C-MACC Sunday Theme and Weekly Recap

Are the “Better Owners” of European Chemical Sites Playgrounds, Theme Parks, or Forests?

- Owners of European chemical facilities looking to exit (a long and lengthening list) likely face few interested buyers, none of whom would pay anything or the alternative of very expensive closure and remediation.

- Paying someone to take the business may make more sense than shutting down, but the list of potential buyers is shrinking, as anyone not deterred by the feedstock challenge will struggle with the environmental challenges.

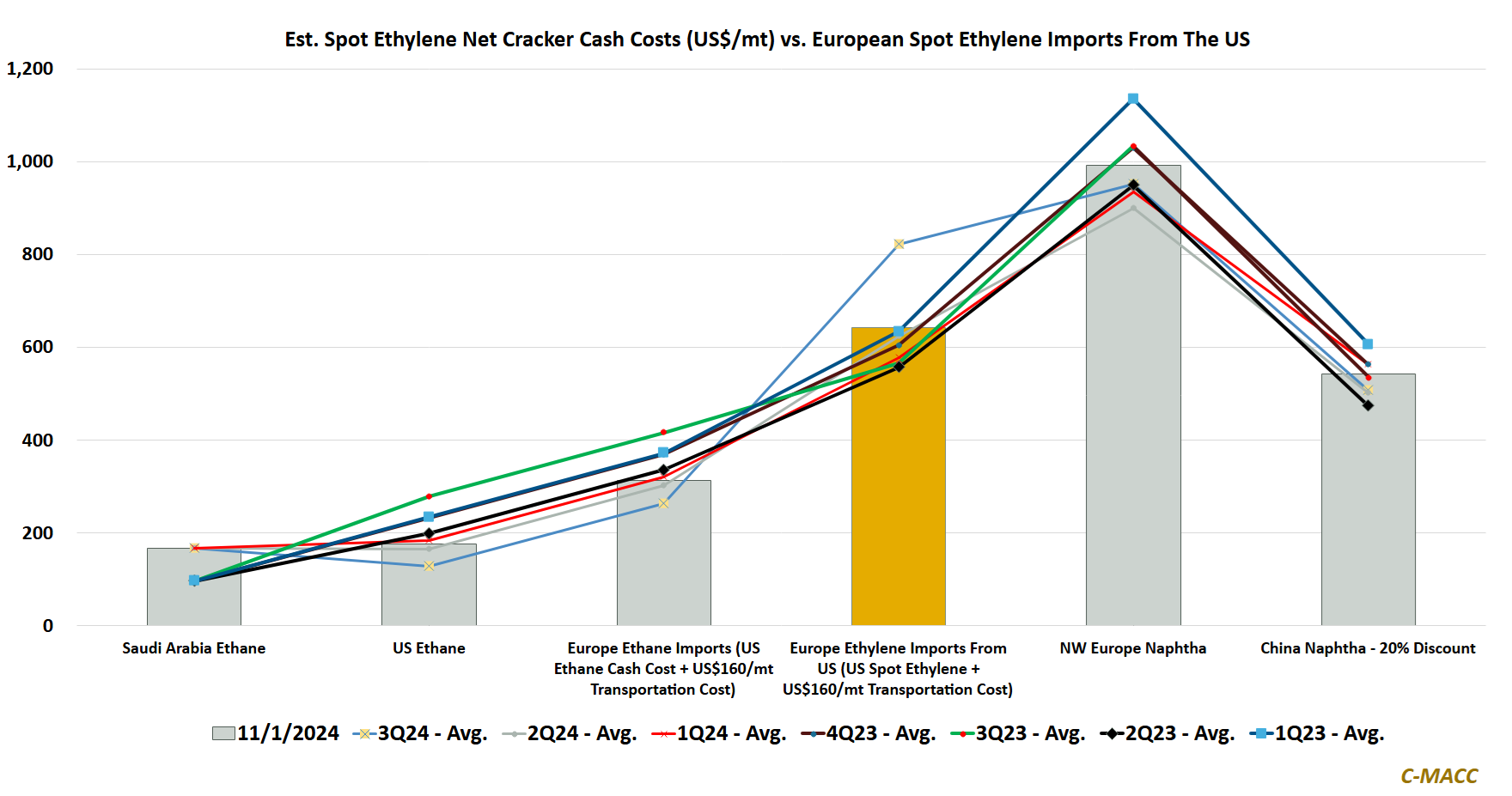

- Ethylene consumers could switch to imported ethane or ethylene from the US, but the emission reduction costs in Europe are so high that, trade policy willing, importing low-carbon polymers from the US will likely be cheaper

- Despite the very high costs of closures in Europe, we expect this is the ultimate fate for more of the ethylene and other basic chemical capacity, but the anti-globalization trend we see today could leave Europe stranded.

- Otherwise, we look at the messages in 3Q earnings and the coincident weakness in refining and chemicals, we talk (a lot) about Air Products, agriculture, project cancellations for hydrogen and the unsustainable US election.

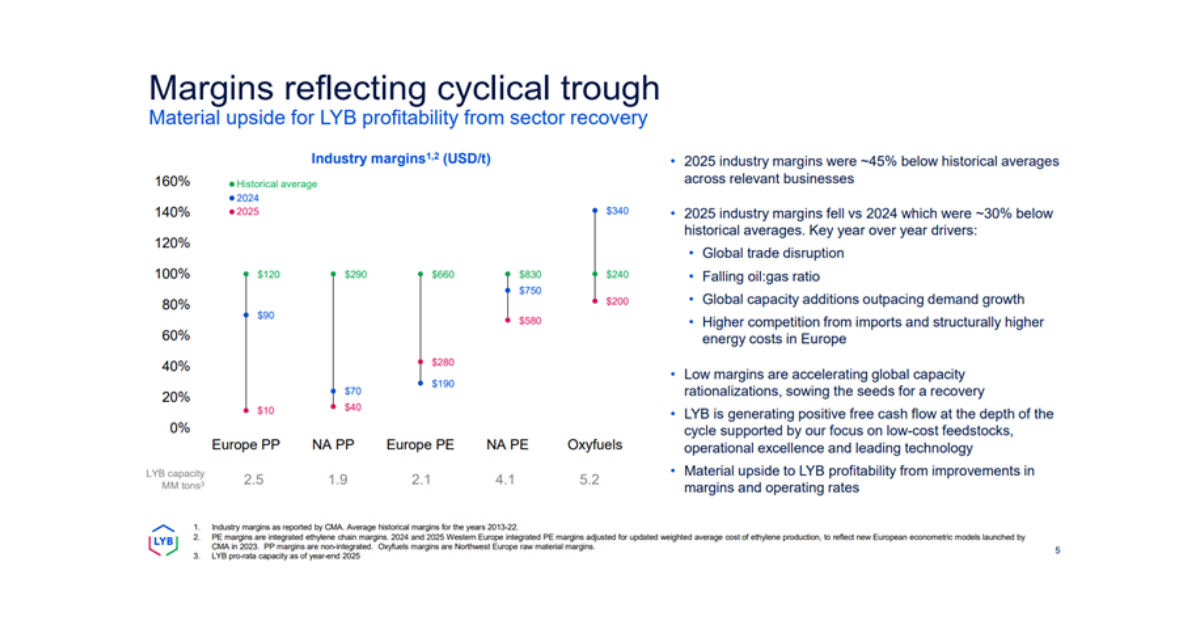

Exhibit 1: Any new European project to crack US ethane would involve capital for furnace refitting and terminal costs.

Source: Bloomberg, C-MACC Analysis, November 2024

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!

