Base Chemical Global Analysis

Global Weekly Catalyst No. 305

- General Thoughts: Global chemical profit improvement in the near term depends less on cyclical recovery and more on rationalized capacity, cost integration, and policy agility as volatility erodes scale-driven advantage.

- Feedstocks & Energy: Flattening feedstock curves and collapsing oil-to-gas ratios intensify margin compression, with oversupplied product chains resulting in petrochemical prices falling with any sign of input cost relief.

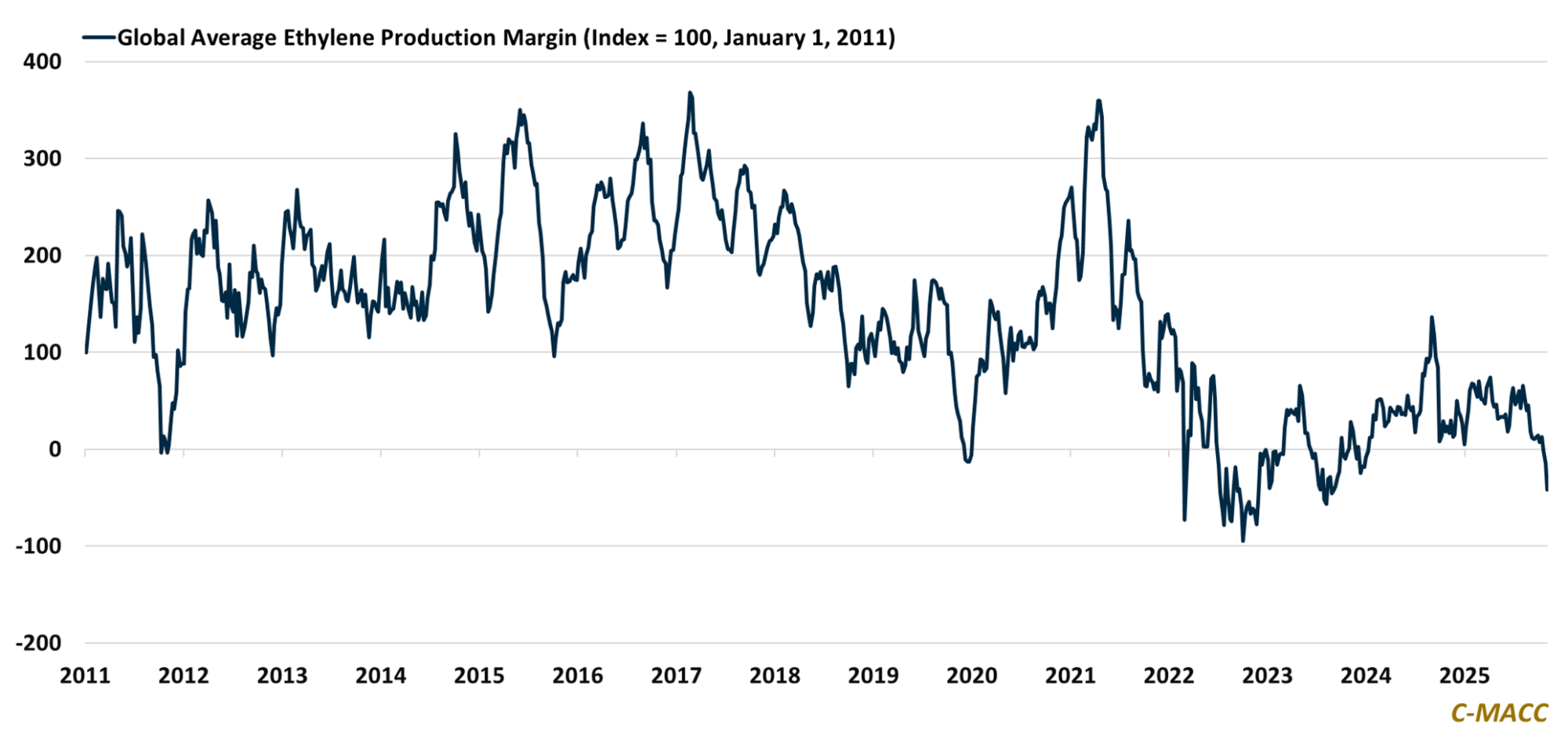

- Olefins: Olefin values fell further against feedstocks, with global ethylene margins at 2025 lows and propylene near PDH cash-cost thresholds. Persistent oversupply and export friction signal a structural, not seasonal, excess.

- Other Base Chemicals: Methanol markets steadied in Europe last week but weakened in Asia and the US; benzene markets saw weakness outside US markets, and global chlor-alkali margins struggle to hold position.

- Agriculture: Ammonia’s firmness still reflects supply restraint, not demand expansion. Soy-to-corn price ratios shift and narrower gas spreads foreshadow the likelihood of softer late-4Q margins despite recent tightness.

- Refining & Biofuels: Western refining margins rise to new 2025 highs on disciplined utilization and lower crude, while Asian spreads erode. US ethanol margins rebounded due to strength in DDGS and easing corn prices.

Exhibit 1 – Chart of the Day: Global avg. spot ethylene margin sinks to 2025 low; US spot ethylene at multi-year low.

Source: Bloomberg, C-MACC Estimates, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!