Global Market Analysis

Control, Not Capacity: The Market’s Shift from Volume to Value Creation

Key Findings

- General Thoughts: When everyone’s focused on scale and sentiment, strategic reinvention often gets overlooked, yet it’s these under-the-radar shifts that tend to compound, endure, and outperform through disruption.

- Supply Chain/Commodities: Structural leverage, not cyclicality, is emerging as 2025’s sharpest differentiator, where DuPont redefines silicon value chains and Fertiglobe steers ammonia’s geopolitical ascent with optionality.

- Energy/Upstream: Strategic control, not scale, is redefining the energy value chain as US integrated midstream and refined product leaders weaponize volatility through yield, export leverage, and system-wide optionality.

- Sustainability/Energy Transition: Ethanol’s new margin map centers on carbon, not corn, as CI scores, feedstock control, and co-product strategy increasingly define profitability more than gallons, geography, or grind rate.

- Downstream/Other Chemicals: As homebuilding stalls, remodeling is driving durable material demand and margin depth. In crops, surplus and tariff risk reward those monetizing logistics, not betting on weather or yield.

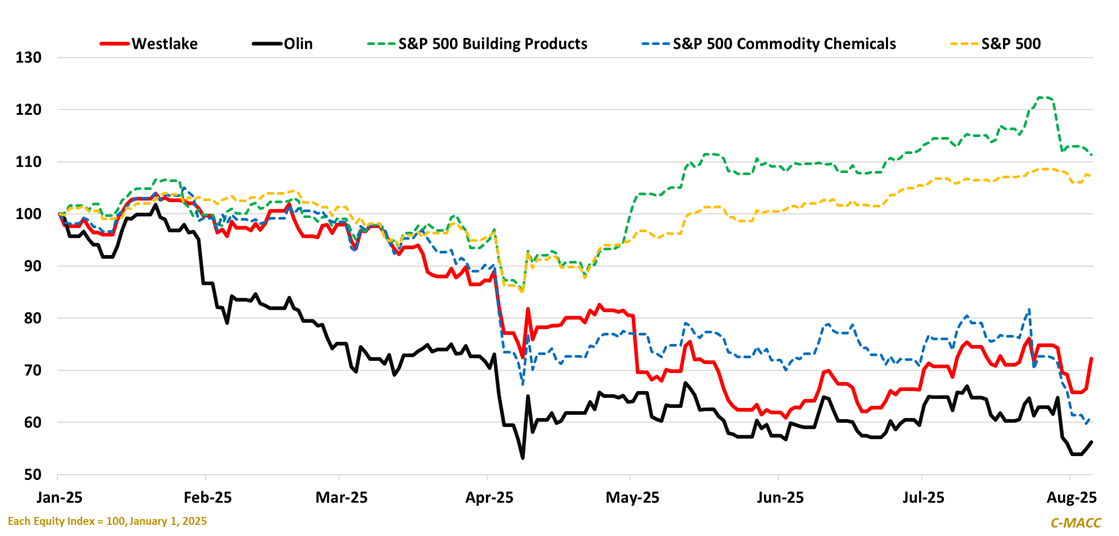

Exhibit 1: Westlake equity has performed more with commodity chemicals than building product players in 2025.

Source: Bloomberg, C-MACC Analysis, August 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!