Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

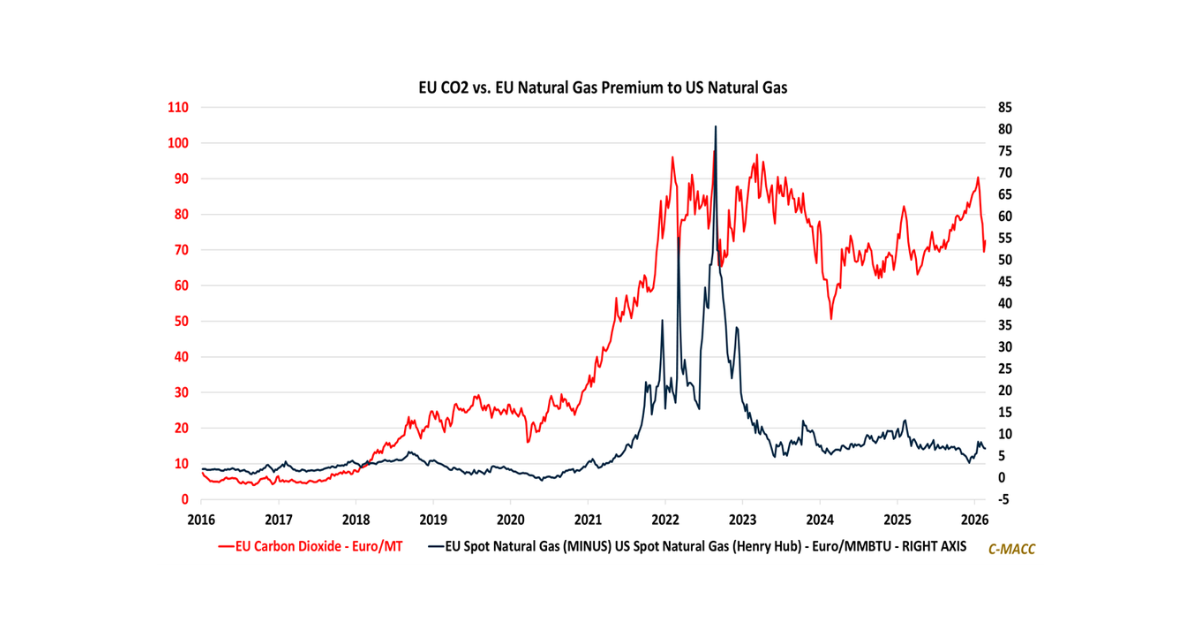

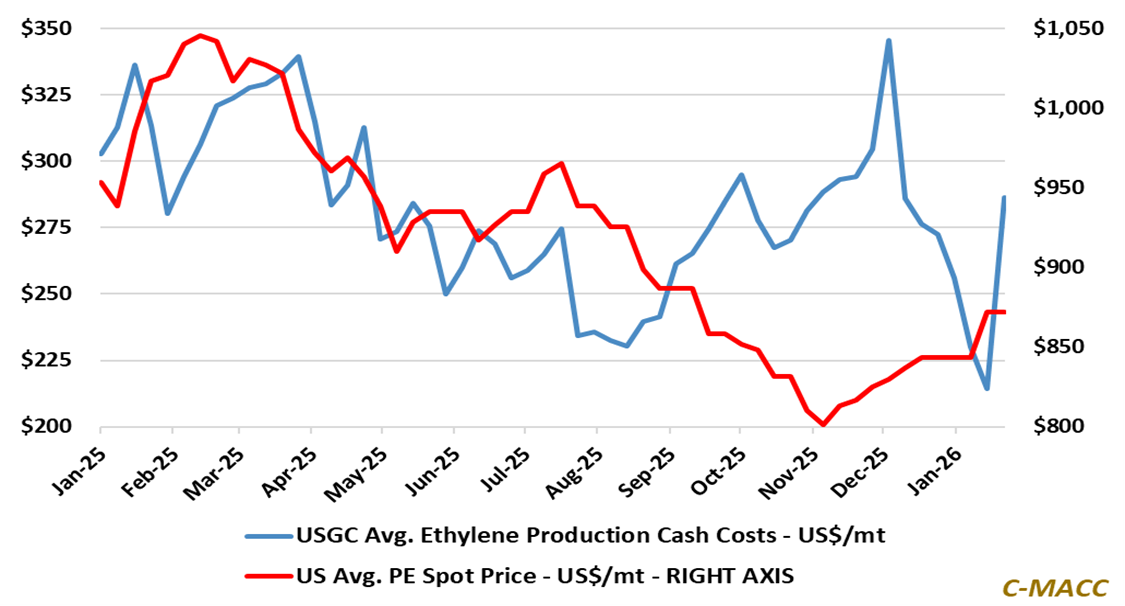

- General Thoughts: Relatively calm US polymer prices in 2025 masked upstream cost volatility, shifting risk into margins and working capital, setting conditions for sharper, producer-led price transmission and earnings dispersion in 2026.

- Polyethylene (PE): Cost-led global PE firmness masks fragile demand recovery, with weather risk and feedstock divergence supporting prices short term while unresolved global oversupply complicates durable balance in 2026.

- Polypropylene (PP): Global PP markets face greater volatility as propylene absorbs weather, logistics, and feedstock shocks, compressing spreads and rewarding integrated operators rather than enabling structural margin expansion.

- Polyvinyl Chloride (PVC): PVC markets are positioning to gradually decouple from olefin oversupply, as policy shifts, logistics friction, and limited capacity additions tighten balances, skewing medium-term price risk modestly upward.

- Other Sector Developments: Feedstock volatility, not polymer scarcity, is shifting margins as LPG exports, weather disruption, and logistics fragility raise profit dispersion and elevate working-capital discipline across value chains.

Exhibit 1 – Chart of the Day: Ethylene cash-cost volatility persisted in 2025 as PE prices masked margin stress.

Source: Bloomberg, C-MACC Analysis, January 2026

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!