Global Market Analysis

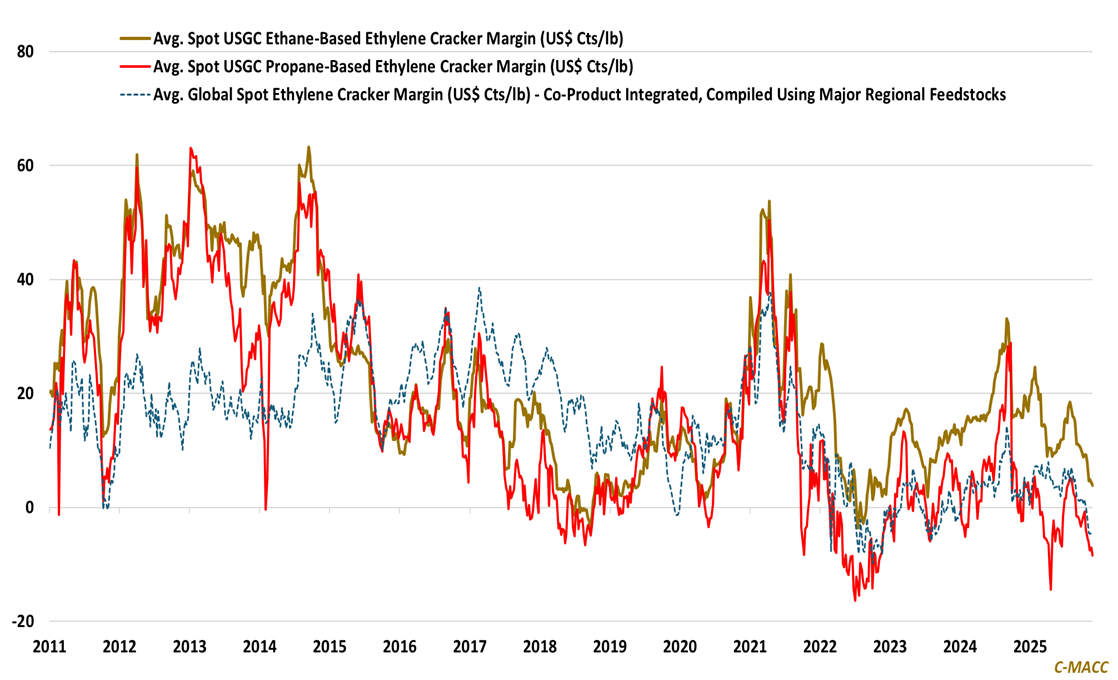

Margins Without Shock Absorbers: Ethylene’s Co-Product Reckoning Reshapes Competitiveness Globally

