Global Market Analysis

Landslide: Capacity, Policy Will Shift 2026 Markets Faster Than Demand Recovers

Key Findings

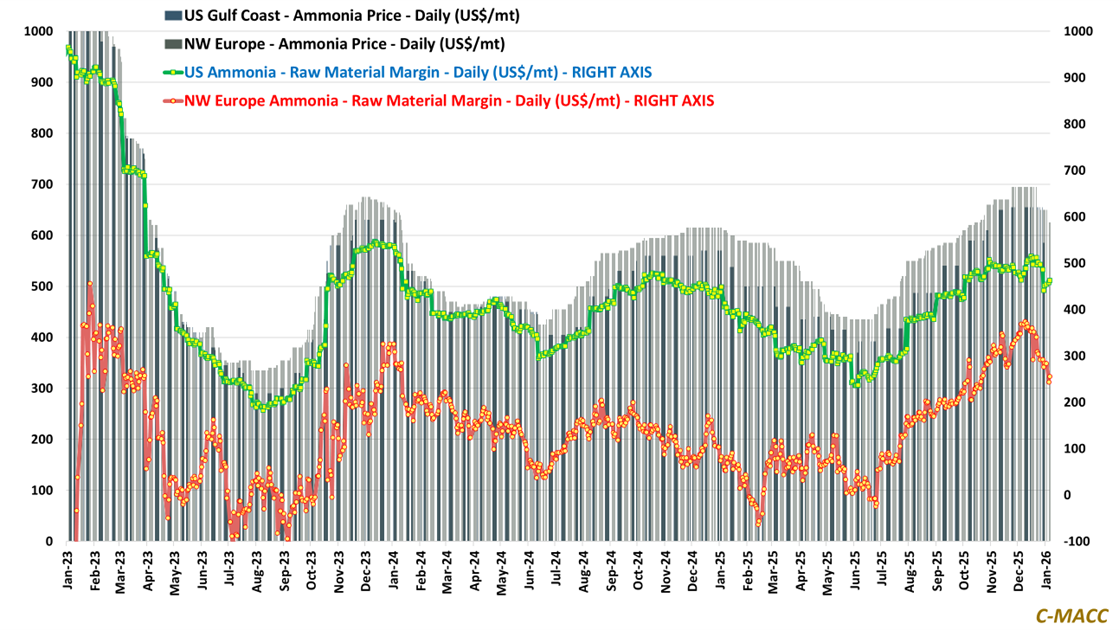

- General Thoughts: Ammonia markets hinge on reliability, not recovery, keeping prices elevated as supply additions lag volatility, farmer demand flexes, and integrated low-cost producers outperform in early 2026.

