Global Market Analysis

When Harry Met Ethylene: Chemistry Holds, Low Returns Are Sending The Global Couple To Therapy!

Key Findings

- General Thoughts: Early-2026 cost-curve shifts amid persistent chemical market oversupply are forcing restructuring, with clear evidence likely emerging in 4Q25 results and more decisive 2026 strategic outlooks.

- Supply Chain/Commodities: US ethylene exports deliver higher value to consumers than ethane, but greater domestic absorption, derivative pull, and policy pressures should tighten spreads and arbitrage timelines.

- Energy/Upstream: US electricity prices are rising amid surging demand, constrained grid supply, and growing time-to-market premiums, increasingly decoupling delivered power prices from generation costs.

- Sustainability/Energy Transition: EU carbon prices keep climbing in 2026, overtaking natural gas as Europe’s primary cost lever, reshaping trade flows, rewarding low-carbon exporters, and forcing industrial adaptation.

- Downstream/Other Chemicals: Housing upside risk in 2026 remains underappreciated as falling mortgage rates unlock deferred demand, surprise volumes, and turn cautious outlooks into asymmetric upside.

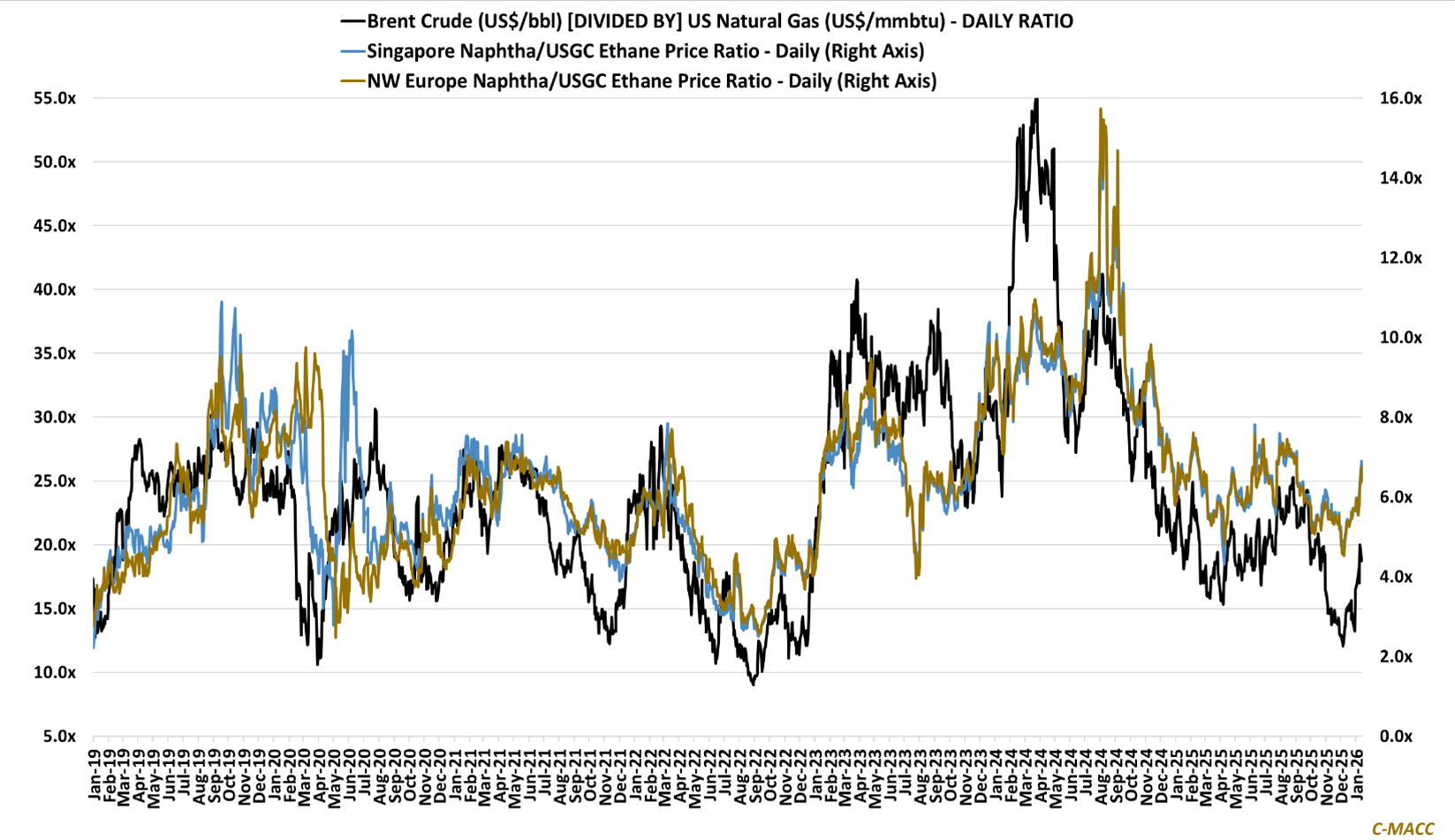

Exhibit 1: Asia and Europe naphtha premiums to USGC ethane are wider than implied by crude-to-gas ratios.

Source: Bloomberg, C-MACC Analysis, January 2026

See the PDF below for all charts, tables, and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!