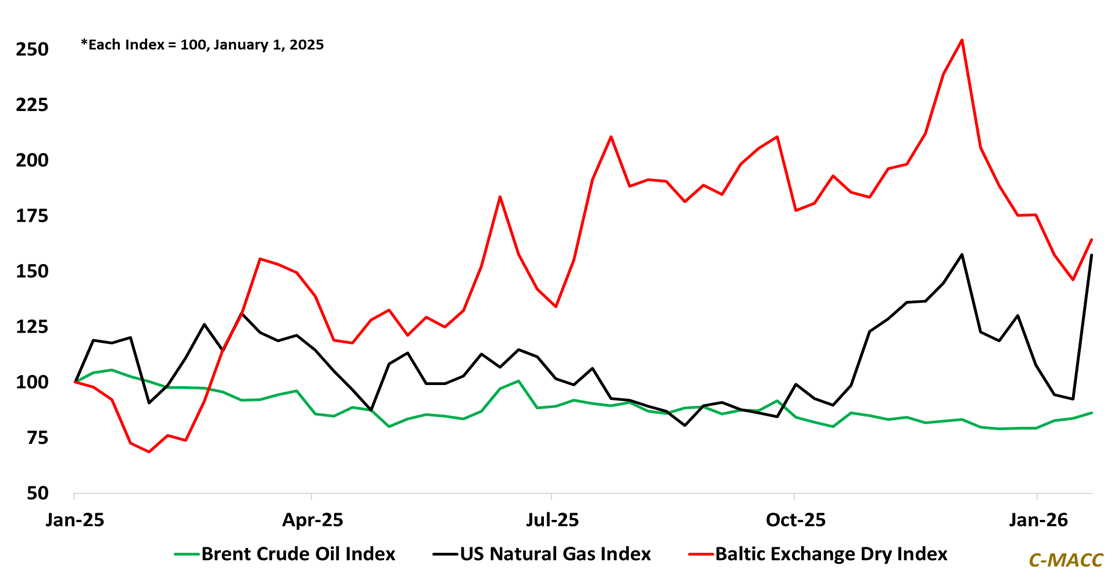

- Liquidity governs commodity outcomes as volatility and freight normalization compress timing buffers, elevating focus on cash conversion discipline over utilization in 4Q25 results and 2026 outlooks.

- Policy acts as a working capital catalyst, forcing cash outlays, creating basis risk, and rewarding companies integrating compliance, contracting, and treasury into disciplined, execution-focused 2026 planning.

- Affordability-driven ordering dominates demand signals as UAN-to-corn economics steer nitrogen timing, channel inventories, and ripple through ammonia rates, gas demand, and chemical intermediates in 2026.

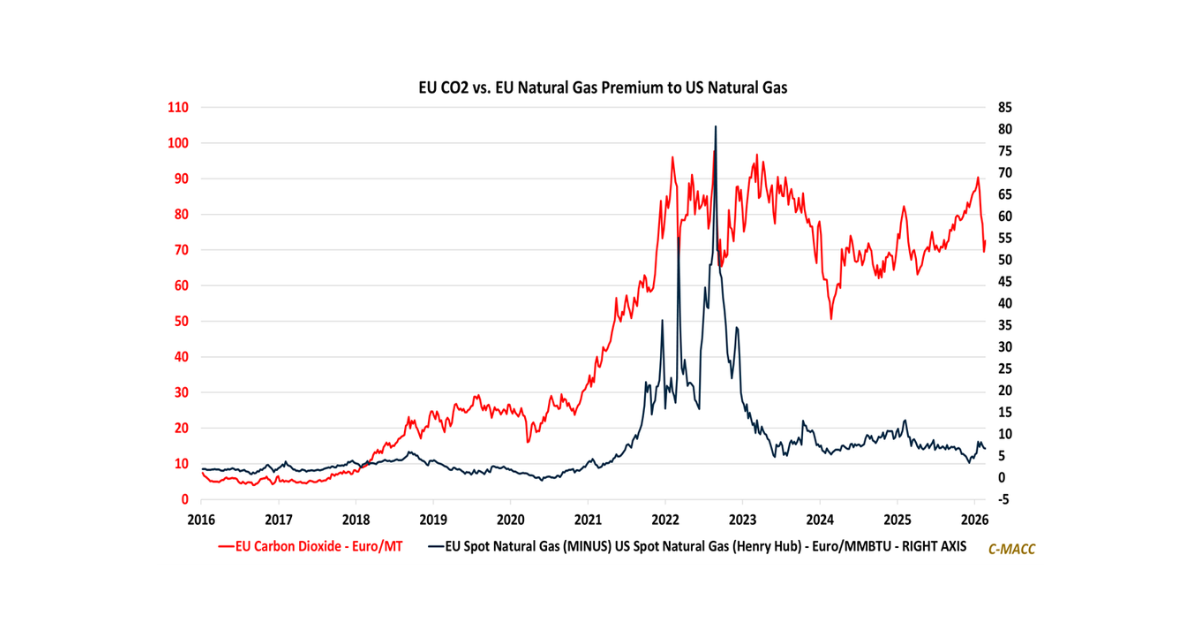

- Oil-to-gas ratio volatility resets petrochemical competitiveness, amplifying trade pressure and margin dispersion as freight normalizes and capital discipline determines winners and losers in 2026 globally.

- Otherwise, we highlight tightening feedstock markets, tire demand, firmer gas prices, power scarcity, and cash constraints rewarding pragmatic operators in 2026, amplifying volatility and differentiation.

- Companies Mentioned: Yara, Continental, Michelin, TPC Group, ExxonMobil, LyondellBasell, BASF, INEOS, RPM, H.B. Fuller, Kinder Morgan, CF Industries, Nutrien, BASF, Corteva, Bayer, Syngenta

- Products Mentioned: Crude Oil, UAN, Corn, Natural Gas, LNG, Ammonia, Methanol, Electricity, Wind, Solar, Batteries, Lithium, Copper, Ethanol

Exhibit 1: Energy volatility returns as freight normalizes, tightening liquidity and accelerating commodity repricing.

Source: C-MACC Analysis, January 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!