C-MACC Sunday Executive Summary

Lights Out, Optionality On: Margin Defense Resets the Cycle, Execution Speed Decides the Winners

- Prolonged petrochemical weakness reflects oversupply not demand collapse, extending the cycle and shifting strategy from growth to margin defense, cost-curve control, and execution-led recovery outcomes.

- Integration, cash discipline, and balance sheet optionality differentiate winners, as diversified portfolios absorb volatility, limit irrational restarts, protect liquidity, and convert downturn efforts into advantage.

- Growth capital is increasingly gated by first-quartile cost positioning, conservative assumptions, and timing flexibility, reducing overbuild risk while improving long-term supply quality and mid-cycle returns.

- Recovery will be uneven, policy-sensitive, and execution-driven, with rationalization pace, price discipline, and financial strength determining who captures asymmetric upside when margin and returns normalize.

- Otherwise, oversupply-driven margin defense, weather volatility, and structural exits are resetting cost curves, rewarding integrated execution, processing speed, and balance sheet optionality across chemicals.

- Companies Mentioned: LyondellBasell, LG Chem, ExxonMobil, Dow, INEOS, Shell, Celanese, Baker Hughes, Eastman, Mitsui Chemicals, Mitsubishi Chemical, Asahi Kasei, Rio Tinto, Glencore, Albemarle, Tesla, AMG Critical Materials, Union Pacific

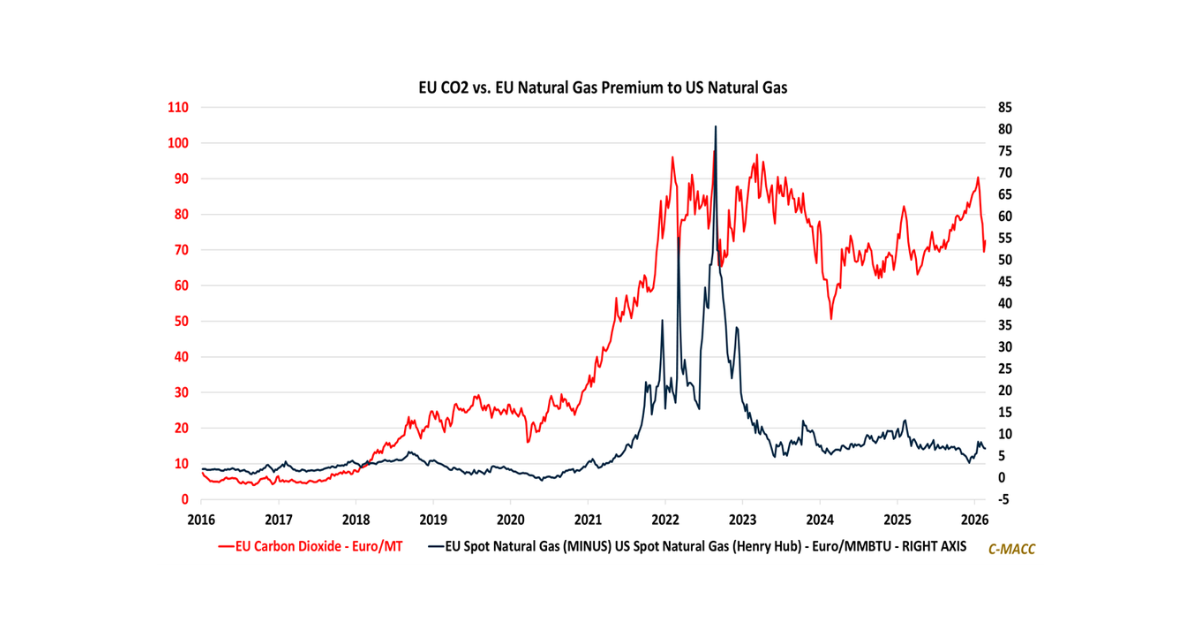

- Products Mentioned: Ethylene, Propylene, Benzene, Polyethylene, Polypropylene, Natural Gas, Crude Oil, LNG, Lithium, Copper, Nickel, Cobalt, Aluminum, Manganese, Graphite, Methanol, Ammonia, Naphtha, Coal, Nuclear, Solar, Wind, Ethanol, Corn, CO₂

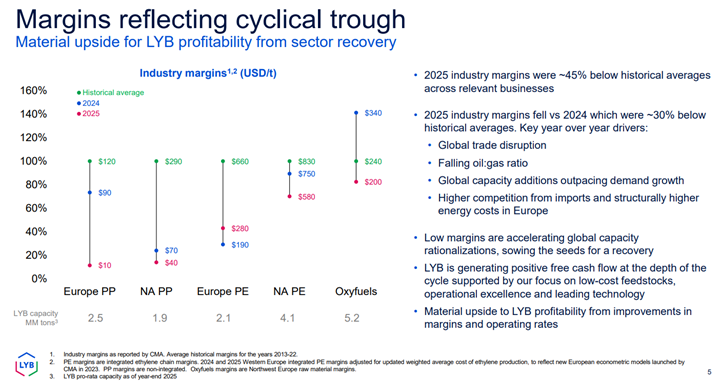

Exhibit 1: Global petrochemical margins reflect a prolonged trough with asymmetric recovery risk and reward.

Source: LyondellBasell – 4Q25 Earnings Presentation, January 2026

See PDF below for all charts, tables and diagrams

Client Login

Learn About Our Subscriptions and Request a Trial

Contact us at cmaccinsights@c-macc.com to gain full access and experience our services!