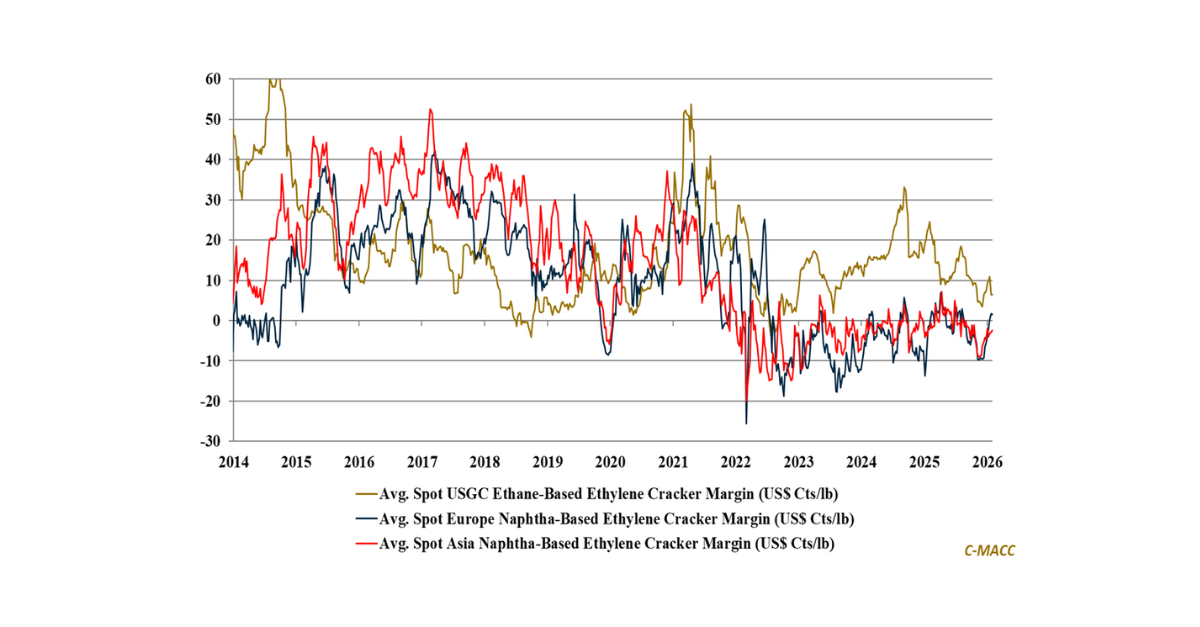

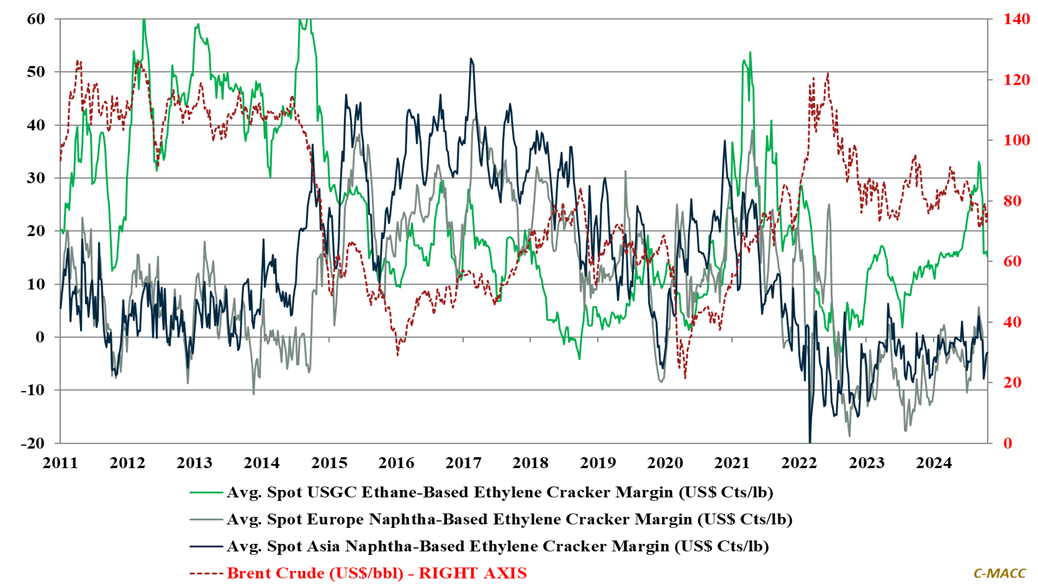

We are seeing more European ethylene unit closures this year than we originally expected, and we now have two majors looking for “better owners” for assets. We doubt there are too many of the latter and expect more closures. The chart above shows one of the challenges facing the bulk of the European basic chemical industry – almost every option versus history makes more sense. What does not make sense is arms-length purchase of naphtha to make local ethylene or other chemicals. But those who have already announced closures – ExxonMobil, SABIC, and Eni, all have access to captive feedstocks and consequently should be able to paint a better picture than the European naphtha bar above, yet they are closing. Those without feedstock are in worse shape, and this is likely why both LyondellBasell and Dow are looking for what they hope will be someone who wants to take on the assets. We noted in work last week that the Dow European platform, at capacity, could consume as much as 10 million tons per annum or naphtha, which all oil producers could reasonably equate to 10 million tons of crude oil. We have also written in the past about the likely thirst for chemical assets from many of the NOCs as they look to protect demand for crude oil through any energy transition. We see Aramco investing in “oil demand” in China and, more recently, in Vietnam – see below – and over the last few years, Aramco has been in discussion in India, the Philippines, and other locations, looking for more opportunities to consume Saudi-based crude oil for the long term. We are also watching not only the Covestro acquisition by ADNOC but also the ongoing discussions around ANDOC, Borealis, Borouge, and OMV, which could also create another integrated consumer of Middle East hydrocarbons, with ADNOC and Borouge also pushing into China.

While the operators in Europe may hope to avoid very high shutdown costs by finding a buyer, the odds of someone stepping into Europe are quite low in our view. Historically, companies like Ineos in Europe and Cain Chemicals in the US stepped in to buy distressed assets, and we have also seen private equity dip its toes in on occasion, but this time, we think it is very different. In what is a very naïve, national security risking policy, many European governments would like to see the end of the chemical industry in the name of environmental cleanliness. There is not a lot of political will to save the local chemical industry, and strong industry lobbying, notably a few years ago from the prior CEO of BASF and most recently from Peter Huntsman, seems to be falling on disinterested ears. If you are looking at Dow’s, LyondellBasell’s, or other assets in Europe, you are unlikely to get a handout from local governments to keep the jobs. Rather, you will be hit with the same overly expensive decarbonization costs that the industry faces today, which will take the costs in the chart above even higher.

Exhibit 2: You would need to discount your captive naphtha into European assets dramatically to compete with low-carbon polyethylene from North America, the Middle East, or China, and/or Europe can impose huge tariffs

Source: Bloomberg, C-MACC Analysis, November 2024

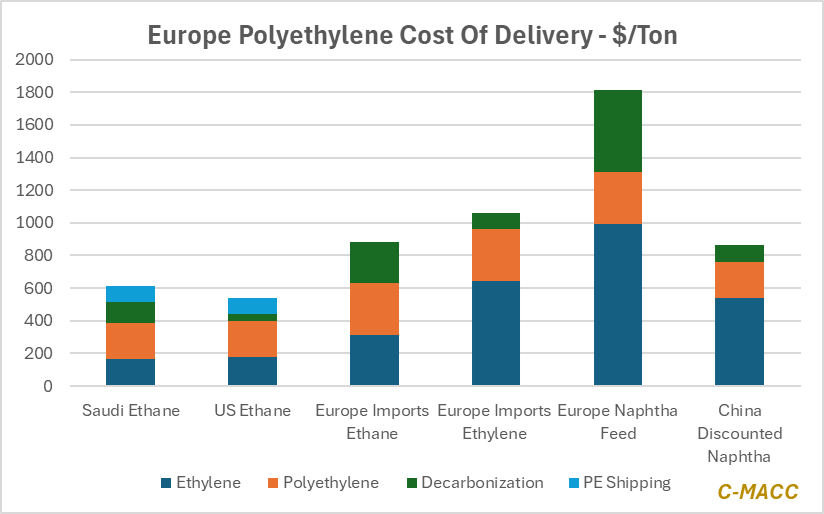

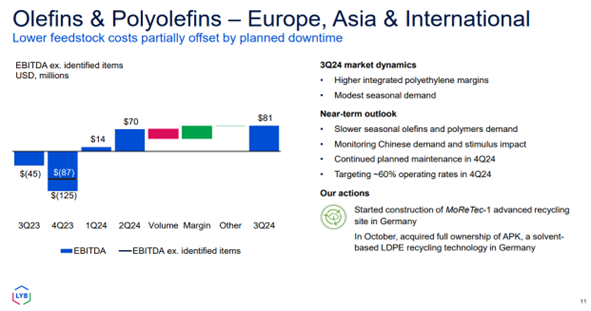

It is also important to note that one quarter does not make a trend – Europe is still in trouble. The European improvement shown by LyondellBasell for 3Q reflects most commodity chemical results for the last quarter. But it is based on two factors that are not sustainable and are already unwinding. During the quarter, we had a drop in feedstock costs and we have had unusually stable pricing for an oversupplied market, in part because of some shutdowns – in Europe and the US – and in part because of concerns that bad weather might impact US production – note that roughly 50% of US polyethylene is now exported and this makes up a large piece of current European supply. LyondellBasell notes much lower expected operating rates in Europe than in the US – with the US likely supplying the shortfalls in Europe. This week we have seen Eni announce two ethylene closures in Italy, and while these are significant moves, we expect a lot more over the coming 12 months. 4Q profitability for basic chemicals is falling and is being well–telegraphed in company outlooks. LyondellBasell, in its call, tried to shine a better light on Europe, suggesting that closures were having an impact and 2025 could be better. This is the same company trying to sell assets and forecasting that its 4Q operating rate in Europe will be an unprofitable 60%.

- Eni to shutter plants in Italy

- Global chemicals at tipping point as CEOs react to persistent downturn

- LyondellBasell reports third quarter 2024 earnings

- LyondellBasell Q3 down on intermediates, oxyfuels and refining

- Repsol posts YOY increase in Q3 chemical margins

Exhibit 3: LyondellBasell is targeting ~60% operating rates in O&P EAI in 4Q24. Also, see the MoRe Tec slide below.

Source: LYB – 4Q24 Earnings Presentation, November 2024

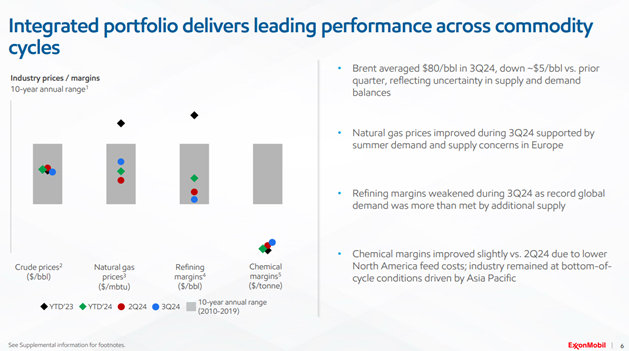

ExxonMobil’s margin chart shows still weak chemicals and less help from refining. We have spent much of the last couple of years discussing the opposing swings in chemical and refining margins, one weak while the other has been strong, but as we end 2024, the balancing effect is gone. Chemical margins remain very weak on a global basis, and refining profitability has declined meaningfully, with neither expecting any immediate recovery. ExxonMobil has a bullish view of refining margins for the medium term, based on an above consensus view of the need for refined products and underinvestment in refining capacity globally, but with economic growth estimates for 2025 underwhelming, we may not see that impact, should it occur for a couple of years. So, 2025 could be a year of weak chemicals and weak refining profitability, with US chemicals the only bright spot because of the feedstock advantage. Another factor to consider is whether there will be more Western refinery closures, such as the one noted by LyondellBasell, which might help tighten positions. LyondellBasell has a negative view of refinery margins in 2025 (from conference call comments), consistent with its announced closure, but we found Valero refining commentary constructive on 2025. We take a cautious view of this market for the next 12 months.

- A Mixed Earnings Season for Oil and Gas Giants

- Aramco Inks Energy Cooperation Agreement with Petrovietnam

- Exxon and Chevron suffer profit falls on lower oil prices

- PBF Energy posts weak Q3 results, set to cut $200 million of costs in 2025

- Shell cuts capex guidance, says higher Q3 oil and gas output boosts resilience

- TotalEnergies to Overhaul Largest European Refinery in 2025

- TotalEnergies Takes Hit from Weaker Refining Margins, Maintains Dividend

Exhibit 4: ExxonMobil highlights shift in oil and gas prices and global refining and chemical margins, which aligns with our general view, and we flag their view of chemical margins being at the bottom-of-the-cycle in Asia Pacific.

