Polymer Global Analysis

Resin To Riches: Weekly Plastic Market Insights

- General Thoughts: Global polymer markets are positioned to exit 2025 structurally oversupplied, as excess capacity further weakens oil-to-resin linkages and shifts 2026 outcomes toward rationalization over cyclical recovery dynamics.

- Polyethylene (PE): Markets globally show regional firmness in late 2025, though it masks imbalances, as China-driven oversupply caps clearing levels and inventory normalization, not demand recovery, drives near-term price behavior.

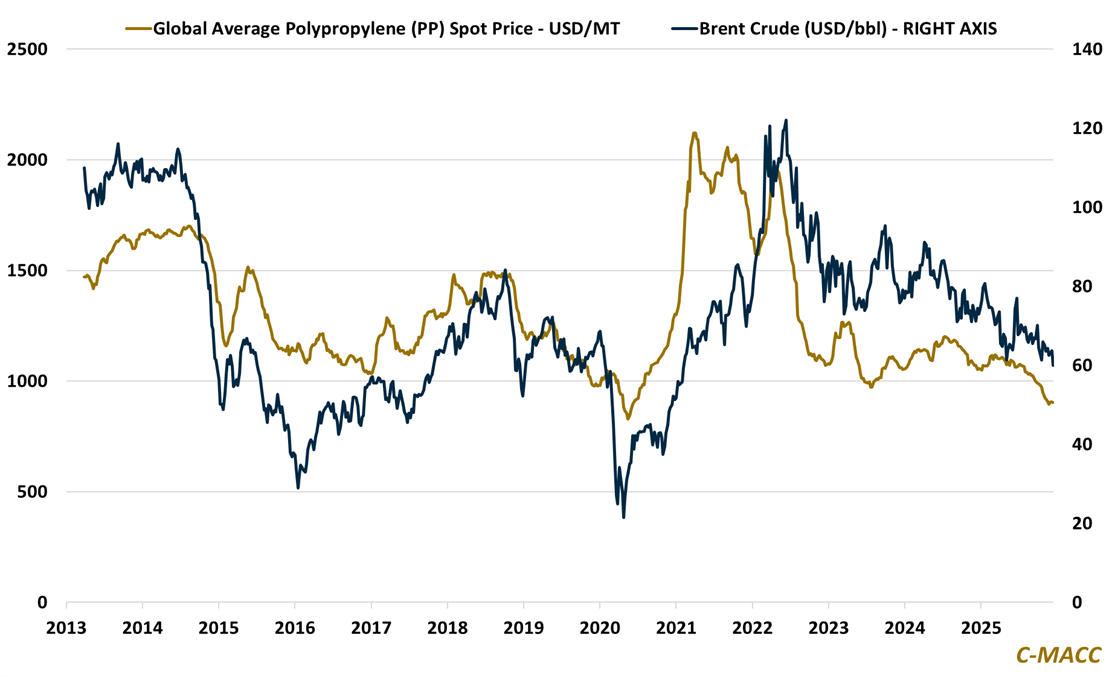

- Polypropylene (PP): Markets stay pinned near cost floors, as ample inventories, generally weak demand elasticity, and accelerating Chinese capacity force exports to absorb surplus volumes, likely keeping PP-to-PGP spreads compressed.

- Polyvinyl Chloride (PVC): Trade policy and asset rationalizations increasingly determine price developments, as Asian imports displace European supply and near-term structural restructuring efforts replace cyclical adjustment dynamics.

- Other Sector Developments: Weakening feedstock relief only provides transient benefits to most producers, as globally oversupplied markets dominate resin economics, limiting energy-driven margin recovery across most chemical markets.

Exhibit 1 – Chart of the Day: Global average spot PP prices near multi-year lows as crude falls heading into year-end.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!