Global Market Analysis

When the Tide Goes Out: Refining Holds, Chemicals Must Cut

Key Findings

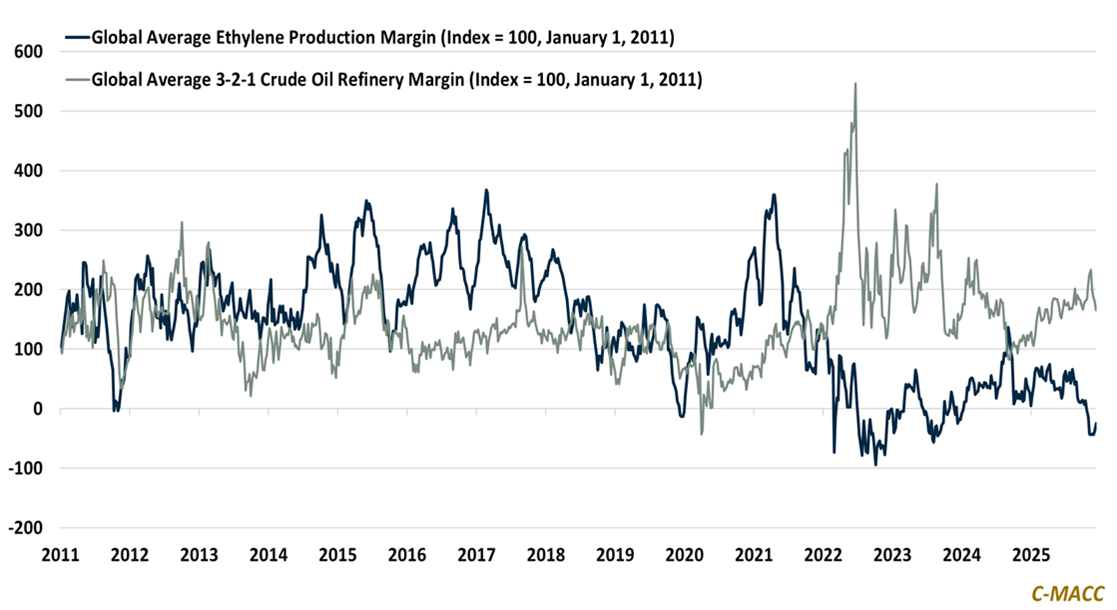

- General Thoughts: Global average ethylene production margins collapsed in early 4Q25 then stabilized modestly, but only restructuring like high-cost cracker closures can loosely replicate refining’s recent margin lift sustainably.

- Supply Chain/Commodities: Propylene markets remain oversupplied, with Asia as the global clearing mechanism, leaving standalone producers more exposed than cost-advantaged integrated C3-chain derivative producers.

- Energy/Upstream: Cheap US gasoline prices reflect year-end oversupply, not strength, while rising China refinery runs add products globally, pressuring cracks and reinforcing downstream margin normalization into 2026.

- Sustainability/Energy Transition: Thyssenkrupp Nucera’s cash flows beyond hydrogen cushion its losses, proving diversified industrial platforms outlast subsidy-gated electrolyser demand resets better than pure-play peers.

- Downstream/Other Chemicals: Range-bound USD and geopolitically volatile freight delays repricing, distorting arbitrage, and rewarding regionalized, balance-sheet-resilient players navigating prolonged uncertainty into 2026.

Exhibit 1: Global ethylene trough meets refining rollover as restructuring rewrites global petrochemical profit cycles.

Source: Bloomberg, C-MACC Analysis, December 2025

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!