Source: ExxonMobil – 4Q24 Earnings Presentation, November 2024

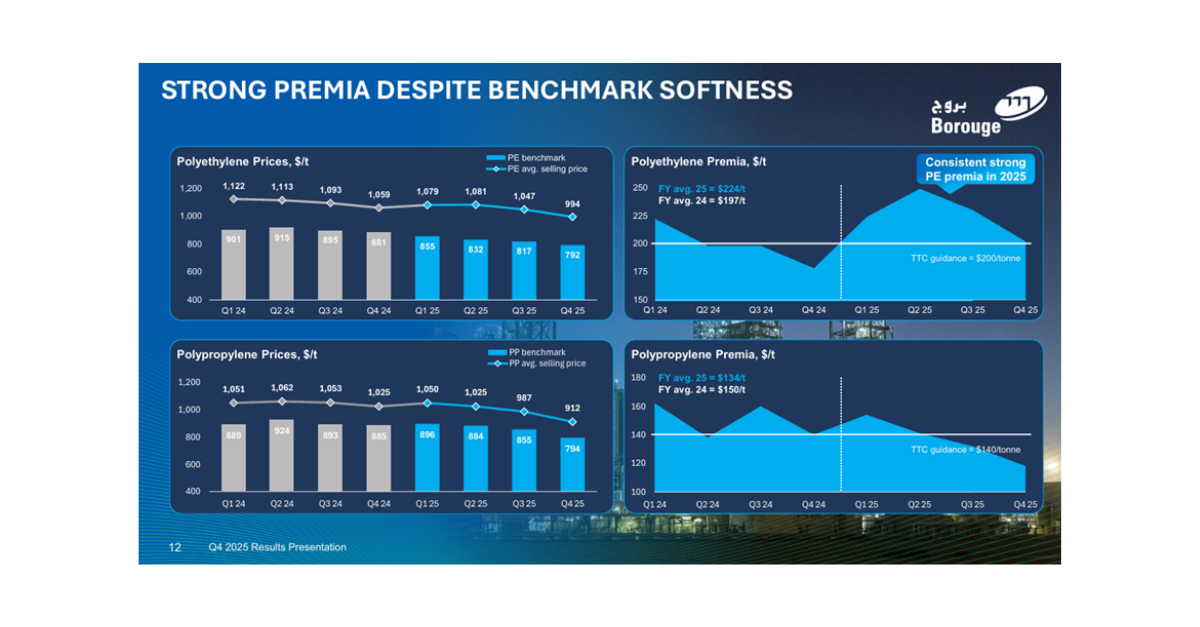

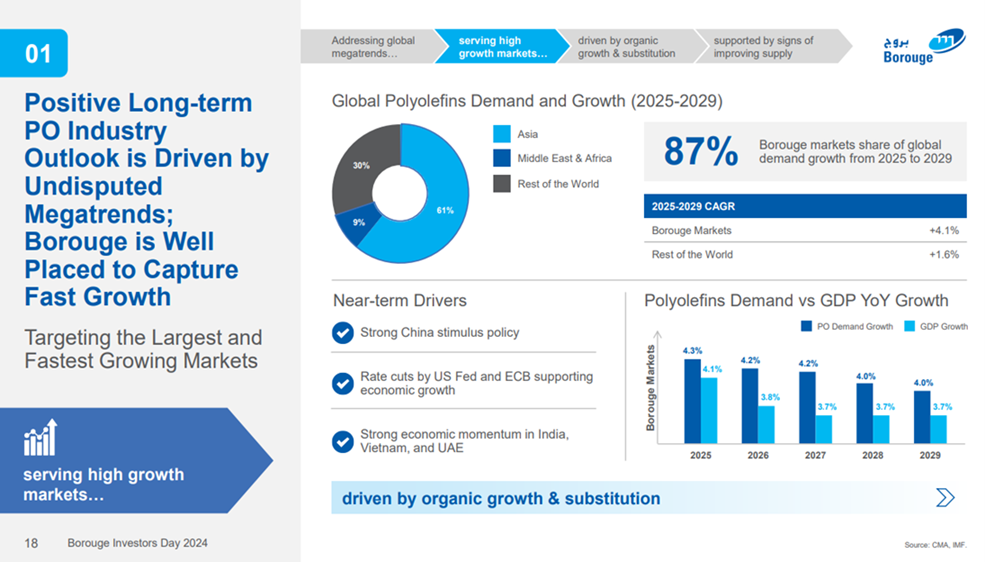

Sticking with 3Q earnings and investor discussions, it is interesting to look at what companies choose to highlight, and we must call out Borouge for somewhat selective data in the slide below. It is not polyethylene demand growth that is the troubling factor in the current market, it is the supply picture that matters, with a wave of new capacity coming online in China in 2025 and 2026, as well as new plants in the US and the Middle East. The bigger risk is that Borouge and others are too optimistic about demand growth and the oversupply is worse.

Exhibit 5: Borouge may be right regarding polyolefins demand growth relative to GDP; however, supply outpacing demand and keeping operating rates under pressure is likely the major global challenge during the 2025-29 period.

Source: Borouge – October 30, 2024 – Investor Day Presentation

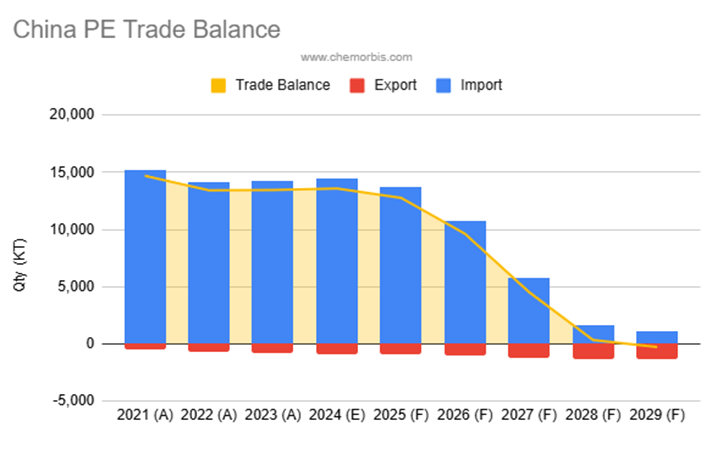

In the chart below, we want to introduce you to a very powerful model that our new partners at ChemOrbis have built, modeling polymer supply demand by country and building very robust forecasting models. Graham Copley (showing his age) was around in the early days of the CMAI global supply/demand model construction and has been a client of IHS and other data providers since, and his view of the ChemOrbis model is that it is the most instructive and user friendly that he has seen – the data is very robust, particularly for Asia. Exhibit 6 shows anticipated Chinese net polyethylene trade over the next 5 years, with domestic demand growth driven by the most recent IMF economic forecast.

Exhibit 6: We also looked at a downside (trade war driven) by reducing Chinese GDP growth by 100 basis points per annum and the export surplus grew by an additional 2.5 million tons in 2029.

Source: ChemOrbis November 2024

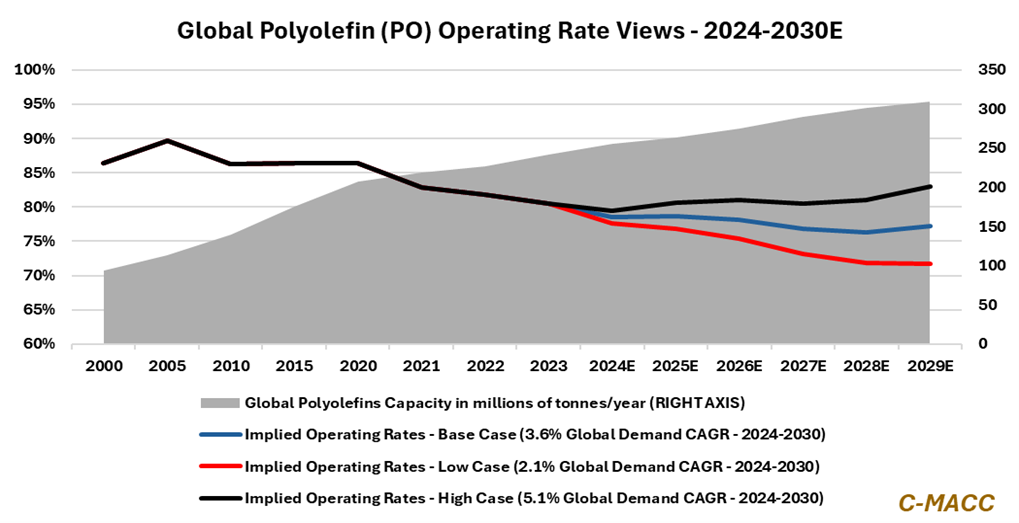

Exhibit 7: We estimate polyolefin operating rates, taking the average of polyethylene (PE) and polypropylene (PP) supply and demand growth views, will struggle to reach 85% by 2029, as shown in this exhibit.

Source: C-MACC Estimates, ChemOrbis, October 2024

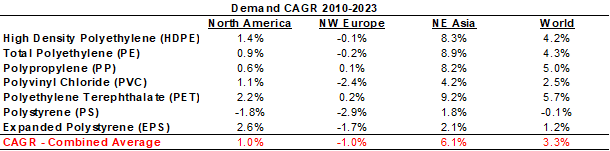

Exhibit 8: Global GDP and China GDP growth reflected a ~3.2% and ~6.8% average in the 2010-2023 period, and global demand at the average slightly exceeded this view with NE Asia leading the uptick in global demand growth.

Source: C-MACC Estimates, IMF, October 2024

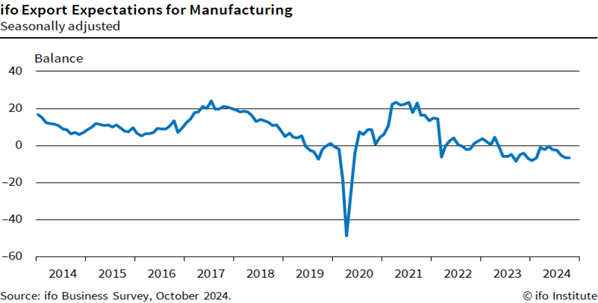

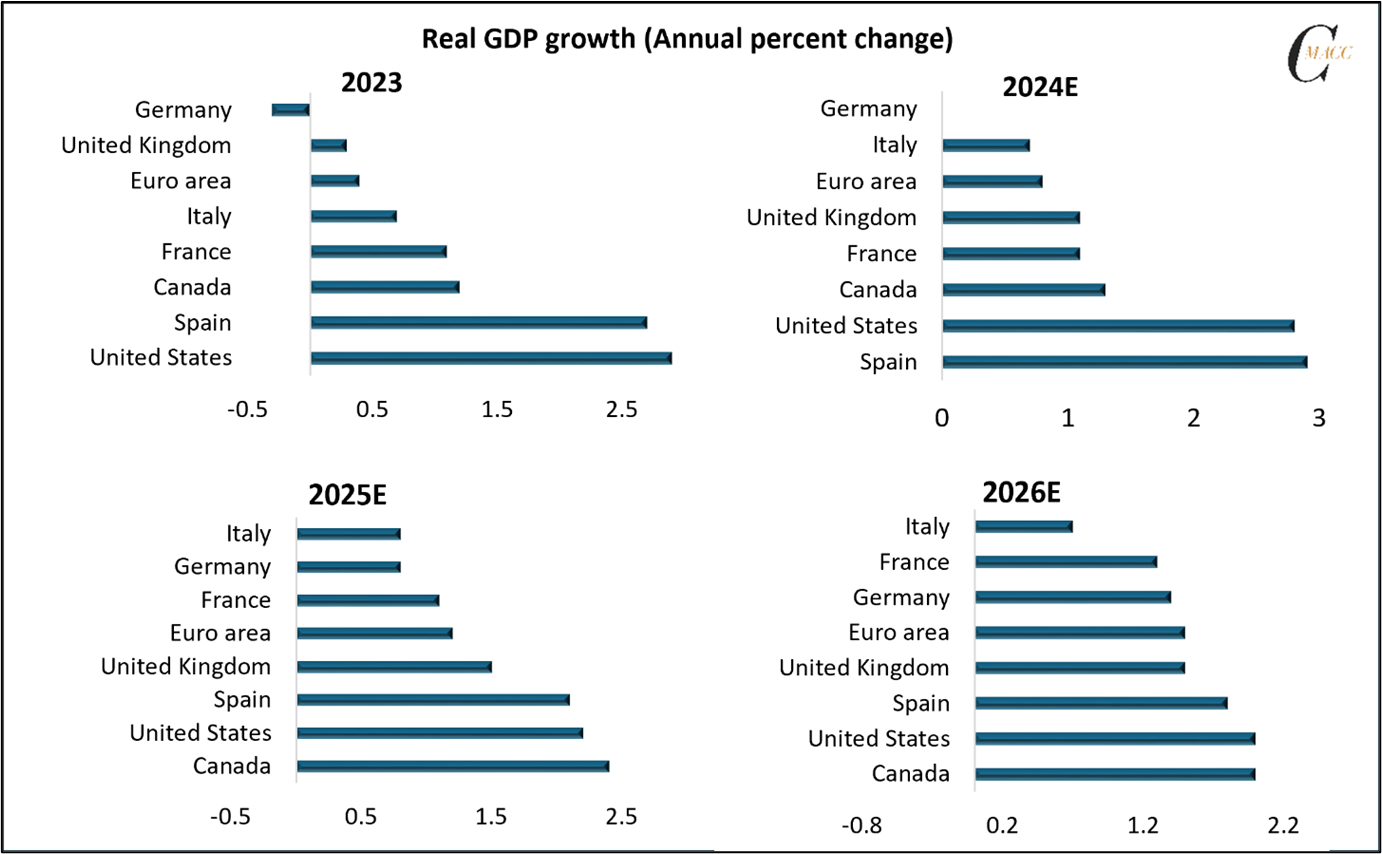

Making matters worse for Europe, demand is weak as economic growth is low, and many industrial and retail manufacturers who might be customers of the basic chemicals are in decline. Plus, Europe’s export competitiveness has fallen and for example, sentiment in the German export industry remains weak, with the ifo Export Expectations falling to minus 6.7 points in October from minus 6.5 points in September. Per the ifo Institute report, companies are not benefiting from positive economic developments in other countries, leading to a continued lean period for the export sector. However, we also add that the high production cost position among many manufacturers in Germany, including chemicals, which is seeing expectations erode, also offers limited options for manufacturers to benefit from export markets during generally weak domestic demand. Ifo Institute findings suggest that the manufacturing industry anticipates a decrease in international business, particularly in the automotive and metal sectors, anticipating significant losses. In contrast, food and beverage manufacturers expect an increase in exports, while paper manufacturers predict a slight positive trend. Notably, electrical equipment manufacturers have revised their expectations upward, anticipating stable export business after initially planning for declines. Still, the overall setting for German manufacturing remains weak, and we expect continued restructuring in this area in the near-to-medium term.