Key Findings

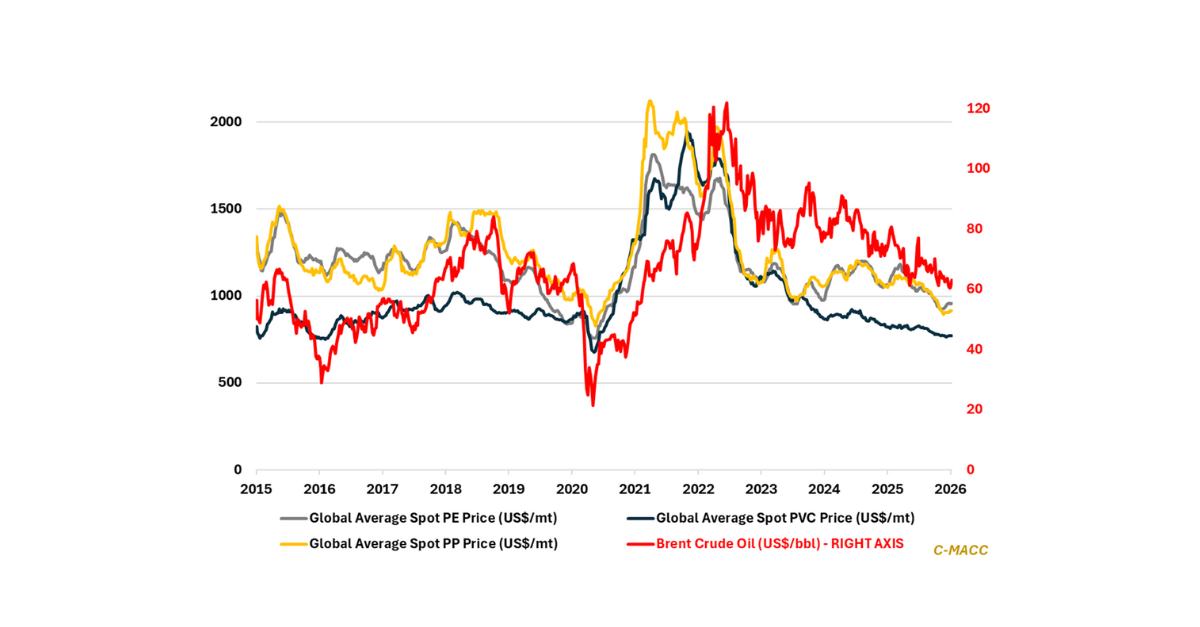

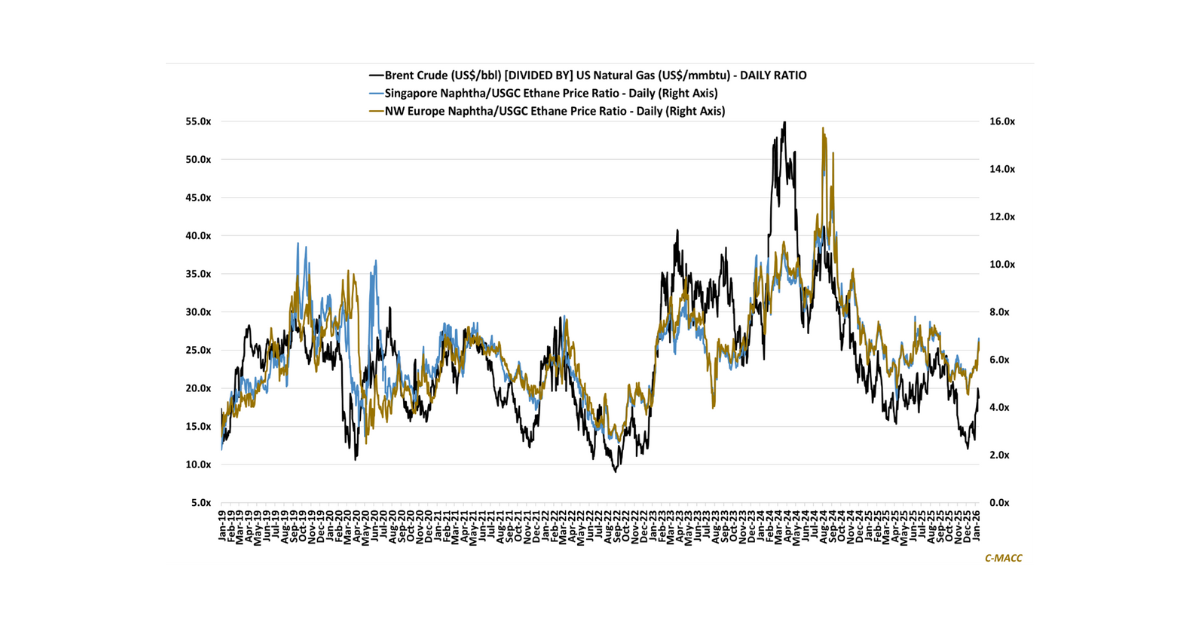

- General Thoughts: Ethylene margins track co-product despair more than oil-gas spreads, flattening global cost curves and forcing integrated producers to weaponize downstream portfolios rather than feedstock advantage.

