Global Market Analysis

You Don’t Have to Be a Weather Man: Feedstock Risk Is Blowing Through Chemicals

Key Findings

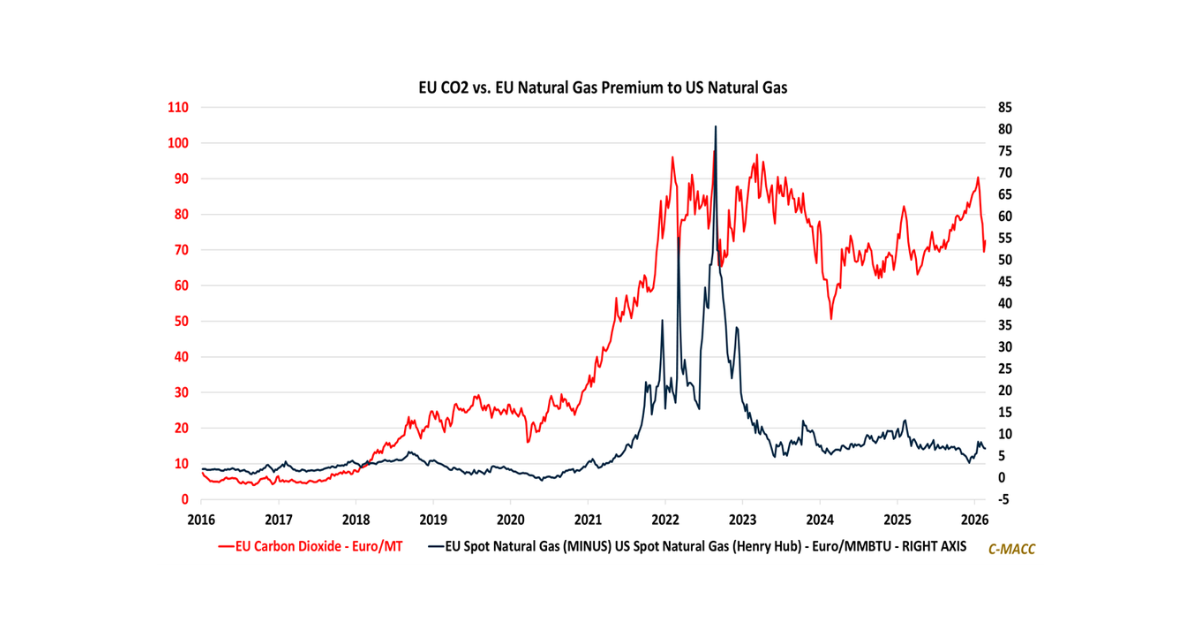

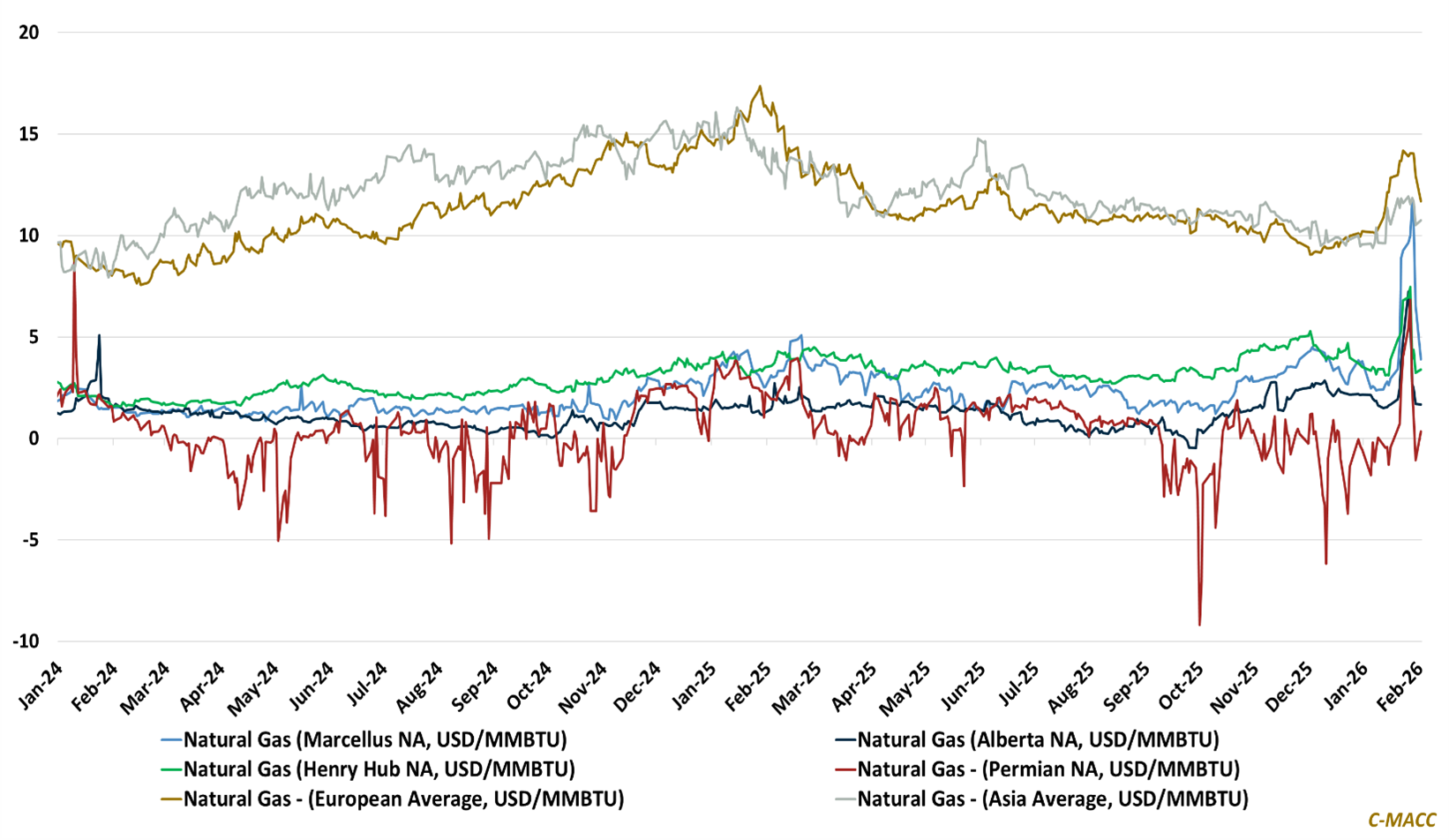

- General Thoughts: Natural gas volatility now translates into risk, as export integration, consolidation, and midstream optionality reprice feedstock economics, slow marginal investment, and lift risk premiums.

- Supply Chain/Commodities: Propylene prices increasingly reflect operational reliability and feedstock economics, as outages, cracking mix, and integration shape volatility, spreads, and regional competitiveness.

- Energy/Upstream: Energy sector capital allocation now determines chemical feedstock pricing power, as export-linked infrastructure, contract structures, and project timing shape US NGL competitiveness globally.

- Sustainability/Energy Transition: Incumbent plastics producers investing selectively in circularity during weak pricing lock in future share, while cost-only global restructurers risk enduring strategic disadvantage.

- Downstream/Other Chemicals: Global freight rate normalization masks security-driven capacity elasticity, as selective Suez returns, insurance friction, FX, and carrier discipline shape rates, costs, and competition.

Exhibit 1: Early 2026 natural gas market volatility signals risk amplification for petrochemical feedstock planners.

Source: Bloomberg, C-MACC Analysis, February 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!