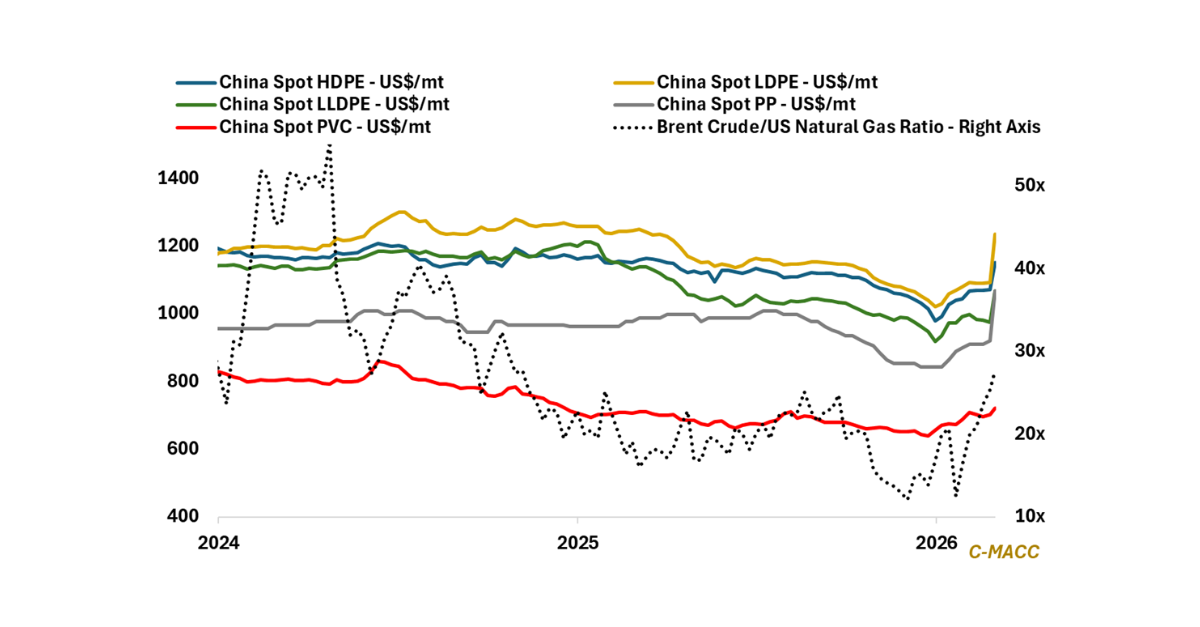

- Supply Chain/Commodities: China-driven polyolefin oversupply shifts clearing to trade, while PVC could tighten faster than polyolefins on housing. Lithium also strengthens as storage demand reshapes markets.

