Base Chemical Global Analysis

Global Weekly Catalyst No. 304

- General Thoughts: Chemical feedstock volatility is uneven and mostly net-margin negative, as derivative demand stays soft into early November and rationalization, not restarts, is broadly needed to lift sector profitability.

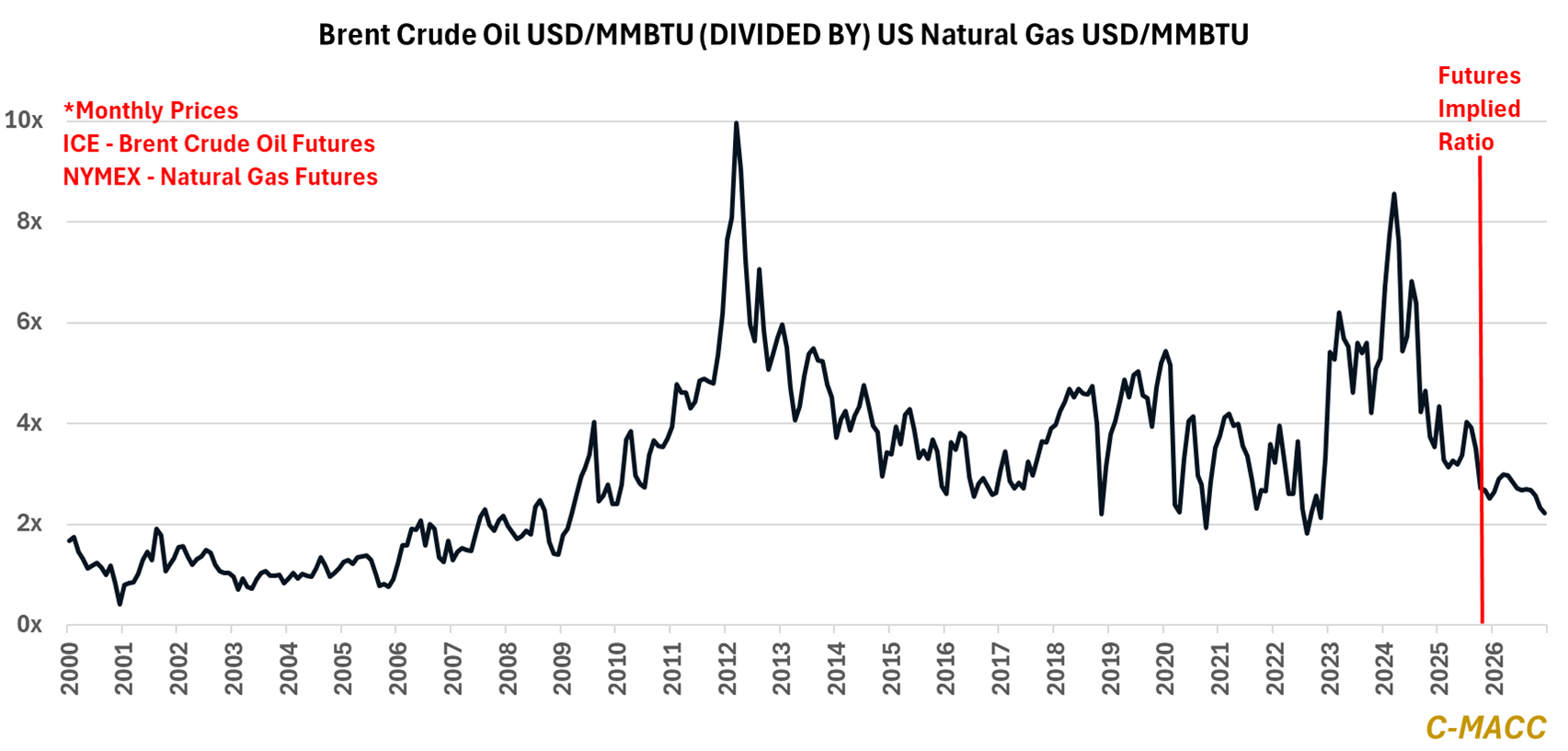

- Feedstocks & Energy: Brent crude hovered near mid-$60s while US natural gas firmed, compressing the oil-to-gas ratio to 2025 lows. With Ex-US gas also falling relative to US levels, cost spreads broadly narrowed last week.

- Olefins: Global olefin prices mostly eased again relative to feedstocks last week. US spot ethylene margins reflect 2025 lows, US PDH margins remain under pressure, and global butadiene spot prices showed further weakness.

- Other Base Chemicals: Methanol, benzene, and chlor-alkali kept fragmenting along energy lines, with Western price compression persisting as Asia trends toward selective parity, showing no evidence of setting up a near-term recovery.

- Agriculture: Ammonia’s firmness reflects supply constraints more than structural demand; recent strength in soy prices relative to corn and Ex-US natural gas prices falling relative to US levels suggest late 2025 headwinds.

- Refining & Biofuels: Refining and biofuel chains have shifted from throughput chasing to strategic calibration; sanctions-driven diesel strength lifted margins, as US ethanol margins softened to levels last seen in August.

Exhibit 1 – Chart of the Day: Oil-to-gas ratio compresses to 2025 lows, tightening US chemical feedstock advantage.

Source: Bloomberg, C-MACC Estimates, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!