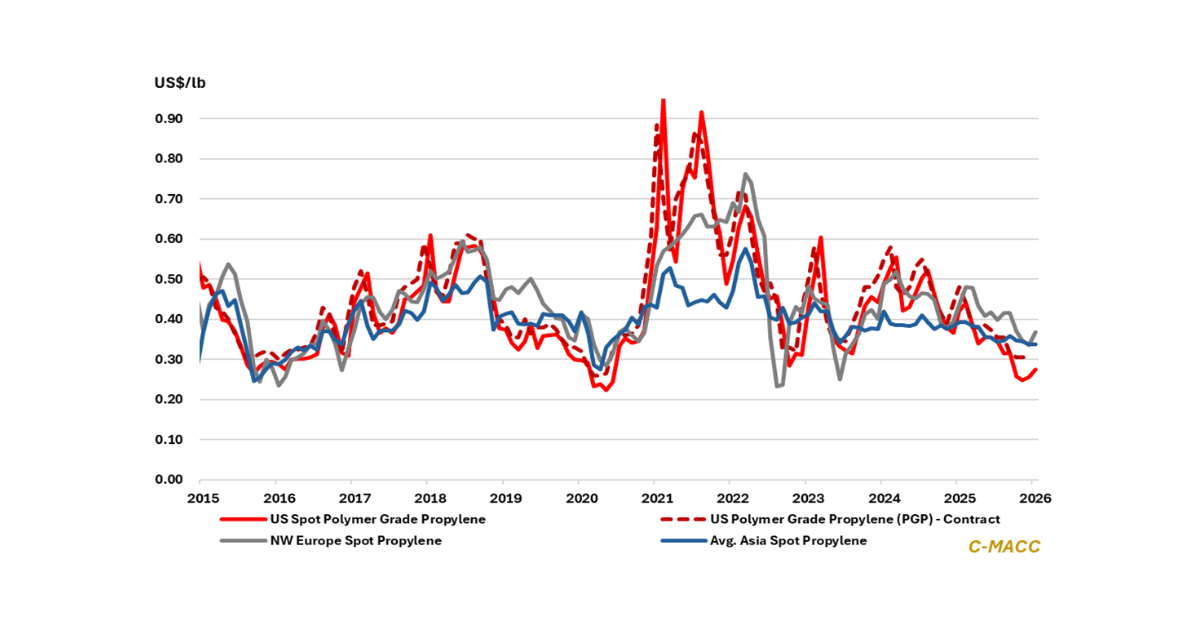

- Supply Chain/Commodities: Historically cheap propane fails to gain a foothold in cracker feedslates, as collapsed co-products cut margins, narrowing arbitrage and turning capacity additions into catalysts for rationalization.

- Energy/Upstream: The 4Q25 US propane glut, partially tempered by recent winter events, fragments transatlantic light-end spreads and reconfigures global clearing prices around volatile heating, storage, and export constraints.

- Sustainability/Energy Transition: Carbon-capture and hydrogen narratives pivot from mega-export dreams to retrofit-first, cluster-embedded projects, constrained by thin binding offtake, volatile policy, and skeptical buyers.