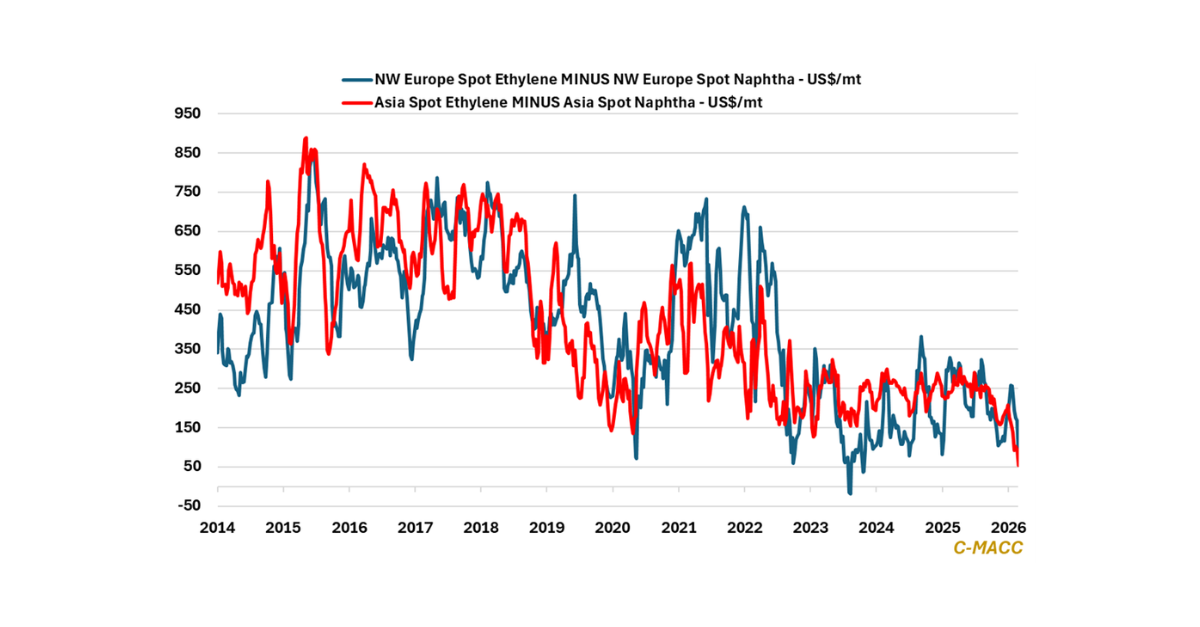

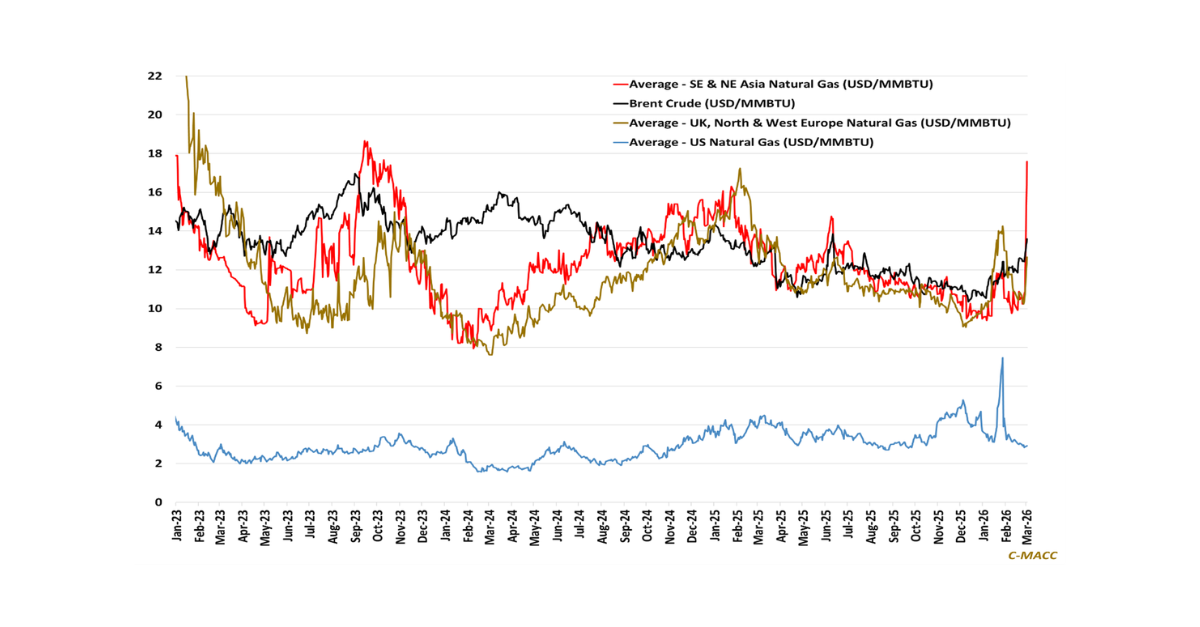

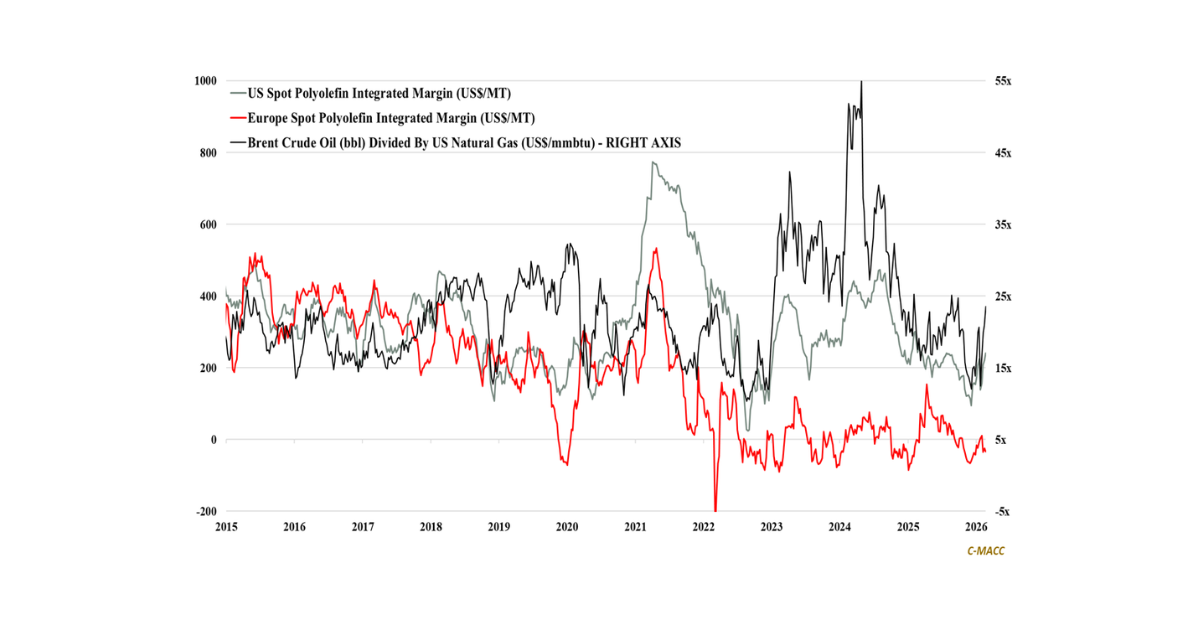

- Energy/Feedstocks: Range-bound oil masks volatile differentials, policy-driven biofuels, and natural gas-linked feedstocks, favoring integrated systems that compound returns as single-asset models face more risk.

- Sustainability/Energy Transition: Carbon prices rise in Europe, functioning as a trade policy. US ethanol margin formation hinges on policy and logistics, rewarding operators and penalizing opaque supply chains.

- Downstream Markets/Demand: Markets underestimate how a softer, volatile US dollar and easier financial conditions shift trade margins, while agricultural profitability pivots on acreage decisions and input timing.

Exhibit 1: Western ammonia margins face early 2026 pressure, but remain elevated relative to their 2025 lows.

Source: Bloomberg, C-MACC Analysis, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!