Base Chemical Global Analysis

Global Weekly Catalyst No. 306

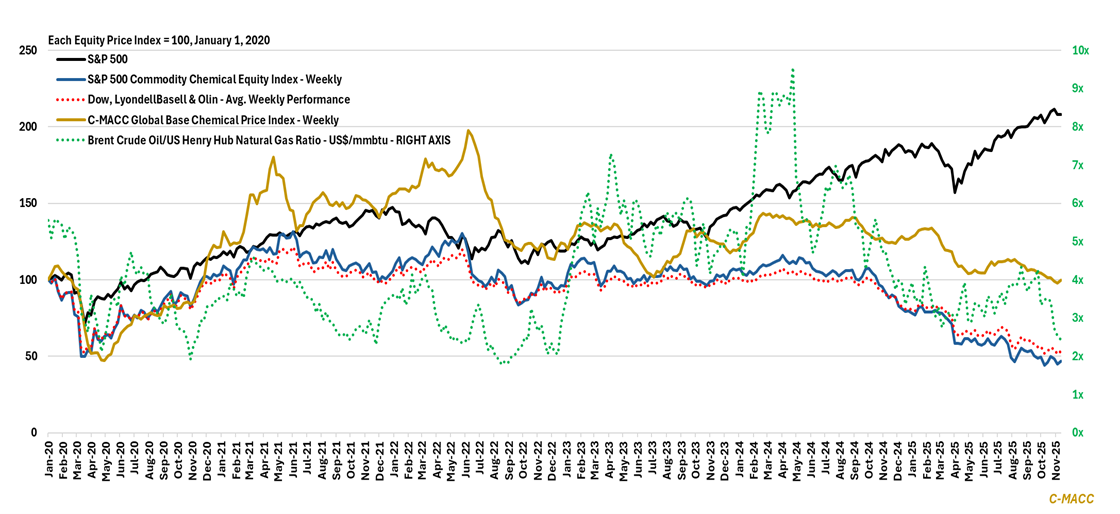

- General Thoughts: Sector momentum in late 2025 reflects commodity divergence, with easing crude and Ex-US natural gas prices, firm US gas, and mixed demand exposing those best positioned for improvement in 1Q26.

- Feedstocks & Energy: Feedstock curves mostly flattened further last week, pushing petrochemical chains lower and rewarding regions and producers with flexible intake strategies that can exploit commodity volatility.

- Olefins: Olefin markets were mixed last week, as spot ethylene and propylene reflected support in the US, but showed varied movements in Europe and Asia. Butadiene spot prices fell across all major regions last week.

- Other Base Chemicals: Methanol spot prices weakened in Europe and Asia last week relative to US levels, and benzene markets were tighter across each primary market. Global chlor-alkali margins struggle to hold position.

- Agriculture: Global ammonia prices remained flat to slightly higher for another week. Higher US natural gas prices eroded domestic producer margins, and lower gas prices in Europe and Asia help keep ammonia prices in check.

- Refining & Biofuels: US refining and biofuel trends diverged last week. US refinery margins increased amid tighter distillate balances and price support, as US ethanol producers saw prices and DDGS values fall relative to corn

Exhibit 1 – Chart of the Day: US commodity chemical equities struggle with oversupply and a flatter cost curve.

Source: Bloomberg, C-MACC Estimates, November 2025

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!