- German Companies are Planning Higher Prices

- German Export Expectations Fall

- Porsche staff to join wave of strikes in key German industries

- Volkswagen to close German plants and cut jobs

- Why Europe’s car crisis is mostly made in China

Exhibit 9: German Export Expectations Fall (October 2024) | Facts | ifo Institute

Source: ifo Institute, October 2024

Most global chemical sector 3Q results show sequential improvement, but 4Q24, so far, reflects sequential weakness. In our research, Winter Is Coming! Many Global Industries Face A Rocky Year End, Some Better Poised For 2025 Improvement Than Others, we highlighted our views through 3Q24 that discussed improved margins amid production outages and some regional feedstock benefits that lifted global average chemical producer profitability and recent trends in 4Q24 that signal a reversal in global profits, with high-cost regions, such as Europe, staying under relative pressure compared to North America (and the Middle East) with still higher relative commodity chemical margins at the average. We anticipate further polyolefin market details/views from LyondellBasell with their 3Q24 results later this week and Huntsman, following the reports from Wanhua, Covestro, BASF, and Dow, in a few of their competing product lines, such as MDI-polyurethanes, and some announced restructuring and strategic movements in this area. Overall, we anticipate cautious views of 4Q24, but we also expect an increasingly positive commentary about 2025 global demand drivers, including the factors listed in the Borouge slide in Exhibit 1, that could steer focus toward a more positive 2025 setting and lift sentiment. With this in mind, we continue to hold a generally cautious view absent seasonal factors of demand in the near-to-medium term, and the outcome of the US presidential election next week could also shift expectations for the future if more protectionist policies are implemented. See our recent research, Navigating the Prisoner’s Dilemma in Rising Protectionist Policy – Policy Benefiting Local Manufacturers May Not Benefit Consumers! and Friends With China Is the Best Option, as China Has Already Won the Energy Transition Race.

- BASF misses Q3 estimates, sees 2024 earnings at low end of guidance

- Covestro narrows earnings guidance lower despite Q3 return to profit

- Japan’s Sumitomo Chemical trims fiscal H1 net loss as sales grow 5%

- OMV maintains margins guidance on upbeat Q3 petchem earnings, Borealis recovery

Exhibit 10: Global chemical margins improved in 3Q24 relative to 2Q24, but most have seen weakness in 4Q24.

Source: Bloomberg, C-MACC Analysis, October 2024

But more chemicals are coming. We note the Aramco/Vietnam tie-up in a couple of stories below and note that the last thing the World needs over the next 5-7 years is another low-cost integrated refining and chemical complex. Within Vietnam, it can probably be justified along the job creation and self-sufficiency arguments, but this will be another source of local polymer – like China – pushing out the need for imports and exposing surpluses in the Middle East, North America, and now also China. Aramco gets what it wants from this with crude oil offtake.

So, if you are sitting in Europe, your options are limited, and whichever way you cut it, the focus is now minimizing costs (of operations or exit). The local industry is not cost-competitive, and several world regions can deliver material to Europe for less than it can be made locally. There is no real government support for the industry, and while the CBAM mechanism may protect those with a lower-cost route to lower carbon products, we are unlikely to see a rush of protectionist tariffs to protect the industry when the inflationary impact would be high. Equally challenging, and this would apply to any possible buyer of European assets, decarbonization costs are high, in part because local costs of labor and materials are high in Europe, but also because of the lack of CCS options, raising the cost meaningfully for local companies looking to meet emission or low carbon standards. European producers have very high costs of shutdown and will try to avoid these where possible, likely offering to pay others to take facilities if the cost is lower than the cost of site shutdown and remediation. Still, we see remediation – playgrounds and forests – as the more obvious route for many. This would leave Europe exposed and even more dependent on imports and the largesse of others, trying to drive forward in a world where globalization may be something in the rear-view mirror.

Otherwise, Last Week

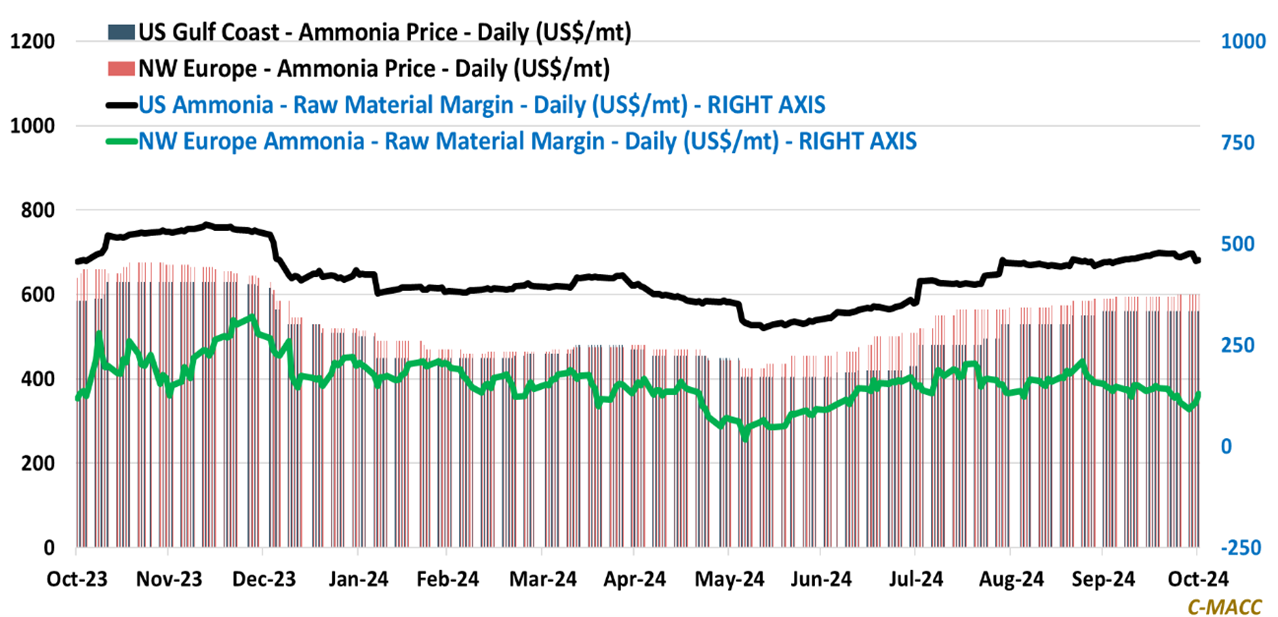

We took another look at agriculture and ammonia, given the number of companies reporting last week and given our upcoming attendance at the Ammonia Energy Association conference in New Orleans from November 11th to 13th. Cooley May will be attending the conference, and Graham Copley will also be in town, although mainly for the Issaquena Green Power business. Please get in touch if you would like to get together during the conference.

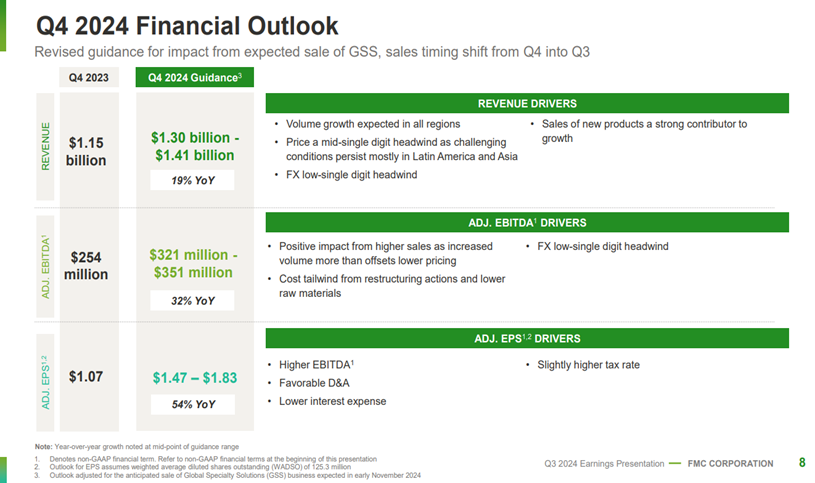

Global crop protection markets remain mixed, with the most notable challenges in Latin America, as shown by FMC and noted by BASF, Syngenta, and peers in recent reports. In the recent quarter, FMC experienced a mixed performance across regions, with expected results in Europe and Asia but weaker conditions in Latin America, counterbalanced by stronger outcomes in North America. Latin America faced unexpected challenges, particularly in Brazil and Argentina, due to delayed rains, high borrowing rates, and one of its major customer’s bankruptcy, which led to significant price declines. Despite these hurdles, FMC delivered growth, primarily driven by new product introductions and strategic pricing actions. Conversely, North America exceeded expectations, with notable sales growth stemming from increased orders from diamide partners and inventory adjustments. The company anticipates a gradual recovery in channel inventories, particularly in the U.S. and Europe, while forecasting a challenging market environment in Asia until 2026. Still, the company anticipates improved conditions in 2025 relative to 2024. We observe that Syngenta shares this view, and we expect Corteva and Nutrien to share this view in their reports next week. FMC is also implementing restructuring measures to enhance cost efficiency, targeting substantial savings for 2024 and 2025, and these efforts are being seen broadly among its peers. Overall, the company maintains a positive outlook for the upcoming quarters, bolstered by the performance of new products and anticipated market improvements. This aligns with our outlook, as part of our argument is based on crop market support amid supply growth, which is proving unable to keep pace with demand. Also, see our report, Will Crop Production Keep Pace With Bioproduct Demand Later This Decade? Unlikely Without Higher Prices!

