Base Chemical Global Analysis

Global Weekly Catalyst No. 310

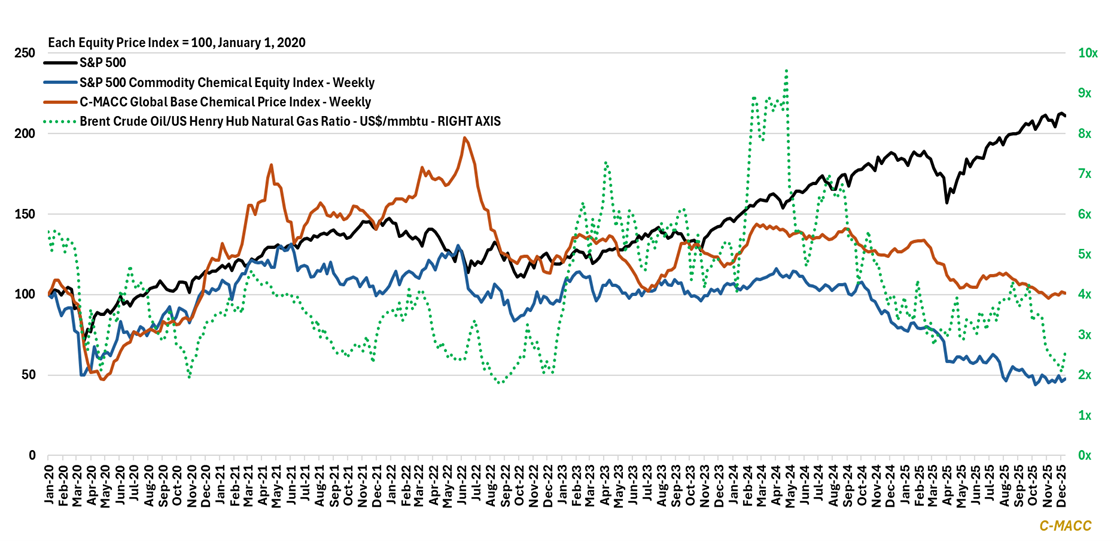

- General Thoughts: Feedstock convergence is eroding regional cost advantages amid weak demand, leaving supply discipline, not demand recovery, as the clearing mechanism into 2026, keeping restructurings in focus.

- Feedstocks & Energy: US natural gas and NGL values retreated relative to crude, compressing feedstock dispersion and reinforcing restructuring pressure as chemical margin risk rises with falling regional protection.

- Olefins: Global olefin markets were weaker, on average, last week, with their prices not falling as aggressively as regional feedstock costs, suggesting more downward pressure on olefin prices absent an unexpected shock.

- Other Base Chemicals: Regional methanol prices diverged further from respective natural gas cost trends WoW. Western spot benzene held up WoW relative to Asia, though West-to-East spreads will likely contract in 1H26.

- Agriculture: Global ammonia prices held near their 2025 highs last week, though we observe price weakness in US corn belt markets that could impact global conditions in the near-to-medium term amid improved production.

- Refining & Biofuels: Refining margins softened WoW, with US refinery cracks easing amid weakening distillate prices. US ethanol profit remains near breakeven, though market conditions appear poised to improve in 1H26.

Exhibit 1 – Chart of the Day: Feedstock convergence and weak prices extend commodity equity underperformance.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!