Global Market Analysis

Gimme Shelter: Feedstock Convergence Exposes Global Petrochemical Vulnerabilities

Key Findings

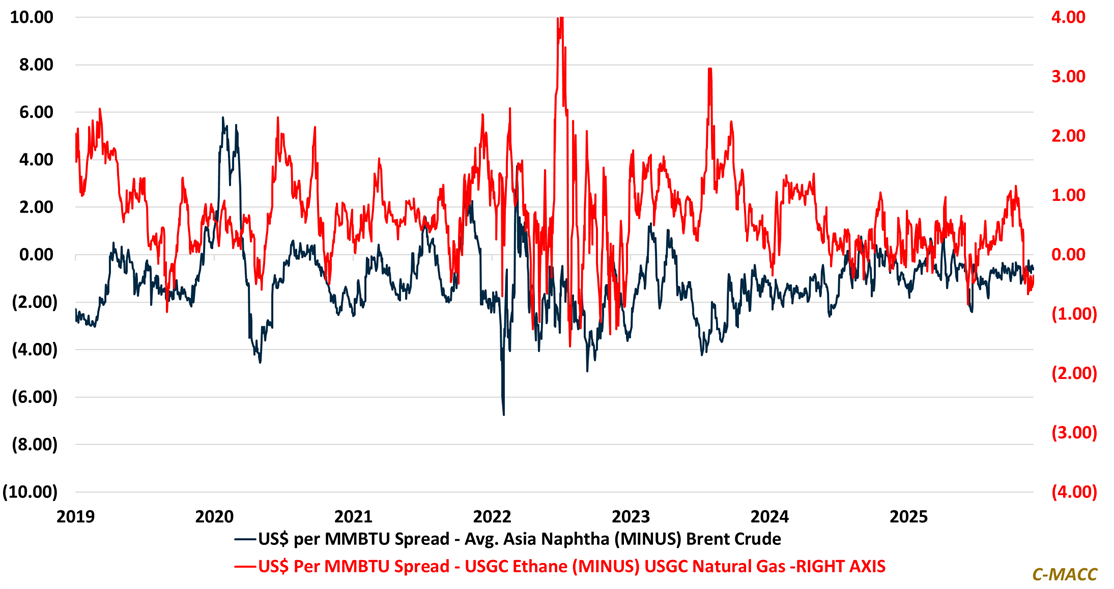

- General Thoughts: Feedstock convergence, rising USGC ethane risk, and disappearing European carbon buffers accelerate petrochemical restructuring, squeezing INEOS Project One and advantaged Asian ethane importers.

- Supply Chain/Commodities: Ethylene capacity additions in 2026, weak derivatives, and compressed feedstock spreads intensify margin destruction, forcing cracker closures and portfolio restructuring in Europe and Asia.

- Energy/Upstream: Crude softness, ex-US gas weakness, and US natural gas price strength reshape regional chemical cost curves, shifting investment toward upstream integration and advantaged downstream platforms.

- Sustainability/Energy Transition: Rising EU carbon costs, tightening biofuel mandates, and shifting compliance incentives fundamentally adjust competitiveness and capital allocation across global energy-intensive industries.

- Downstream/Other Chemicals: Soybean-driven acreage shifts, renewed export flows, and tightening farm economics alter fertilizer, seed, equipment, and biofuel margins across agriculture-linked chemical value chains.

Exhibit 1: Feedstock convergence threatens ethylene competitiveness as rising US ethane meets cheap naphtha.

Source: Bloomberg, C-MACC Analysis, November 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!