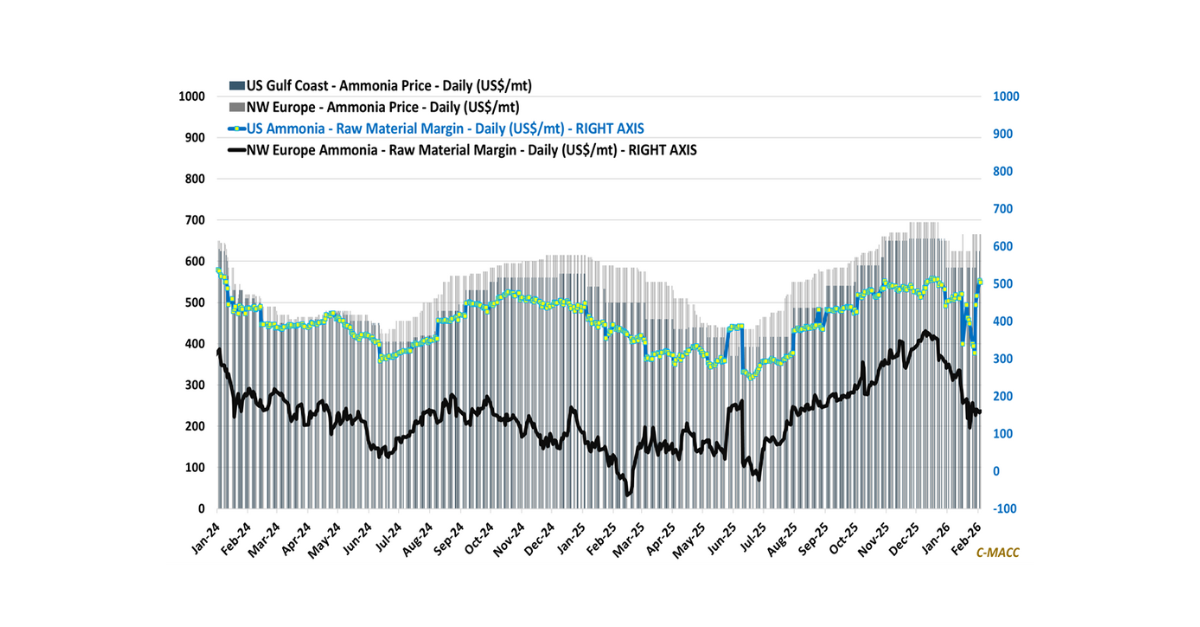

Exhibit 11: US ammonia production margins have increased YTD in absolute terms and relative to Europe.

Source: Bloomberg, C-MACC Analysis, October 2024

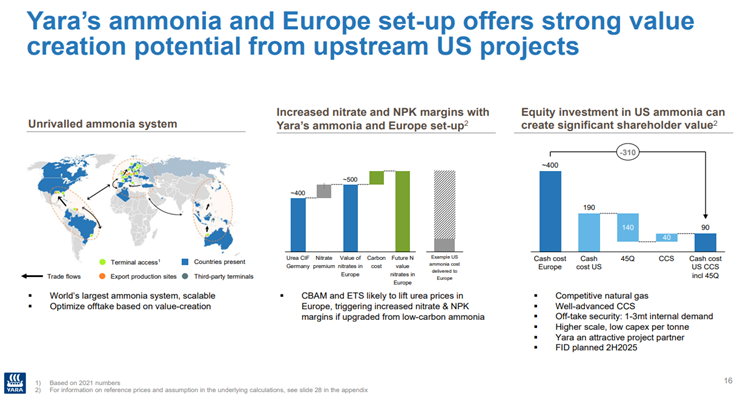

US ammonia producers remain in an enviable global position, backed by a significant cost advantage. C-MACC CEO Cooley May attended the Ammonia Energy Association (AEA) annual conference last year, where the benefits facing domestic ammonia producers were on display in terms of global demand and relative cost position, and he will attend the upcoming annual conference, as noted above, where we anticipate more comments from producers, such as LSB Industries and CF Industries, whose recent results and commentary are also flagged and discussed below, regarding their performing well in a weak crop setting and the general global market outlook for ammonia remaining constructive. Beyond US borders, we highlight the Yara slide below, as it highlights the leveraging of a low-cost ammonia production cost position through its JVs into a global logistic/supply network, which we tend to generally applaud, though also recognizing that production units in Europe and other high-cost regions feeding into this system reflect a relative disadvantage in terms of profitability, which is shown very basically in Ex. 1. With this in mind, we also see several positives ahead for Fertiglobe from the Middle East as it leverages its low-cost (and low carbon) network to target premium markets. Looking more globally, we generally share the CF Industries view highlighted on its earnings call this morning, as it anticipates a tightening global ammonia market during the next few years as demand growth in traditional applications, much less for the addition of new clean-product applications, outpacing supply growth. Overall, we share their generally constructive outlook. Also, see our report following the November 2023 AEA conference, Tighter Ammonia Markets – A Plus For Producers & Its Clean Transition, Negative For Non-Integrated Derivative Profits.

Exhibit 12: FMC highlights improved conditions to drive stronger volume growth in 4Q24 to help offset price weakness.

Source: FMC – 3Q24 Earnings Presentation, October 2024

- CF Industries said global nitrogen pricing supported by many factors including natgas shortages

- CF Industries Reports First Nine Months 2024 Net Earnings of $890m, Adjusted EBITDA of $1.72bn

- FMC reports strong growth in third quarter, confirms full-year outlook adjusted for expected sale of GSS business

- FMC earnings turn around on strong North America results

- Syngenta Group Reports Q3 2024 Results

- USDA Awards $120M to 6 Fertilizer Production Projects

- Yara’s core profit soars 47% on strong production, high prices

Exhibit 13: Yara highlights the benefits of its global footprint with its 3Q24 results, but also flags the significant benefits of leveraging low cost production positions, including clean ammonia, relative to other regions.

Source: Yara – 3Q24 Earnings Presentation, October 2024

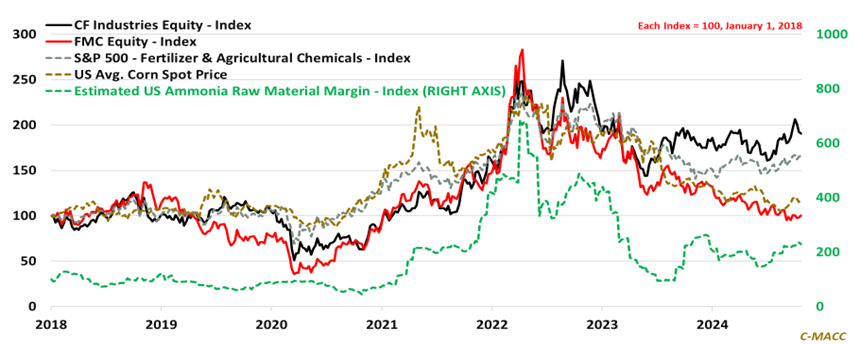

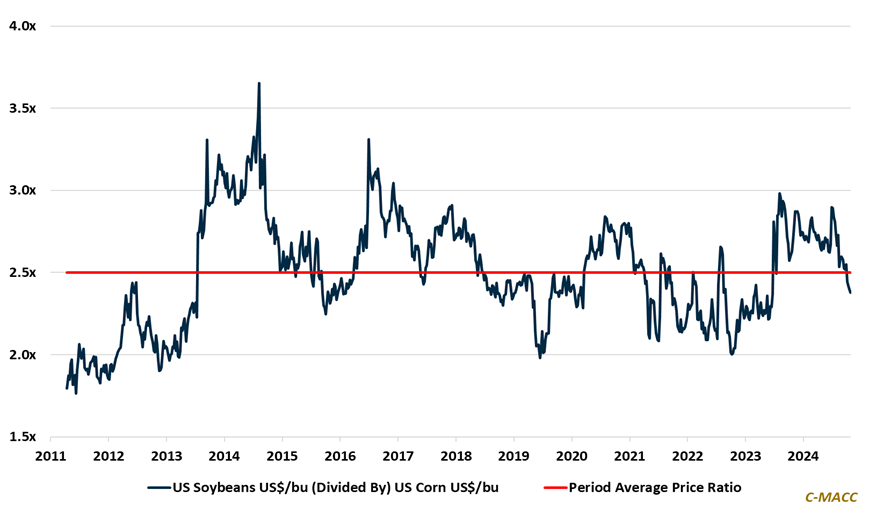

It’s all relative, and our constructive agriculture view for 2025 versus 2024 could lift all sector boats but could favor recent underperformers the most. In our latest global agriculture monthly report, It’s All Relative – 2024 Agriculture Sector Underperformers Now In Focus Ahead of Likely Improved Conditions In 2025, we began our general thoughts comments highlighting that the phrase “It’s all relative” is often used to convey that individual perceptions and circumstances influence judgments about situations and experiences, and this concept is central in many fields beyond finance and agriculture as it highlights the subjective nature of understanding and interpreting the world around us. With this in mind, we observe CF Industries and most US ammonia producers, including Nutrien, LSB Industries, Koch Fertilizer, and peers, facing high positive sentiment across these operations. The question mainly surrounding them is: will it last? Based on recent crop price movements shown below and supply/demand balances, we take a generally constructive view, and producer 3Q results and outlook commentary generally aligns with our constructive views. In this report, we also showed the exhibits below. We highlighted the relative underperformance of FMC equity compared to CF Industries, as the crop protection portion of the market has been relatively negative amid falling farmer incomes, the items impacting demand on a regional basis, which we highlight above, and other factors, such as stress on some distribution channels. While we view the overall agriculture sector as in a good spot for improvement from its 2024 lows, we see some of the “out of favor” areas as worth focus as they could hold the 2025 outperformers amid a sentiment shift from negative to positive and long-term sector views turning broadly more constructive.

Exhibit 14: We highlight the performance of a few equity indicators relative to corn and ammonia margins.

Source: Bloomberg, C-MACC Analysis, October 2024

Exhibit 15: Corn prices have risen relative to soybeans, which is a plus for US corn plantings in 2025 and nitrogen use.

Source: Bloomberg, C-MACC Analysis, October 2024

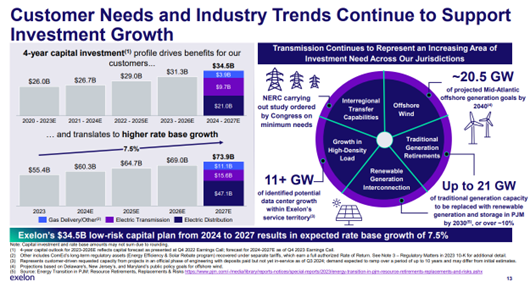

Switching to power – encouraging but expensive: The Exelon projections below provide some comfort that a few US utilities might have plans that can match expected power demand growth over the next 5-6 years, but as we look at the levels of investment needed, we do not see a pathway to cheaper power anytime soon. We are stretching the limits of equipment and labor to meet the growth objectives, and even if the marginal cost of any wind and solar power installed is close to zero, the utilities are allowed to cover their costs of capital at local rates and this likely means more expensive power for both consumers and for local industry. Power prices in the US are relatively low (versus most other regions) and so the economic consequence of incrementally higher rates is not much of a problem and the inflationary impact will be minimal, even if consumers complain about higher prices. The larger challenge, as we have noted in much of our recent work, is that the hydrogen economy, being touted as the best path to decarbonization, relies on falling and very low power prices. In regulated US states this cheap power is going to be elusive for a long time, while in deregulated states with good wind and solar resources, we could still see some development.

Exhibit 16: Exelon highlights a 7.5% rate base growth rate estimate through 2027 to cover its growth investments.