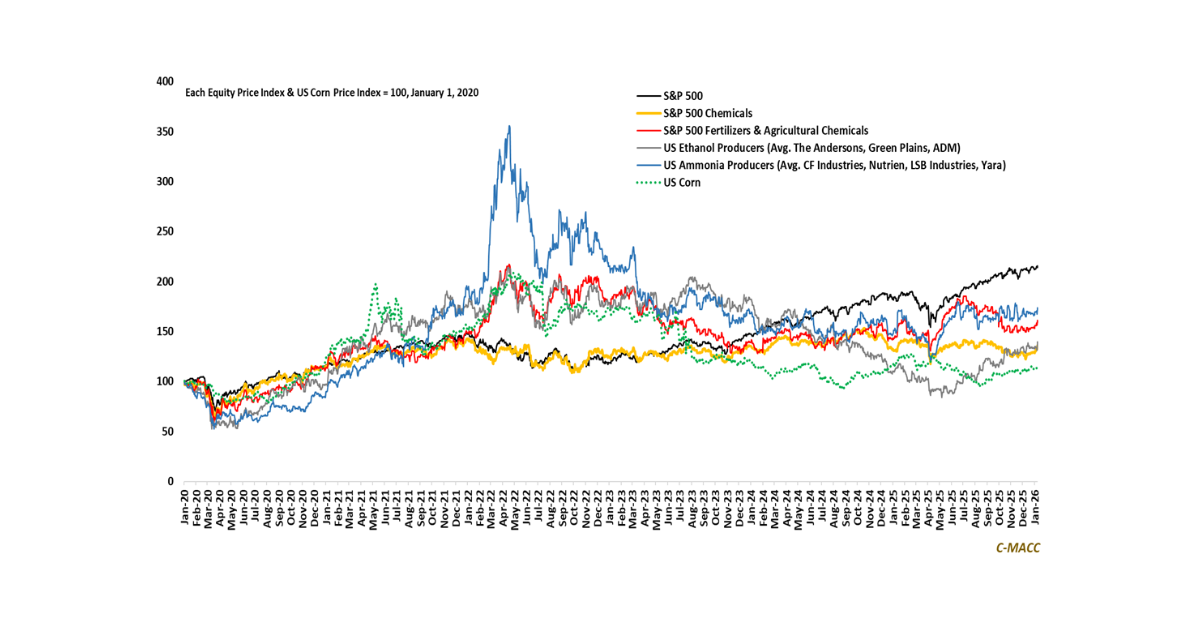

- Downstream/Other Chemicals: Low but jumpy container freight and a softening dollar amplify trade elasticity, shifting polymer, fertilizer, and fuel demand toward emerging-market buyers with constrained hedging.

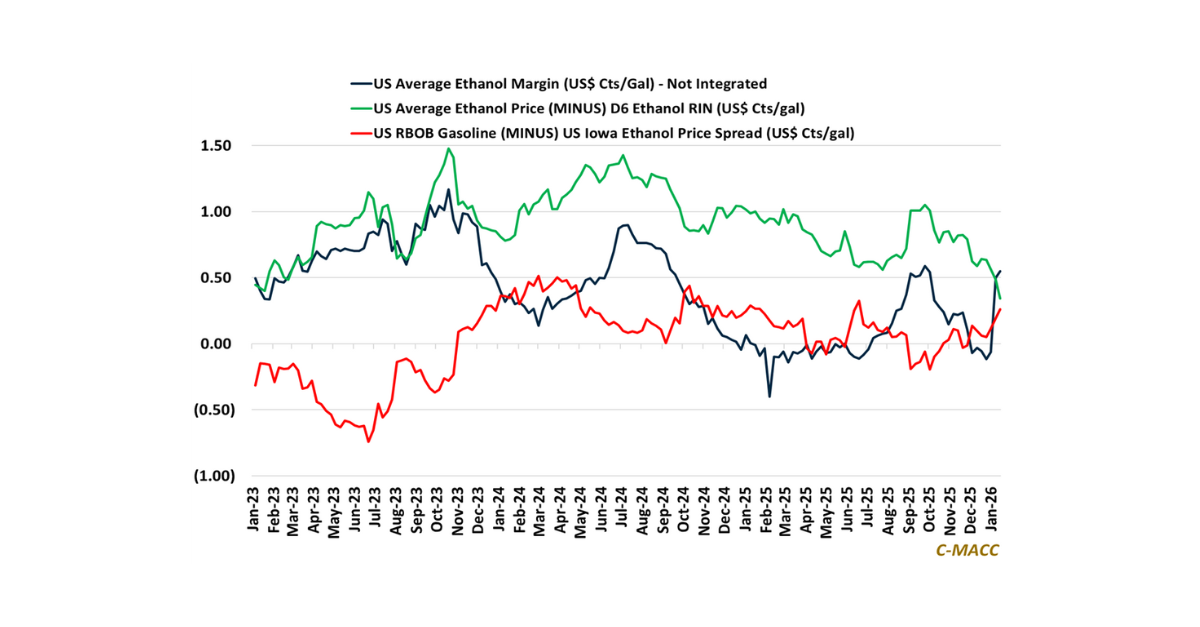

Exhibit 1: Weak cracker co-product prices offset propane cost declines to keep ethane as the preferred US feedstock.

Source: Bloomberg, C-MACC Analysis, December 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!