Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

- General Thoughts: Otter Tail’s merchant pipe model thrives on resin deflation and agility, while Westlake’s integration converts volatility into advantage through internal transfer optionality, co-product leverage, and more resilient returns.

- Polyethylene (PE): Global PE markets transition from cyclical turbulence to structural refinement as integration, regional cost discipline, and end-use collaboration replace scale as the defining source of competitive durability.

- Polypropylene (PP): Weak PP production margins expose an integration hierarchy, where feedstock flexibility, process optimization, and downstream coordination separate durable returns from temporary, opportunistic performance.

- Polyvinyl Chloride (PVC): Global PVC price stability masks transformation as integrated producers align chlor-alkali economics, reliability programs, and infrastructure demand to outlast margin troughs and reset the global cost curve.

- Other Sector Developments: Feedstock convergence compresses geographic advantage while co-product economics, policy alignment, and capital precision structurally strengthen low-cost integrated systems, driving earnings resilience.

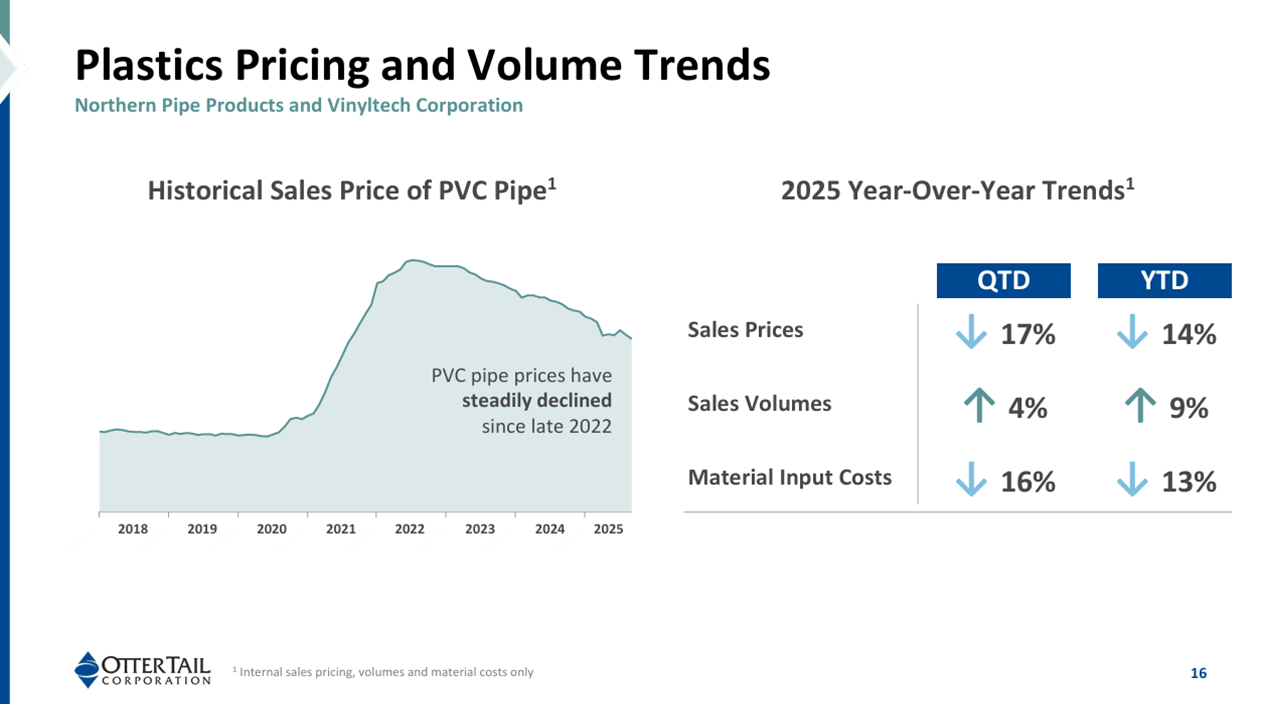

Exhibit 1 – Chart of the Day: Falling PVC pipe prices test margins, but integration and efficiency redefine resilience.

Source: Otter Tail – 3Q25 Earnings Presentation, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!