Source: Exelon – 3Q24 Earnings presentation, October 2024

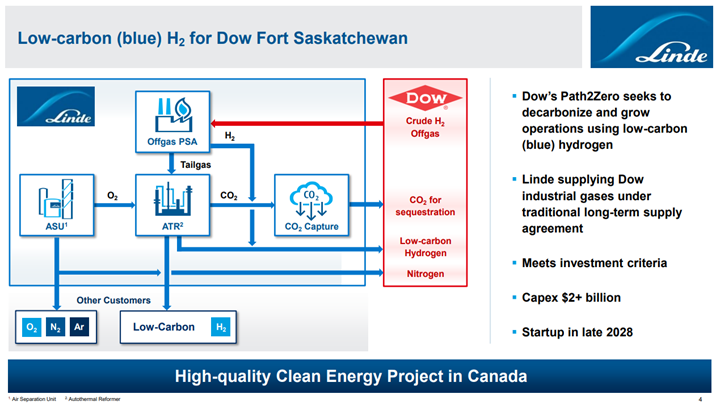

Following on from our very well-attended webcast on Air Products last Tuesday – see link below – we also commented on the sanctuary effect behind Linde’s valuation. There are very high expectations priced into Linde’s valuation, as we discussed in our recent webcast focused on the activism at Air Products. As such, if the company does not exceed expectations meaningfully each quarter, there is a possible downside, as we saw this week. Still, these drops in the share price are generally temporary, and buying Linde (and previously Praxair) on dips in value has historically been a safe bet. Today, Linde is expensive against a very expensive broader market, bolstered by some very high-tech valuations, but Linde has historically proven to be the one industrial stock you can buy to show sector weighting and not have to worry too much about your decision. Earnings growth is predictable because the underlying strategy has been unchanged for decades, and the business model leaves the company very diversified from a risk perspective. The company is not overly exposed to one industry or one region and has so many assets that underperformance from one has no measurable impact overall. Capital discipline is exemplary and dependable, with surplus cash always returned to shareholders if it cannot be deployed at returns that meet very stringent goals. But this has driven significant interest in the stock and the valuation is very high. Betting on further relative multiple expansion is likely not wise – unless the market multiple rises, Linde’s multiple will likely not get much better, and in a market correction, Linde will likely correct also. However, the upside comes from earnings growth, and there has been plenty of that. Industrial gas demand is driven more by industrial production than GDP, and in the West, while we have lots of problems in Europe – which will be our focus on Sunday – there is an intense focus on manufacturing locally today, however uneconomic, and this should be good for Linde. US manufacturing investment growth is especially good for Linde because of its steel exposure in the US and its very large, packaged gas business (welding gases). The negative is the very large exposure to Europe, where industrial production is falling, and this was also signaled by Air Liquide as a weak spot in 3Q. We doubt that this trend will change. Separately, Linde is playing energy transition sensibly, investing where it can get a traditional industrial gas take or pay structure, whether for hydrogen or for other gases. This is the model that the activists in Air Products aspire to, but Linde does it so well. Air Products has a long way to go to catch up.

- Linde beats estimates on higher prices, flags weakness in industrial end markets

- Linde doubles project backlog to $10bn, led by major Dow contract

Exhibit 17: Linde highlights its involvement in the Dow Fort Saskatchewan presentation in earnings slides

Source: Linde – 3Q24 Earnings Presentation, November 2024

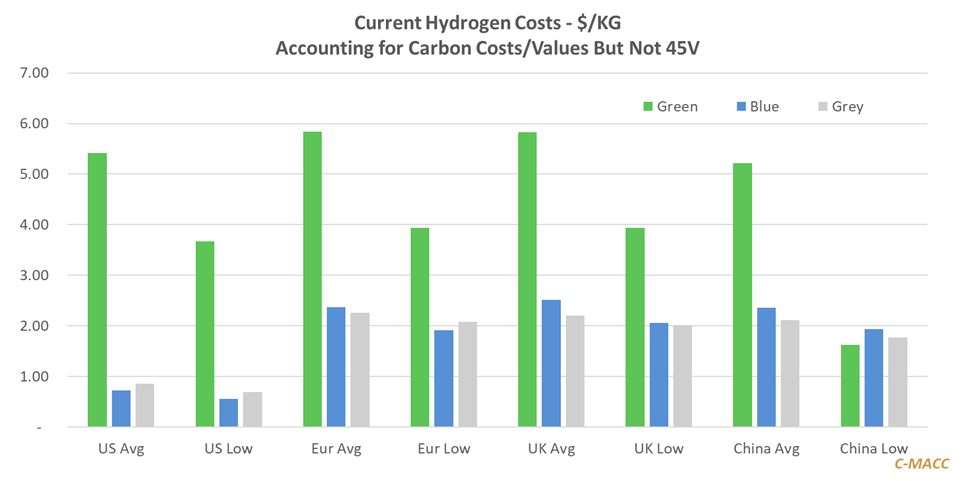

Hydrogen Economy – Project cancellations outnumber new announcements

- Europe is seeing a wave of green hydrogen cancellations, and an FT article over the weekend latched on to the story we have been telling for a while – this is all too expensive, and projects and equipment are too early.

- The ramifications for the electrolyzer makers will be as harsh as we have suggested in prior work, with bankruptcies/restructuring inevitable and residual values unclear: what is a factory worth if no one needs it?

- Other routes to hydrogen or hydrogen derived fuels and products will get more attention – blue in the US, the UK and the Middle East, gasification/pyrolysis everywhere and novel technologies, like Utility Global.

- Climate goals will need to change and the cancellations in Europe come just ahead of COP29 and will get attention and likely cause much wringing of hands. Nuclear power is an answer, but it is long-term.

Exhibit 18: Note that these are cash costs. Capital charges can double the costs, especially where power is intermittent. Even the low power price-based costs in each region are too high – except possibly in China.

Source: Capital IQ and C-MACC Analysis

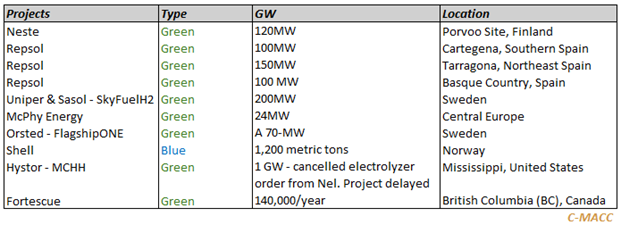

The title is a bit misleading as it is likely not all over for blue hydrogen, but the picture looks bleak for green. The last few weeks have seen a wave of project cancellations in Europe – see the list below – and while some of this may be politically motivated – i.e., give us more money and we will press go again, it is not clear that the political backdrop will allow this to happen. About 10 months ago, we gained a new client for this service, and they insisted on adding a clause to the contract stating that if we stopped publishing, they got their money back – the client was perhaps more forward-thinking than we were at the time! But no fear, as there is enough going on in this space for us to find something each week – it would, however, be good to find something positive occasionally. The news and recent trends in the market are far from positive, and the likely collapse of more projects and some of the equipment suppliers will make it even harder to find capital, even for projects that might make economic sense, of which there are very few today based on electrolysis.

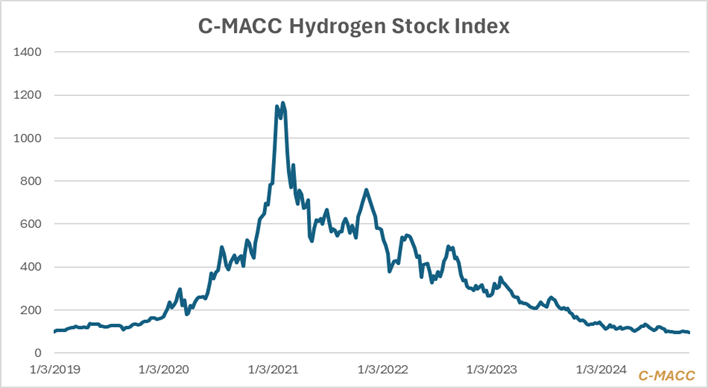

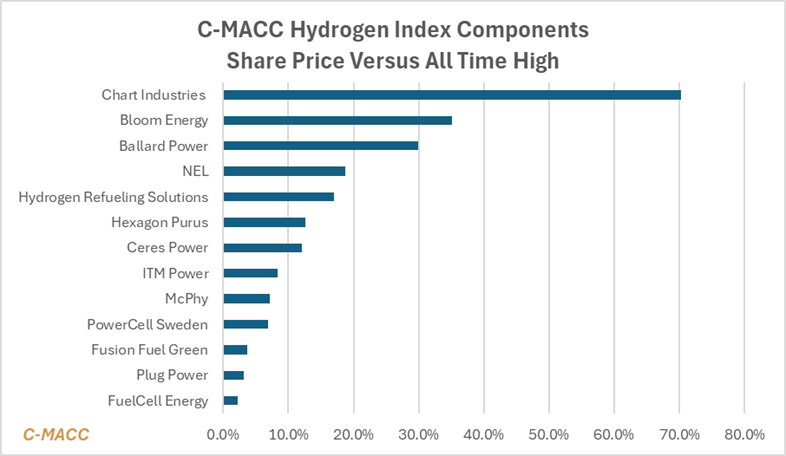

In the article linked above, there is a chart that shows many of the publicly traded hydrogen stocks (mostly equipment makers, but it just shows the poor performance year-to-date. In our index chart below, the trend has been terrible since the peak of the clean energy hype in 2021, when people thought renewable power would be free, and when the DOE suggested that we could have $1/kg hydrogen in the US by 2030. The components of our index are shown in Exhibit 3 ranked by how valuable they are versus their peak. These were values taken before the FT article and likely not accounting for the more recent cancellations. In the article, the CEO of Plug Power states, “We had unrealistic expectations about how fast this initially could move.” Plug Power, like many others, has built significant capacity to build electrolyzers through raising equity, debt, and some government grants and possible loans, only to find that the potential users of the equipment, many of whom signed conditional purchase orders, are backing down.

Exhibit 19: Some of the larger recent project cancellations

Source: Corporate reports

Exhibit 20: The hype of early 2021 was short-lived, but the slow and painful decline of the last 2 years has been mostly about realizing that power prices are not going to help hydrogen.

Source: Capital IQ and C-MACC Analysis

Exhibit 21: Even the companies with sustainable business models are off their highs.

Source: Capital IQ and C-MACC Analysis

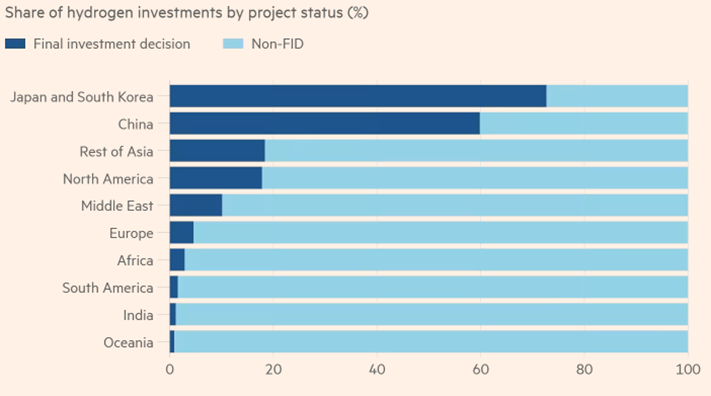

The conditional orders for the equipment were either tied to funding to reach FID or both, and as the chart below shows, projects are stalling pre-FID because the math does not work. Either power prices are too high, or offtake prices are not high enough, or both, and nominal order books are not only not real, but the gap between nominal and real is getting wider. Some equipment producers are holding finished and semi-finished goods that now have no home, adding to increasing working capital, and driving a significant cash imbalance. Several companies have begun aggressive restructuring and headcount reduction programs, but this is what we like to refer to as throwing a cow in front of a train – it may slow it down, but it will not stop it! As we have noted in prior work, the endgame for the electrolyzer makers in the West is very unclear, because it is unclear what long-term value the order books or the assets have. In our Sunday piece – Friends With China Is the Best Option, as China Has Already Won the Energy Transition Race – we note that China already has the lead here and if tariffs prevent Western companies from buying Chinese equipment, they may instead choose to buy hydrogen and derivatives made offshore with cheap Chinese equipment. Cost is the overwhelming problem with hydrogen, and no one wants expensive equipment when you are striving for lower costs. A large US or European production base may have limited value, except perhaps to a Chinese manufacturer wanting to diversify locations.

