Base Chemical Global Analysis

Global Weekly Catalyst No. 311

- General Thoughts: Depressed global chemical sector growth expectations, co-product erosion, and flattened cost curves make restructuring pace and margin resilience more decisive than demand recovery in 1H26.

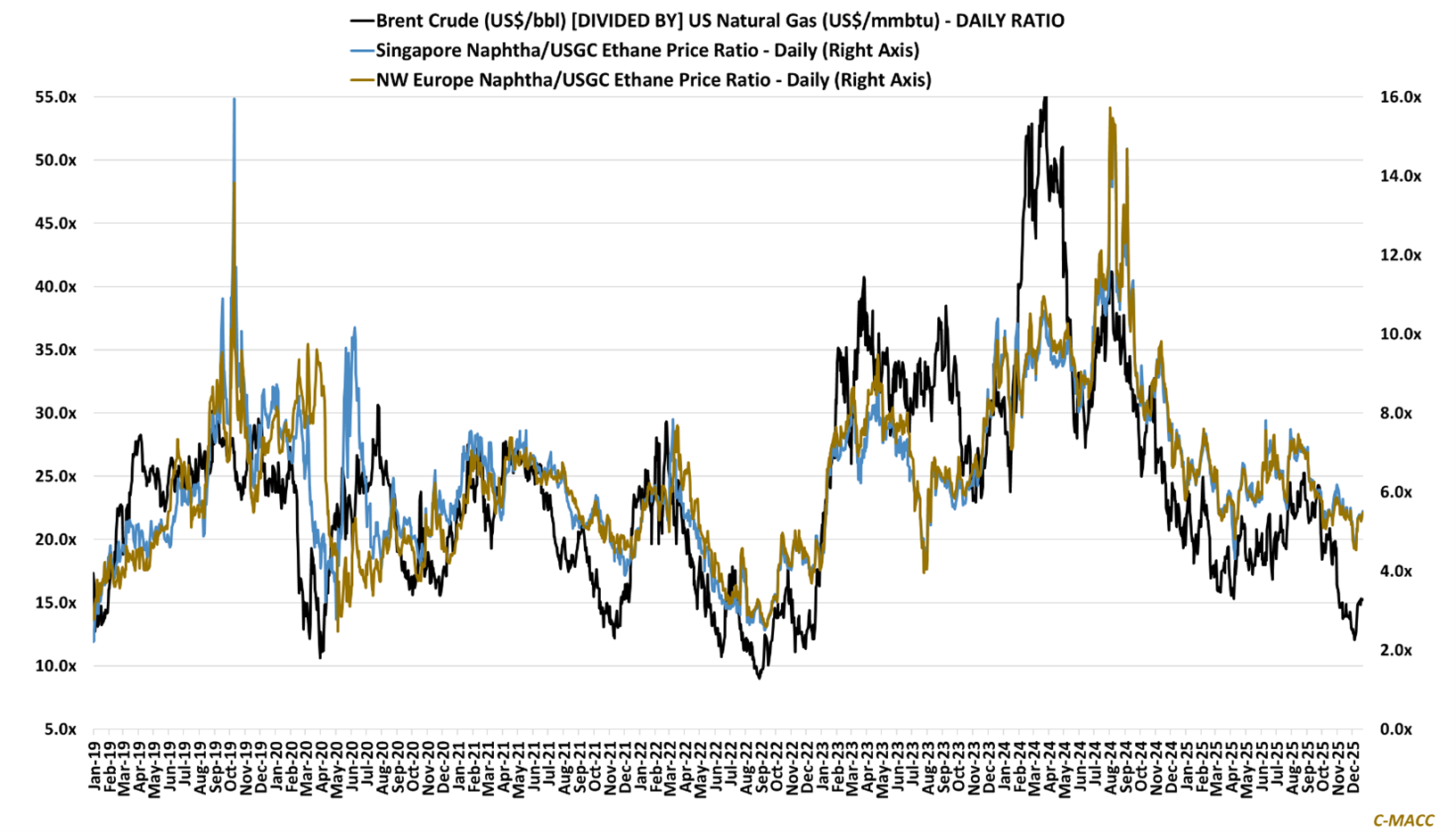

- Feedstocks & Energy: Flattening cost curves and sustained oil-gas divergence pressure margins, but upside risk for chemical prices appears biased relative to already depressed expectations amid weak energy fundamentals.

- Olefins: Global olefin markets remain structurally weak, with prices near their 2025 lows; restructuring and closures reflect endemic oversupply, while co-product price erosion globally increases ethylene margin pressure.

- Other Base Chemicals: Non-olefin base chemicals exhibit patchy price behavior into year-end; Western benzene and methanol prices softened relative to Asia last week, while chlor-alkali prices benefited from cost support.

- Agriculture: Global ammonia spot prices hold firm near their 2025 highs, supported by still high fertilizer demand expectations and delayed supply, yet 2026 global margin expansion looks capped by gradual market loosening.

- Refining & Biofuels: Global refining margins remain positive but structurally normalized; ethanol margins have weakened in 4Q25; 1Q26 seasonal trends and turnarounds should offer some relief amid tepid product demand.

Exhibit 1 – Chart of the Day: Ex-US naphtha-to-USGC ethane ratio has outperformed oil-to-gas ratio in 2H25.

Source: Bloomberg, C-MACC Estimates, December 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!