C-MACC Sunday Executive Summary

The Heat Is On: Power Inflation, Low Expectations Test Chemical Investment Strategies Into 2026

- Chemical sector outcomes in 2026 will hinge more on managing volatility across power, gas, and policy, not on forecasting averages, as infrastructure constraints and capital discipline dominate margin formation globally.

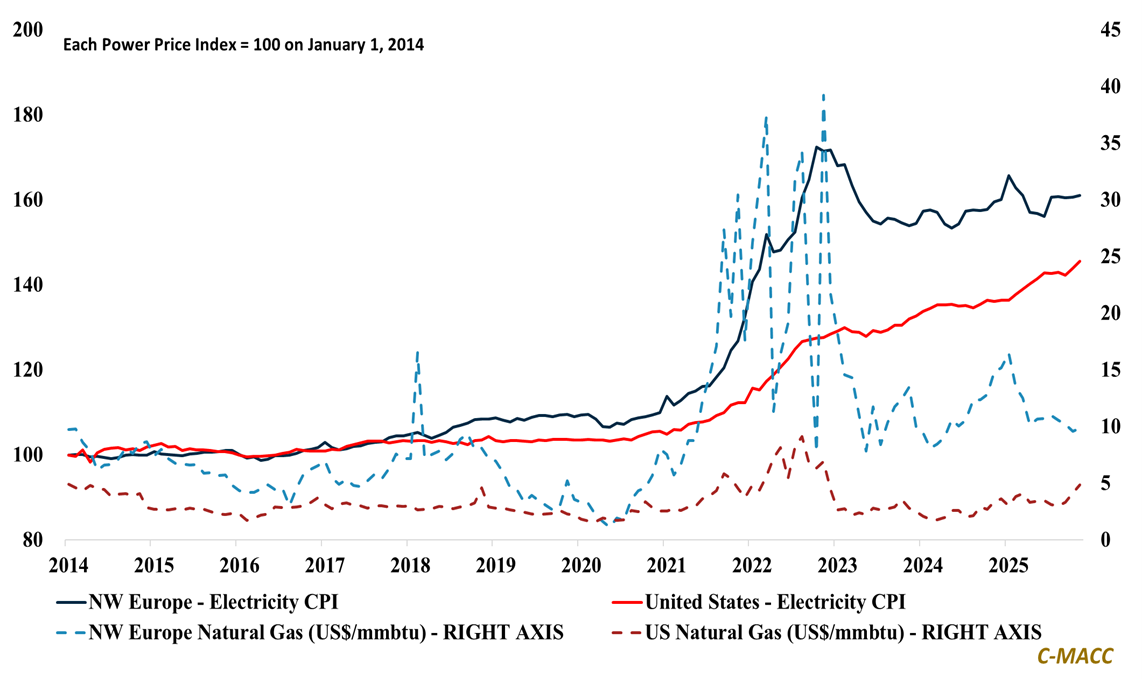

- Electricity replaces fuel as the binding constraint, with sticky power inflation, grid congestion, and contracting structures reshaping industrial competitiveness despite easing global gas price benchmarks.

- Chemical sector returns depend more on restructuring speed, supply discipline, and cost-curve repositioning than demand recovery, as refining outperformance versus ethylene in 2025 underscores imbalance risks.

- Acreage shifts, oil price upside risk, sector restructuring, and political incentives create asymmetric outcomes, rewarding firms positioned for range-based strategies rather than linear forecasts in 2026.

- Otherwise, the analysis frames petrochemical movements through integration over volume, product-level sustainability governance, and freight and currency volatility, which increasingly shape global trade economics.

- Companies Mentioned: Westlake, Vynova, Borealis, Braskem, ExxonMobil, Dow, BASF, SABIC, LyondellBasell, Home Depot, Sherwin-Williams, Huntsman

- Products Mentioned: Electricity, Power, Natural Gas, LNG, Crude Oil, Naphtha, Ethylene, Propylene, Polypropylene (PP), Gasoline, Diesel, Fertilizers, Nitrogen, Corn, Soybeans, Polyvinyl Chloride (PVC)

Exhibit 1: US power inflation re-accelerates versus Europe, keeping domestic industrial electricity risk elevated.

Source: Bloomberg, C-MACC Analysis, December 2025

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!