Exhibit 22: Some of the projects that are through FID in North America are blue.

Source: McKinsey and Hydrogen Council

In our Sustainability Report from last week, we talked about the need for larger balance sheets and fewer start-ups in energy transition because the funding and incentive programs would then be less expensive, and we might get things done. In the report we were focusing on the production-based projects rather than the equipment space for hydrogen and ammonia, but the same logic applies. Perhaps the electrolyzer industry should migrate to larger and more diverse engineering/electrical equipment makers, but the better companies in these sectors recognize the benefits of low-cost operations and consequently may not be interested in a new shiny factory in a part of the world that is uncompetitive. If we see the failures that we anticipate in this sector over the next 14 months, we are unlikely to see government bailouts as the pushback will be throwing good money after bad.

So, is there a silver lining – maybe if you have a different route to hydrogen. The cancellations that we are seeing for green hydrogen and some that we also expect for blue ammonia, should rekindle interest in other ways to get to hydrogen. This may mean new blue projects moving into the hands of those with larger balance sheets, but it also looks interesting for those looking to find or use hydrogen by other means. This mostly means syngas from waste or biomass, but it can also mean ethanol-based fuels – whether the ethanol comes from traditional fermentation or from the process that Synata Bio and LanzaJet are pursuing – see – Time to Put Your Foot on The Gas(ification), and – It’s About Money – Pricing Is Driving Cancellations, Not Demand: Demand Is There at the Right Price!

Then there is Utility Global (a C-MACC Client), with a unique take on power-free solid oxide electrolysis! It sounds too good to be true, but it is not – it is limited by the locations and processes which offer the right feedstocks. The process gets the electron needed to separate the water molecule through the shift reaction from carbon monoxide (CO) to carbon dioxide (CO2), so you need a stream with carbon monoxide. So far, the focus has been on steel production off-gases, but in a meeting last week we discussed how many heating-related combustion processes are designed to minimize carbon monoxide generation and whether, if that was not the goal, CO volumes could be increased (at no cost), offering more opportunity to make more hydrogen. This may not be a panacea for the hydrogen industry, but it is ideas like this, ethanol-based fuels and gasification that may offer more affordable routes to hydrogen, at least until we have overbuilt renewable/clean power to the point where there is plenty of very low-cost power available.

Sustainability and Energy Transition: We will be relieved when the campaigning stops, but what next

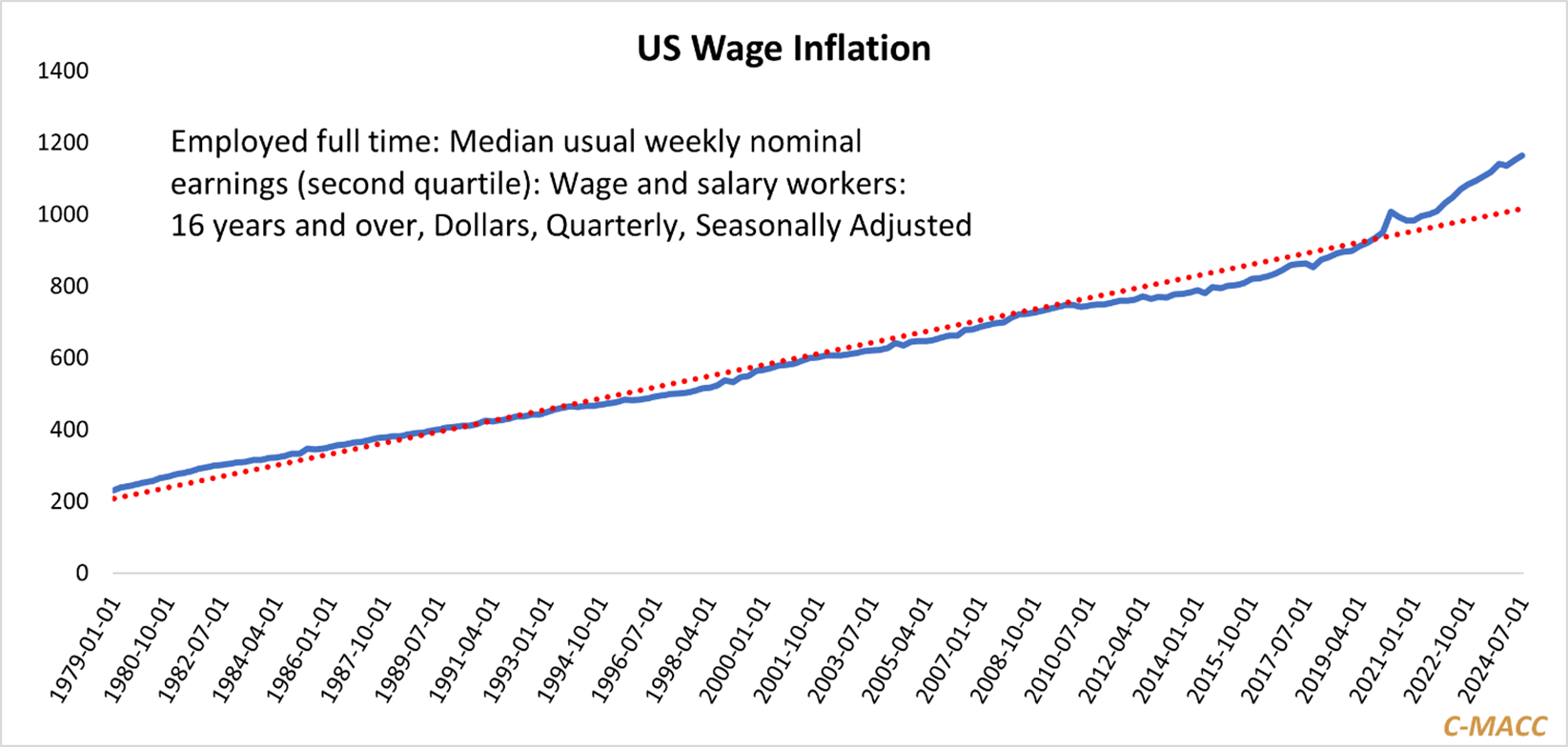

As the US chooses its next president, there are all sorts of possible outcomes for those engaged in programs focused on sustainability and energy transition/emission abatement. While the parties have very different views around climate change and the fossil fuel industries, perhaps the more critical near-term risk is a contested election and the possible government chaos that could drive, including possible delays to any required transfer of power at both the Federal and State levels. This is a country very divided, and it is hard to quantify the possible effects of civil unrest and what that might do to both economic growth and industrial operations, but we should not assume that as a base case. While the focus of this report is sustainability and energy transition, one of the bigger risks to all industrial and manufacturing progress in the US is that the winning party tries to fix something that is not broken! More economic stimulus, whether that comes in terms of looser regulations for oil and gas, incentives for reshoring (clean or dirty industries), or trade barriers, runs the risk of derailing the US economy because of inflation. We do not have a labor surplus in the US as the data below shows, and we will struggle to find the workforce needed for a rapid expansion, especially if there is a major move against immigration. We should take a lesson from the UK here, which saw a decline in migrant workers following Brexit, and the lack of labor in some industries, like farming and trucking, has constrained growth and, in many cases, caused declines. Overstimulating the US economy will drive labor cost inflation and shortages of some of the materials needed to drive faster growth, which will increase material pricing. Blocking opportunities to import cheap raw materials and components from China will also drive inflation. It may also cause some industries to falter if there are retaliatory moves on the trade front, such as the drone story below. Many manufacturers in the US rely on components from China.

Exhibit 23: Both parties in the US are telling the public that the US economy is broken and needs fixing – outside the US no-one sees this, and the US economy is the envy of most of the developed world.

Source: IMF

Exhibit 24: The US labor market is strong, and this is reflected in wage inflation

Source: FRED/BLS

But back to sustainability and energy transition – much has been written about the Trump Administration’s lack of climate focus and the interest in repealing large parts of the IRA, but the reality is that not only is much of the funding already allocated from the IRA gone to Republican States, but we may also see less of a push against EVs given the support that Elon Musk has given to the Trump campaign. Still, we have seen almost zero projects in the US that require elements of IRA support make it through FID this year, and while part of that may be related to challenging project economics, even with incentives, most of the delays have been associated with election risk. One of the reasons why we have seen many more (unprofitable, in our view) hydrogen investments in Europe this year is because the political backdrop in Europe is more stable, and the support for energy transition has a much broader base. Where we see projects canceled in Europe, it is because the project economics do not work, not because the political will is missing. And this European point is important because even where there is political will, there does not appear to be enough money to drive energy transition at the rate many seem is needed. The World is already failing to meet climate targets, regardless of the politics in the US. With the US election result expected before COP29 begins, it would be interesting to see whether the level of commitment of the US becomes the main topic of the conference or whether the conference focuses instead on the climate progress shortfall in almost every other country.

If you are a US corporation, an anti-climate administration in the US presents all sorts of challenges, especially if you operate globally. Will you, for example, operate your facilities to higher environmental standards outside the US versus within the US – unlikely. Will global brand owners have less of a focus on their image in the US versus elsewhere, and if you are a supplier to them, will you be held to a global standard that demands the same commitment to sustainability in the US as elsewhere, regardless of the legal backdrop – probably. Perhaps the larger challenge will be possible litigation, as this is something that is almost a requirement in the US. Litigation around possible regulatory changes at the federal, state, and even local project levels could ramp up with one party trying to stymie the plans of the other. Attempts by any Republican administration to relax permitting procedures and regulations will be met in many cases by well-funded local opposition, and suits and countersuits could hold up projects, clean or otherwise, for years. But even as an industrial or energy-based manufacturer you could find yourself in the legal crosshairs regardless of what you do – sued if you pursue a less clean agenda by the environmental lobby and sued by the anti-woke lobby if you pursue the same pathway in the US that you might be pursuing in Europe for example. In our Sunday piece this week we are going to look at who the better owners might be for the US chemical businesses of US and local chemical owners. One side benefit of getting out of a European business for a US-based company would be not having to operate your US business to a European ESG standard, avoiding possible litigation risk in the US.

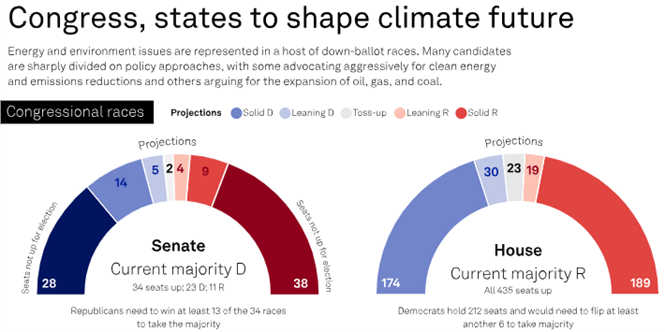

Exhibit 25: With the contest so finely balanced it is very hard to call the energy transition impact, but a Republican sweep would slow progress dramatically.

Source: S&P

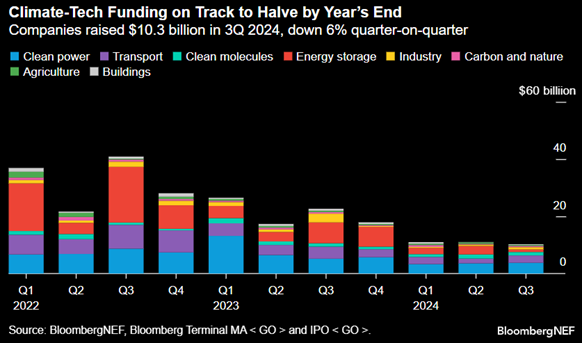

Pulling back the reins – a sign of more uncertainty and getting more selective. The BloombergNEF estimates in the exhibit below estimates that climate-tech companies secured US$10.3bn in equity from public and private markets, marking a ~6% decline from the previous quarter and an ~18% drop compared to the rolling four-quarter average. Nearly 70% of the total funding was sourced from venture capital and private equity deals, with clean power companies leading the way by raising US$3.8bn. Following clean power, the transport and clean molecules sectors also attracted significant investments. The United States remained the top market for climate-tech funding, which in a way is unsurprising, though we sense concern among some surrounding the upcoming US presidential election which is likely putting many in a “wait-and-see” type of holding pattern. We foresee more investment likely entering the industry following the election, though we also anticipate it more in selective areas, such as power generation relative to building out battery and electrolyzer capacity, which already appears oversupplied relative to near-to-medium-term demand. This funding could drop much further with a broad Republican victory, might be somewhat unchanged with a split congress, and may recover with a broad Democrat victory.

Exhibit 26: Climate-tech funding trended lower in 3Q24 and is likely to close 2024 reflecting a significant annual drop.

Source: BloombergNEF, October 2024

The week of October 28th – click on the day or the report title for a link to the full report on our website.

Monday – Weekly Margin and Pricing Analysis

European Chemical Industry Headwinds Stiffen WoW; North America (& Asia) Face Fewer Relative Pressures

- Polymer Market Trends: Global spot polymer prices were mainly lower last week, with spot polyethylene and polypropylene prices falling in all significant regions relative to feedstocks, on average, especially in Europe.

- Chemical Market Trends: Western methanol markers have tightened during the past three months relative to Asia, with European prices rising the most amid a mix of production issues and Middle East tension concerns.

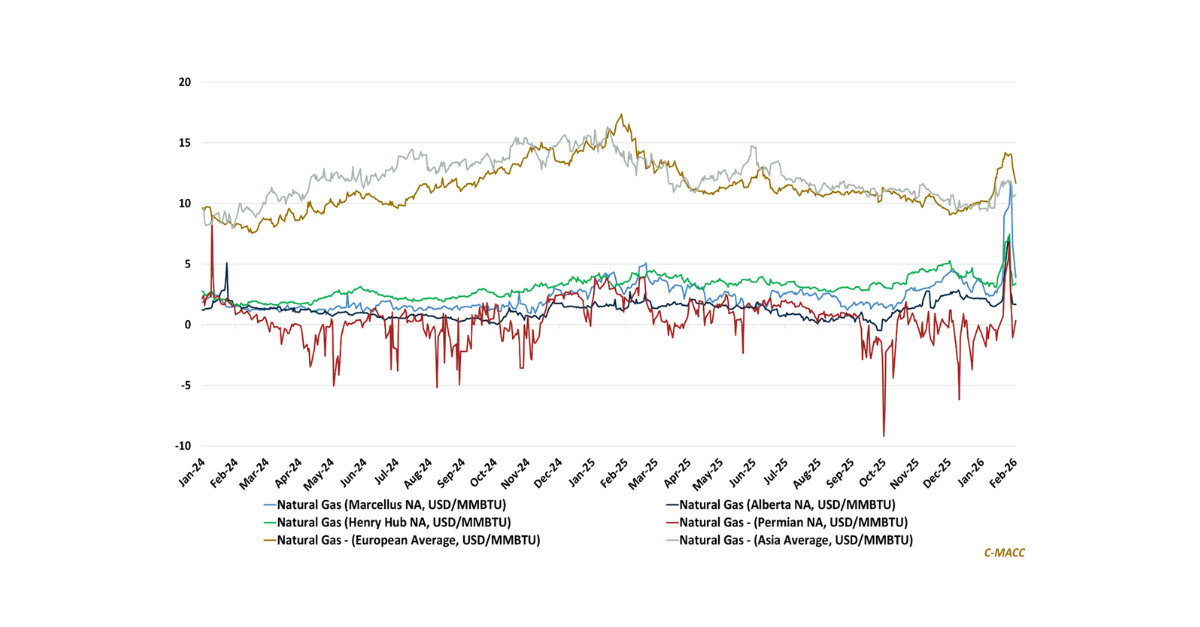

- Feedstock Market Trends: Global chemical production feedstock costs increased last week – NW Europe saw the most sizable increases from higher naphtha and natural gas, and Asia reflected less cost inflation WoW.

- Agriculture Market Trends: Global spot ammonia prices were mainly unchanged last week, and higher natural gas costs in all regions trimmed margins. Crop prices rose WoW, a positive indicator for farmer spending.

Winter Is Coming! Many Global Industries Face A Rocky Year End, Some Better Poised For 2025 Improvement Than Others

- General Thoughts: Global refinery and ethylene production margins have fallen considerably from the YTD highs. Refinery margin outlooks are mostly linked to demand, while overexpansion is more of a concern in ethylene.

- Supply Chain/Commodities: We discuss takeaways from Element Solutions and Enterprise Products 3Q24 results and our negative view of US spot polymer-grade propylene prices in the near term amid improved supply.

- Energy/Upstream: We highlight bp 3Q24 results showing its push away from some clean energy projects and weak refining results. We also discuss the rising value of US existing power/pipeline right-of-ways, such as at EPD.

- Sustainability/Energy Transition: We discuss the sizable drop in clean-technology investment YTD in 2024 relative to 2023, which is also being met by a recent surge in cancellations among existing projects proving uneconomical.

- Downstream/Other Chemicals: We highlight the drop in German manufactured goods export expectations, which many link to weak demand that misses that many of its manufactured goods cost positions are uncompetitive.

Global Polyolefin Demand Will Rise Through 2029; However Oversupply Is Inevitable Absent Unprecedented Rationalizations

- General Thoughts: We discuss low-cost global polyolefin producers painting a positive picture of demand through 2029; however, global supply growth outpacing demand is the major global problem, and it is a risk to all players.

- Supply Chain/Commodities: Global chemical producer’s profits, on average, show sequential improvement in 3Q24, but face declines in 4Q24, as evidenced by our spot market data and by sector 2024 profit guidance cuts.

- Energy/Upstream: We flag the build-out of US utility power production and infrastructure, where capital costs are being factored into the rate cases for consumers, which does not translate into a “cheap” electricity setting.

- Sustainability/Energy Transition: We discuss the First Solar legal challenge targeting those suspected of misusing its IP on its 3Q24 earnings call, and we comment on the recent trend of Western clean project cancellations.

- Downstream/Other Chemicals: We highlight the BASF view of global light vehicle production and the impacts of Chinese vehicle exports on vehicle producers in other regions, including Europe, among other relevant trends.

Food for Thought: Global Agriculture Market Improvement In 2025 Likely, Low-Carbon Transition Challenges to Stay High

- General Thoughts: We are more confident that agricultural sector conditions will improve in 2025/26 relative to 2024 than in the rapid formation of price premiums for low-carbon on-farm inputs/products.

- Supply Chain/Commodities: We highlight FMC and Syngenta 2H24 global crop protection market views, and we give our view of global ammonia markets following Yara, CF, and LSB 3Q24 business updates.

- Energy/Upstream: We highlight the Shell 3Q24 report showing strength in indicative chemical margins relative to refining margins, though base chemical margins now reflect relative declines, as we expected.

- Sustainability/Energy Transition: We discuss the development of US low-carbon ethanol and ammonia markets, flagging two US projects relying on CCS when production starts and a few global policy shifts.

- Downstream/Other Chemicals: We comment on agriculture sector equity performance, give our view, and highlight our CEO Cooley May attending the upcoming Ammonia Energy Association conference.

3Q24 Good, 4Q24 Bad, 2025 Off to The Races?!?

- General Thoughts: We discuss takeaways from a few global chemical sector earnings reports, which mostly expect a weak 4Q24 but anticipate improvement in 2025 – beyond seasonal factors, some will still face a rocky 2025.

- Supply Chain/Commodities: We highlight takeaways from LyondellBasell on domestic PE and PP markets from its 3Q earnings call, Linde results related to their strategy compared to Air Products, and other sector 3Q reports.

- Energy/Upstream: We highlight ExxonMobil and Chevron results, discuss differing views of crude oil refinery margins in 2025 among operators, and flag the planned closure of the LyondellBasell Houston refinery in 2025.

- Sustainability/Energy Transition: We discuss Linde’s involvement in a Dow Fort Saskatchewan growth project and flag LyondellBasell and Eastman projects in advanced recycling, among other relevant sector updates.

- Downstream/Other Chemicals: We discuss most chemical sector management teams signaling better demand conditions globally in 2025, following interest rate cuts and government stimulus, and its impact on expectations.

Weekly Climate, Recycling, Renewables Energy Transition and ESG Report (CRETER) No 204

Poll Dancing: The US Election Promises Instability, Bad for Business & Sustainability

- 1st Topic of the Week: The vitriol and uncertainty around the impending US election is at a fever pitch, with each side describing the other as the harbinger of doom. Most industries and capital markets thrive on stability, and historically neither US party has managed to create too much instability – could this time be different?

- 2nd Topic of the Week: Carbon Capture may be the winner in a Republican win as 45Q is likely intact, and some of the pipeline plans could get fast-tracked.

- Otherwise: We look at packaging recycling rates in Europe – another reason not to own European virgin polymer capacity, the China lead in renewable power, and we look again at some balance sheet opportunities.

Weekly Hydrogen Economy Update No 70

It’s All Over Now Baby Blue (& Green).

- Europe is seeing a wave of green hydrogen cancellations, and an FT article over the weekend latched on to the story we have been telling for a while – this is all too expensive, and projects and equipment are too early.

- The ramification for the electrolyzer makers will be as harsh as we have suggested in prior work, with bankruptcies/restructuring inevitable, and residual values unclear: what is a factory worth if no one needs it?

- Other routes to hydrogen or hydrogen derived fuels and products will get more attention – blue in the US, the UK and the Middle East, gasification/pyrolysis everywhere and novel technologies, like Utility Global.

- Climate goals will need to change and the cancellations in Europe come just ahead of COP29 and will get attention and likely cause much wringing of hands. Nuclear power is an answer, but it is long-term.

- Otherwise, we look at the strength in pricing for European methanol – good for US producers. We also discuss the competitive edge in China outside of electrolyzers.

C-MACC/PXI Polymer Price Expectations Service

October Monthly – Polymer Pricing Report #9

More About Chemical Market Analysis & Consulting Company (C-MACC) – www.c-macc.com

Loading…

Loading…

/

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!